Wisconsin Sample Letter for Compromise on a Debt

Description

How to fill out Sample Letter For Compromise On A Debt?

If you require to finalize, acquire, or create legal document templates, use US Legal Forms, the largest collection of legal forms available online.

Leverage the website's straightforward and user-friendly search feature to find the documents you require.

Numerous templates for business and personal purposes are categorized by type and state, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

Step 6. Select the format of your legal form and download it to your device.

- Use US Legal Forms to obtain the Wisconsin Sample Letter for Compromise on a Debt in just a few clicks.

- If you are an existing US Legal Forms client, sign in to your account and click on the Obtain button to get the Wisconsin Sample Letter for Compromise on a Debt.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Confirm that you have selected the form for the correct city/state.

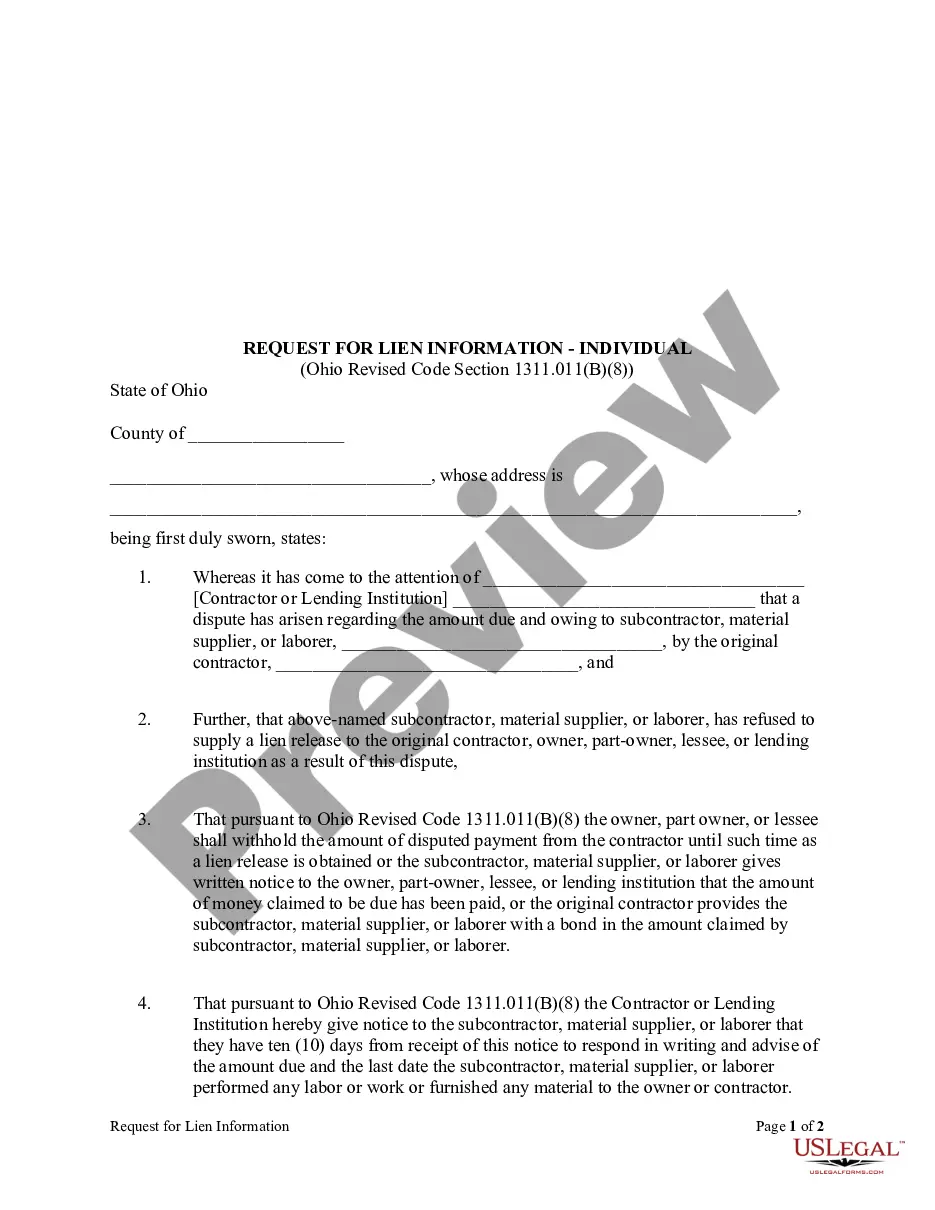

- Step 2. Use the Review option to inspect the form's content. Be sure to read the explanation.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find other types of your legal form template.

- Step 4. Once you have located the form you need, click on the Acquire now button. Choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

The 777 rule refers to guidelines that debt collectors must follow when trying to collect debts from consumers. This rule emphasizes that consumers should be informed about their debt and their rights. If you're facing challenges with debt collectors, a Wisconsin Sample Letter for Compromise on a Debt can help you negotiate your debt effectively. Using such a letter helps you communicate clearly and assertively, outlining your proposal for compromise and addressing any concerns regarding the collection process.

When writing a settlement offer to a debt collector, start with a polite greeting and state your intention to settle your debt. Clearly mention the debt details, your offer amount, and any reasons for your offer. Ending with a request for a written confirmation can solidify the agreement. Using a Wisconsin Sample Letter for Compromise on a Debt can simplify this process and structure your offer appropriately.

To write a good debt settlement letter, be clear and concise about the debt you wish to settle, and include your proposed settlement amount. Provide details about your financial difficulties and any pertinent account information. Importantly, ensure to request a formal agreement in return. A Wisconsin Sample Letter for Compromise on a Debt can serve as a valuable template for your letter.

