The "look through" trust can affords long term IRA deferrals and special protection or tax benefits for the family. But, as with all specialized tools, you must use it only in the right situation. If the IRA participant names a trust as beneficiary, and the trust meets certain requirements, for purposes of calculating minimum distributions after death, one can "look through" the trust and treat the trust beneficiary as the designated beneficiary of the IRA. You can then use the beneficiary's life expectancy to calculate minimum distributions. Were it not for this "look through" rule, the IRA or plan assets would have to be paid out over a much shorter period after the owner's death, thereby losing long term deferral.

Wisconsin Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account

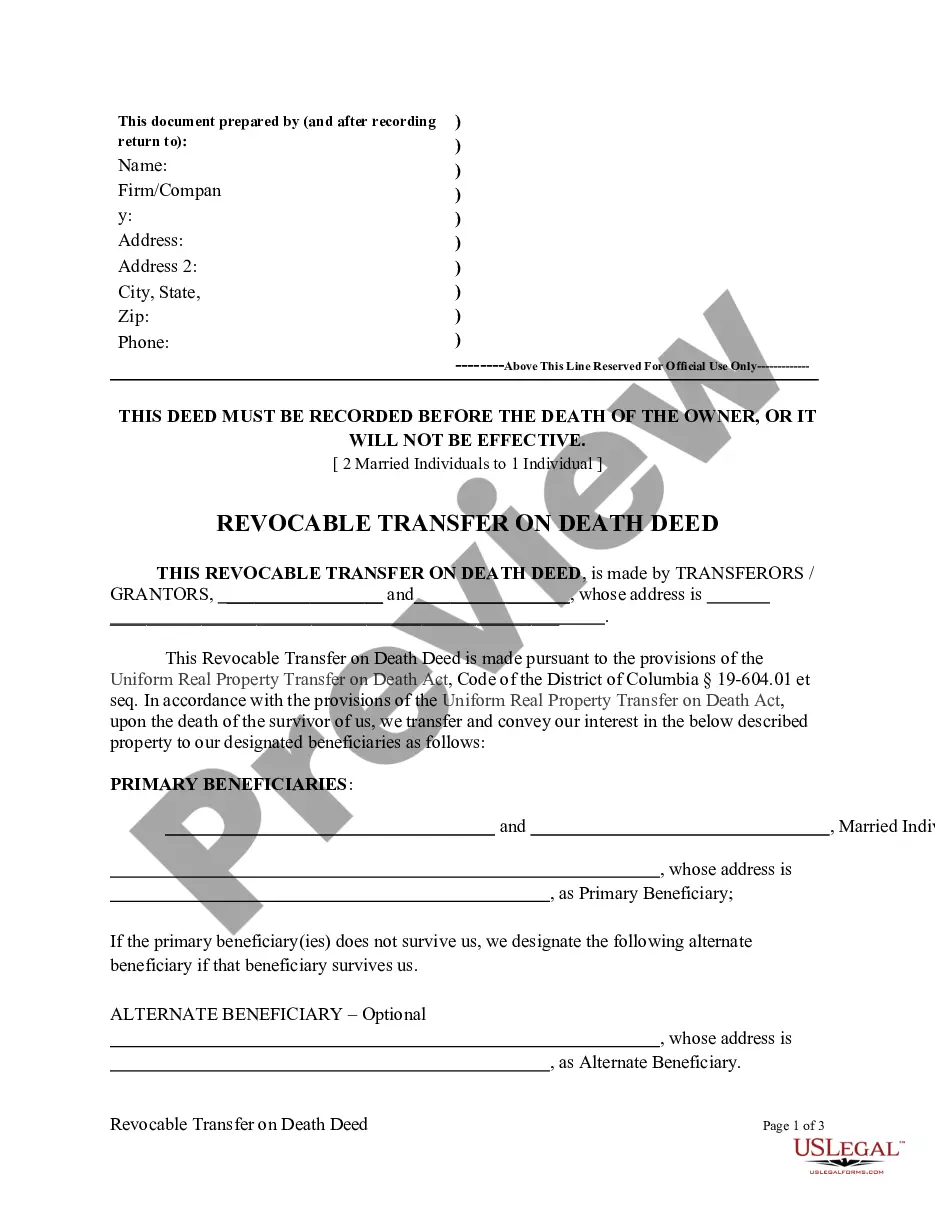

Description

How to fill out Irrevocable Trust As Designated Beneficiary Of An Individual Retirement Account?

