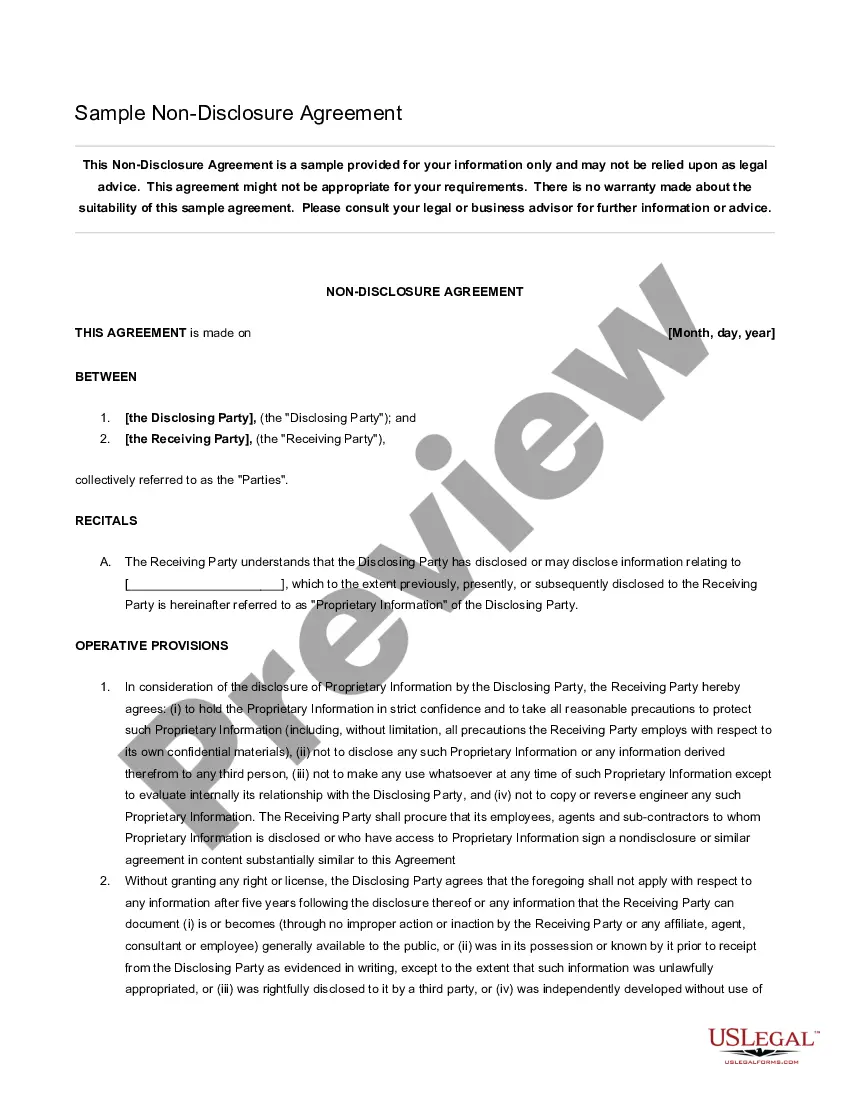

This sample form, a detailed Web Site Use Agreement document, is adaptable for use the internet industry. Tailor to fit your circumstances. In the context of Internet sales, disclaimers of warranties should be plainly visible to customers before they make a purchase. Courts may find that the disclaimer of a warranty is conspicuous even if contained within the site and not discovered before a user agrees to a sale from the site.

Many Internet users are concerned that personal identifying information will be sold to entities that market their products through the Internet. A privacy statement gives assurance that information gathered will not be distributed.

Privacy statements and disclosures also allow those who visit a Website to assess how private information will be collected and used. Accordingly, the visitor can make an informed decision on whether or not to interface with the Website. The following form is a sample of such a privacy statement.