This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wisconsin Second Amendment of Trust Agreement

Description

How to fill out Second Amendment Of Trust Agreement?

If you want to obtain, acquire, or print legal document templates, use US Legal Forms, the largest collection of legal forms available online.

Utilize the website's simple and convenient search to find the documents you require. Various templates for business and personal purposes are categorized by types and states or keywords.

Use US Legal Forms to locate the Wisconsin Second Amendment of Trust Agreement in just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you acquired within your account. Access the My documents section and select a form to print or download again.

Compete to obtain and print the Wisconsin Second Amendment of Trust Agreement with US Legal Forms. There are numerous professional and state-specific templates you can utilize for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to obtain the Wisconsin Second Amendment of Trust Agreement.

- You can also access forms you previously acquired from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to check the explanation.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose your preferred pricing plan and enter your information to sign up for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, review, and print or sign the Wisconsin Second Amendment of Trust Agreement.

Form popularity

FAQ

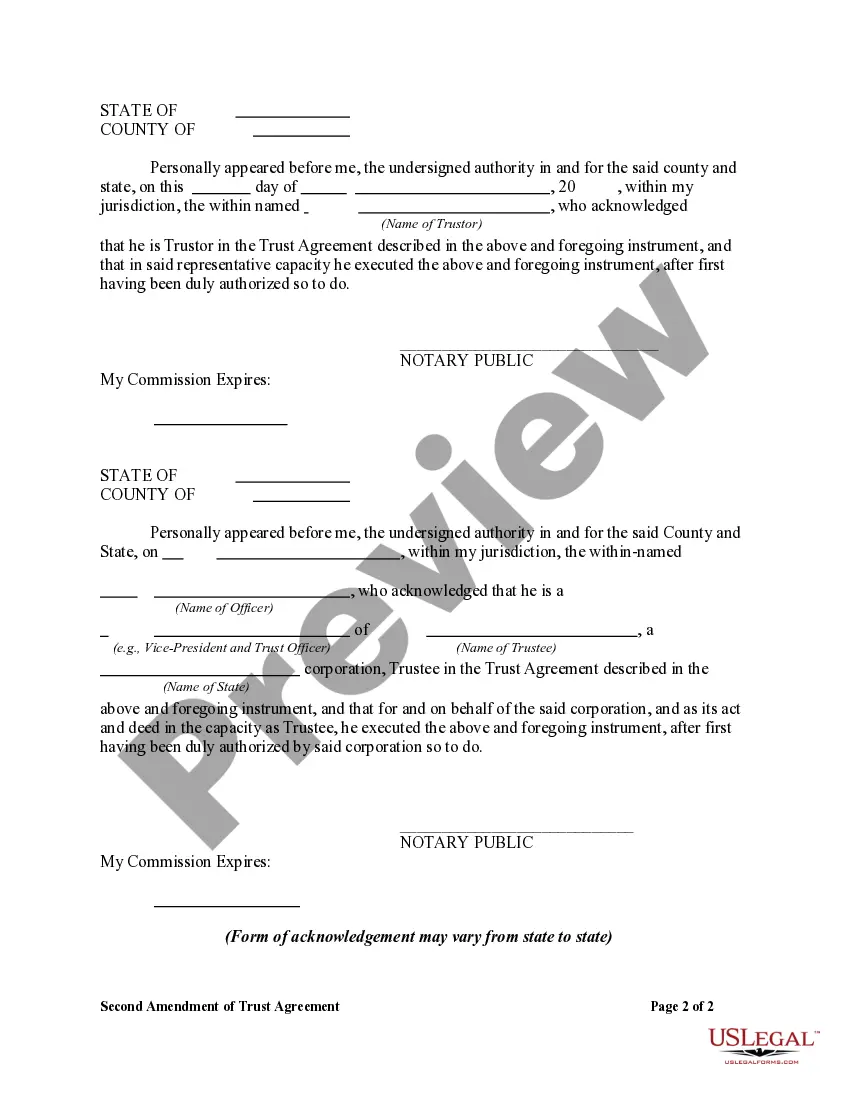

The deed of amendment of a trust is a document that signifies changes to an existing trust arrangement. It serves as an official record of the revisions made, ensuring clarity and legal standing. When dealing with a Wisconsin Second Amendment of Trust Agreement, properly executing this deed is essential to maintain the trust's validity and enforceability.

An amendment to contract terms refers to any modifications made to the stipulations of a contract. In the context of a trust, these modifications can provide flexibility in handling assets or changing beneficiaries. By incorporating such amendments in your Wisconsin Second Amendment of Trust Agreement, you can ensure that your trust evolves alongside your personal circumstances and legal obligations.

An amendment to the agreement refers to a formal change made to an existing legal document, which can include trusts. This process typically involves updating terms, beneficiaries, or conditions outlined in the original agreement. If you need to adjust your Wisconsin Second Amendment of Trust Agreement, understanding how amendments work will help you make informed decisions.

A deed of amendment to a trust deed is a legal document that alters the terms of an existing trust. It allows the granter to make specified changes without creating a new trust entirely. By using a Wisconsin Second Amendment of Trust Agreement, individuals can effectively modify their trust to better reflect their current wishes while adhering to state guidelines.

In Wisconsin, trusts must adhere to state laws that govern their creation and administration. The Wisconsin statutes outline requirements for drafting, executing, and modifying trust agreements. When creating a Wisconsin Second Amendment of Trust Agreement, ensuring compliance with these regulations can help you avoid legal complications and ensure your intentions are clearly expressed.

In Wisconsin, you can inherit up to $100,000 without incurring inheritance taxes. However, it is important to understand that this applies to most beneficiaries, while spousal transfers are generally exempt from taxes. If you're considering a Wisconsin Second Amendment of Trust Agreement, it can provide a tax-efficient way to manage your inheritance. Utilizing trusts strategically helps in minimizing tax obligations and ensuring your assets are preserved for your loved ones.

Writing an amendment to a trust involves creating a document that states the changes to be made clearly. Start by identifying the trust's name and the original date, then list each amendment in straightforward language. It is crucial to sign and notarize the amendment in compliance with the requirements of the Wisconsin Second Amendment of Trust Agreement to ensure its legality.

An amendment to the trust agreement is a formal document that changes specific terms of the existing trust. It can include alterations to beneficiaries, asset distributions, or trust management duties. The Wisconsin Second Amendment of Trust Agreement allows for such modifications to reflect changes in circumstances or intentions.

To write a codicil to a trust, begin by labeling the document clearly as 'Codicil to the Trust Agreement.' Reference the original trust's name and date, then detail the specific modifications or additions you wish to add. Sign and date the codicil, ideally with a notary's acknowledgment, to confirm its acceptance under the Wisconsin Second Amendment of Trust Agreement.

In Wisconsin, a trustee typically cannot sell trust property without the consent of all beneficiaries unless the trust document allows for such actions. The Wisconsin Second Amendment of Trust Agreement often outlines specific powers granted to the trustee. If in doubt, consult a legal professional to navigate these complexities.