Whenever credit for personal, family, or household purposes involving a consumer is denied or the charge for the credit is increased either wholly or partly because of information obtained from a person other than a credit reporting agency bearing on the consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living, certain requirements must be met. The user of such information, when the adverse action is communicated to the consumer, must clearly and accurately disclose the consumer's right to make a written request for disclosure of the information. If such a request is made and is received within 60 days after the consumer learned of the adverse action, the user, within a reasonable period of time, must disclose to the consumer the nature of the information.

Wisconsin Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency

Description

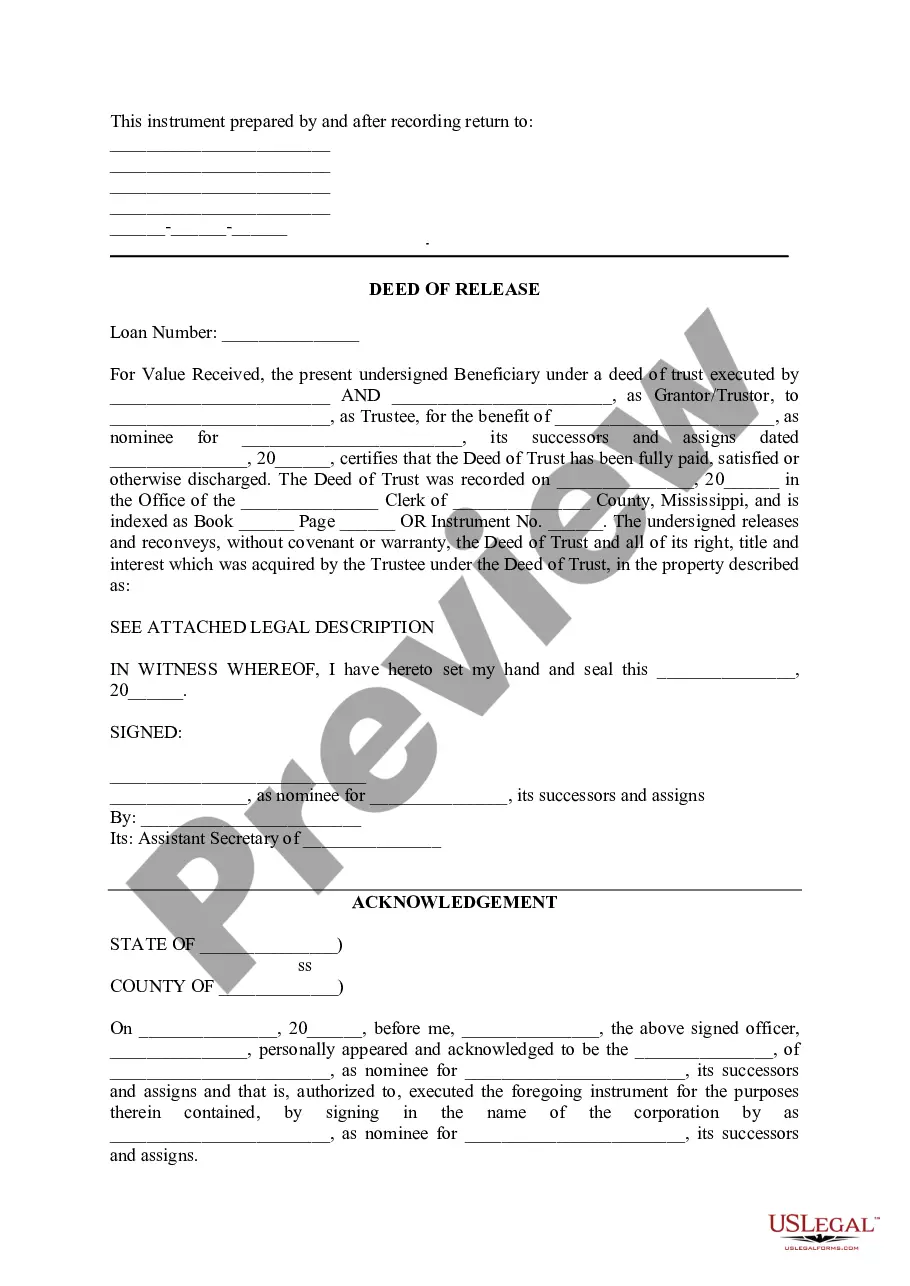

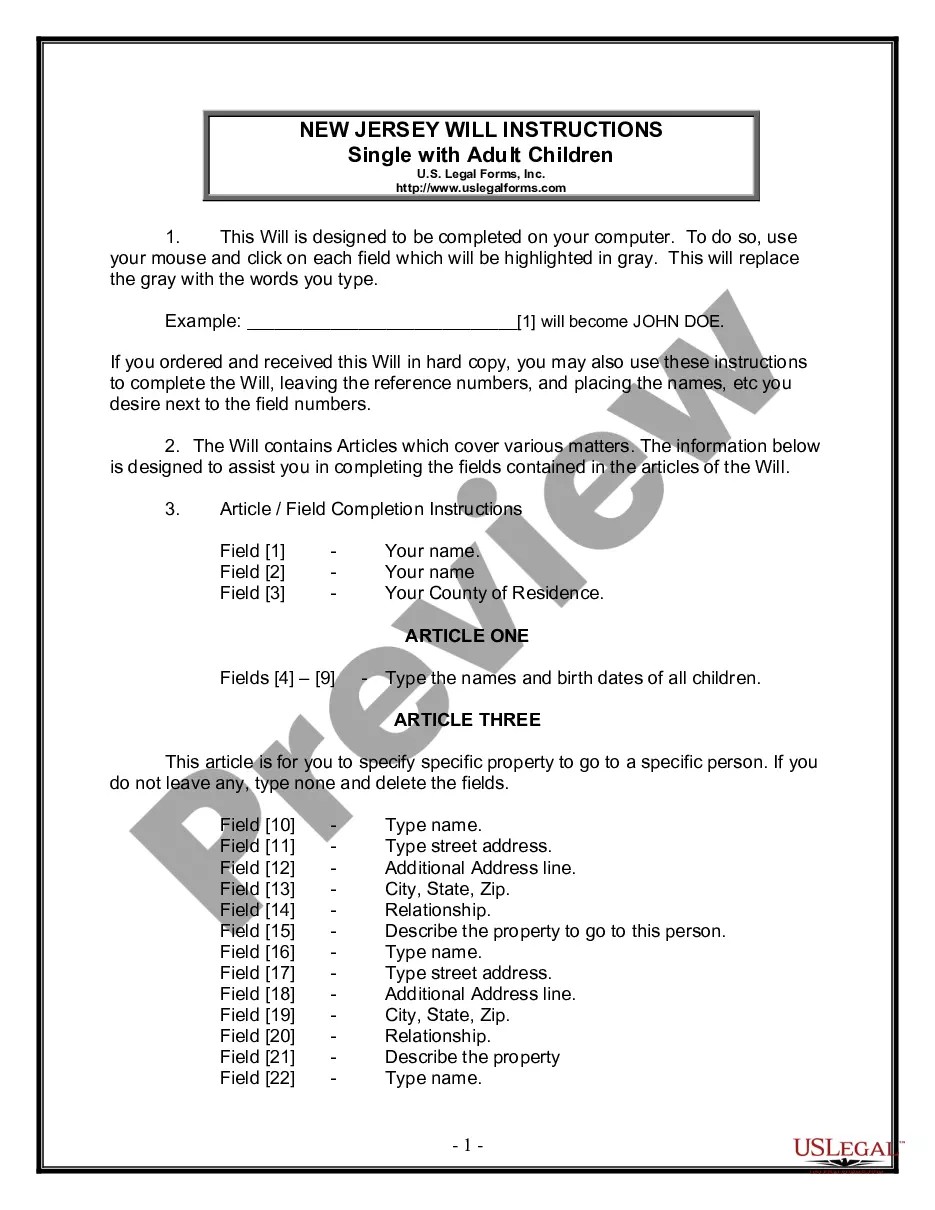

How to fill out Notice Of Increase In Charge For Credit Based On Information Received From Person Other Than Consumer Reporting Agency?

Are you in the situation where you will need files for sometimes enterprise or personal functions nearly every day time? There are plenty of legal papers templates available on the net, but discovering versions you can rely isn`t simple. US Legal Forms gives thousands of develop templates, much like the Wisconsin Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency, which are written to fulfill state and federal needs.

Should you be previously acquainted with US Legal Forms website and also have a free account, just log in. Following that, you are able to down load the Wisconsin Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency design.

Should you not have an accounts and would like to begin to use US Legal Forms, adopt these measures:

- Obtain the develop you need and ensure it is for that right metropolis/area.

- Take advantage of the Preview button to examine the form.

- Look at the information to actually have chosen the proper develop.

- In case the develop isn`t what you are looking for, make use of the Search industry to discover the develop that meets your requirements and needs.