Selecting the optimal legal document template can be challenging. Naturally, there is an abundance of templates accessible online, but how can you locate the legal form you need.

Utilize the US Legal Forms website. The platform offers a multitude of templates, such as the Wisconsin Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, that can be employed for both business and personal purposes. All forms are reviewed by experts and conform to federal and state regulations.

If you are already a registered user, Log In to your account and click on the Download button to acquire the Wisconsin Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account. Use your account to browse through the legal forms you have previously purchased. Go to the My documents section of your account and download another copy of the document you need.

Complete, modify, and print and sign the downloaded Wisconsin Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account. US Legal Forms is the largest collection of legal forms where you can find a wide variety of document templates. Use the service to obtain professionally crafted documents that comply with state regulations.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure you have selected the correct form for your city/state. You can preview the form using the Review button and peruse the form summary to confirm it suits your needs.

- If the form does not meet your criteria, utilize the Search field to find the appropriate form.

- Once you are certain that the form is suitable, click the Buy now button to purchase the form.

- Select the pricing plan you prefer and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

If an irrevocable beneficiary dies, the policy must be reviewed to determine the next steps. Typically, the policy may name contingent beneficiaries or default to the estate, depending on the terms outlined in the policy. It is especially prudent to consider the implications of having a Wisconsin Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, as it can provide a clear succession plan for asset distribution.

A policy with an irrevocable beneficiary ensures that the beneficiary cannot be changed by the policyholder once designated. This structure provides a sense of security for the beneficiary and allows for clear direction in estate matters. Choosing a Wisconsin Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account can be advantageous in achieving specific financial goals while safeguarding your loved ones.

An irrevocable life insurance policy is a type of life insurance where the policyholder cannot change certain aspects of the policy, such as the beneficiary or premium amount, without consent from the beneficiary. By utilizing a Wisconsin Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, you create a solid foundation for estate planning, ensuring that funds are distributed in alignment with your wishes.

Yes, a trust can be an eligible designated beneficiary. Specifically, when a Wisconsin Irrevocable Trust is named as the designated beneficiary of an Individual Retirement Account, it can provide valuable protection and control over the asset distribution. This approach helps in planning for your beneficiaries’ long-term financial security.

A policy with an irrevocable beneficiary means that the beneficiary named cannot be changed without their consent. This feature is often used in estate planning to ensure that assets, such as those in a Wisconsin Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, are distributed according to the policyholder’s wishes. By designating an irrevocable beneficiary, you provide security for the beneficiary’s rights to the policy proceeds.

Naming a trust as the beneficiary of a retirement plan can complicate tax matters and potentially reduce the amount your beneficiaries receive. A Wisconsin Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account may encounter challenges with required minimum distributions. Furthermore, if the trust does not meet certain standards, you could face unintended tax consequences. It's vital to consult with a professional to navigate these complexities.

One issue with naming a trust as a beneficiary of an IRA is the potential for increased taxes on distributions. A Wisconsin Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account can lead to faster taxation on the account's growth compared to individual beneficiaries. Additionally, if the trust is not properly structured, it may invalidate the stretch provision, limiting tax deferral options. Careful planning is essential to avoid these pitfalls.

You can name an irrevocable trust as the beneficiary of a retirement account, but you cannot transfer the account directly into the trust. By choosing a Wisconsin Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, you ensure that the trust controls the distributions. This arrangement can provide flexibility and protection for your beneficiaries. However, you should review the potential tax consequences.

In Wisconsin, irrevocable trusts must adhere to specific rules governing their administration and taxation. A Wisconsin Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account can help maintain the trust's assets for beneficiaries while addressing tax implications. It is crucial to ensure that the trust is properly established and managed to comply with state laws. Consulting with a legal expert can clarify these regulations.

Yes, an irrevocable trust can inherit an IRA. When you name a Wisconsin Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, the trust becomes the recipient of the IRA's assets. This strategy can help ensure that the distributions are managed according to your wishes. However, it is essential to comply with IRS regulations to avoid tax complications.