A sample letter for a settlement offer typically outlines your proposal to settle your debt for a lower amount. It should include your personal information, the debt details, and the proposed settlement amount. Additionally, adding a clear deadline for the response can be beneficial. Using a Wisconsin Sample Letter for Compromise on a Debt can guide you in crafting a persuasive offer.

To write a letter of debt relief, start by clearly stating your intention to request a reduction or compromise on your debt. Include your details such as your account number and the amount owed. You can mention your financial situation and your desire to settle this debt amicably. Utilizing a Wisconsin Sample Letter for Compromise on a Debt can help you format your request properly and ensure it covers essential points.

Yes, you can settle state tax debt through various programs and initiatives offered by tax authorities. Using a Wisconsin Sample Letter for Compromise on a Debt can be an effective way to make your case for a reduced payment. It is essential to gather all necessary documentation to support your claim and demonstrate your financial situation clearly. By taking action now, you can alleviate the burden of state tax debt and achieve a favorable outcome.

A petition for compromise of taxes is a formal request to reduce the amount you owe to tax authorities. By submitting a Wisconsin Sample Letter for Compromise on a Debt, you can provide evidence of your financial hardship and explain why a lower payment is justified. This process can help you settle your tax liability while ensuring you remain compliant with tax regulations. Engaging with experts in tax settlements can further streamline this process.

If you are struggling with tax debt, start by exploring available resources and options tailored to your situation. One effective way is to consider using a Wisconsin Sample Letter for Compromise on a Debt, which can help you negotiate with tax authorities for a reduced payment. Additionally, consulting a tax professional can provide personalized advice and support throughout the process. Remember, seeking help early can make a significant difference in managing your tax obligations.

Form A 133 in Wisconsin is used for formalizing offers of compromise related to various debts and legal obligations. This form is crucial for laying out the terms of your settlement clearly. For assistance in crafting your offer, utilize a Wisconsin Sample Letter for Compromise on a Debt to ensure it meets necessary standards.

The SB form in Wisconsin is commonly associated with specific bankruptcy and debt compromise procedures. It allows individuals to present their debt situation formally and propose a settlement. If you're navigating this process, reference the Wisconsin Sample Letter for Compromise on a Debt for an effective way to articulate your case.