- Whenever you discover the right develop, click on Acquire now.

- Select the pricing program you would like, fill in the required info to generate your money, and buy your order utilizing your PayPal or credit card.

- Select a convenient data file structure and down load your duplicate.

Locate all the papers templates you might have purchased in the My Forms food selection. You can obtain a further duplicate of Wisconsin Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency anytime, if required. Just click on the needed develop to down load or produce the papers design.

Use US Legal Forms, by far the most comprehensive collection of legal kinds, to save lots of time as well as prevent mistakes. The services gives appropriately created legal papers templates that can be used for a range of functions. Generate a free account on US Legal Forms and start generating your way of life easier.

Form popularity

FAQ

Consumer credit transactions are transactions that include a finance charge or are payable in more than four installments.

Definition: A consumer transaction is a type of agreement or exchange where one party purchases goods or services for personal, family, or household use.

The term "consumer credit transaction" means any transaction in which credit is offered or extended to an individual for personal, family, or household purposes.

The Wisconsin Consumer Act (commonly called the ?WCA?) has a provision that states: Any action brought by a customer to enforce rights pursuant to chs. 421 to 427 shall be commenced within one year after the date of the last violation of chs.

Some common types of consumer credit are installment credit, non-installment credit, revolving credit, and open credit. Similarities of these types of credit are that they all have some form of a repayment period, interest rates, the possibility of interest charges, and monthly or lump sum payments.

Credit, transaction between two parties in which one (the creditor or lender) supplies money, goods, services, or securities in return for a promised future payment by the other (the debtor or borrower). Such transactions normally include the payment of interest to the lender.