A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

Wisconsin Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability

Description

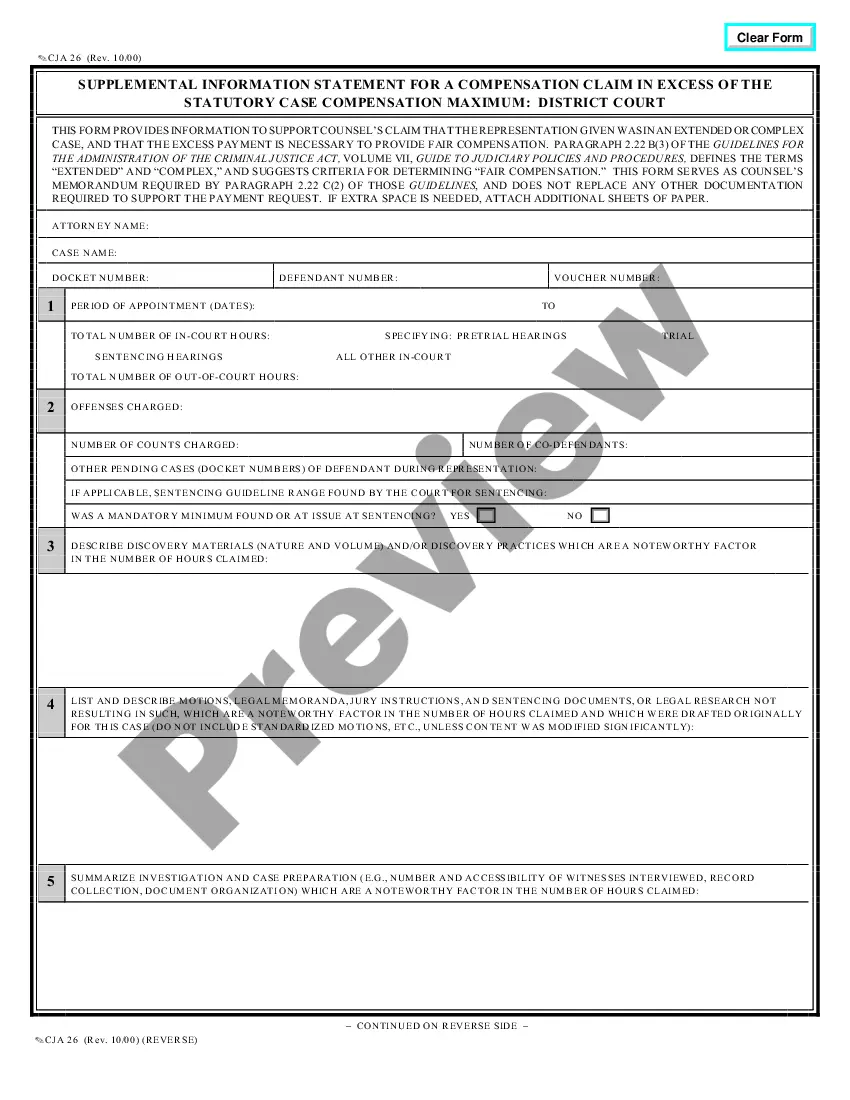

How to fill out Continuing Guaranty Of Business Indebtedness With Guarantor Having Limited Liability?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal form templates that you can download or print.

By using the website, you can find thousands of forms for business and personal use, organized by categories, states, or keywords. You can access the latest versions of forms such as the Wisconsin Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability in just a few minutes.

If you already have an account, Log In and download the Wisconsin Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability from your US Legal Forms library. The Download button will appear on each form you view. You can access all previously saved forms in the My documents section of your account.

Select the format and download the form to your device.

Edit. Complete, modify, and print and sign the downloaded Wisconsin Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability.

- If you want to use US Legal Forms for the first time, here are simple steps to get started.

- Make sure you have selected the correct form for your state/region. Click the Preview button to review the content of the form.

- Read the form description to confirm that you have chosen the right form.

- If the form does not meet your needs, use the Search box at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose the pricing plan you prefer and provide your details to register for an account.

- Process the payment. Use your credit card or PayPal account to finalize the purchase.

Form popularity

FAQ

Different types of guarantors include personal guarantors, corporate guarantors, limited guarantors, and unconditional guarantors. Personal guarantors use their assets as collateral, while corporate guarantors are businesses that back the obligation. A limited guarantor only takes on a specified part of the debt, as seen in the Wisconsin Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. Knowing the type ideal for your situation can make a significant difference in your risk management.

A guarantee is a commitment that obligates the guarantor to fulfill the debt if the borrower defaults. A limited guarantee, however, restricts this obligation to a certain amount or specific conditions detailed in the agreement. When exploring a Wisconsin Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, understanding these differences is critical for making informed financial decisions. This distinction can significantly influence your financial security.

The primary difference between a limited and unlimited personal guarantee lies in the scope of liability. A limited personal guarantee restricts the guarantor's responsibility to a specific amount or conditions, while an unlimited guarantee does not impose such restrictions. In the context of the Wisconsin Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, choosing a limited guarantee can be a wise decision to protect your assets. Always consider the implications of both types before signing.

The three types of guarantees typically include personal guarantees, corporate guarantees, and limited guarantees. A personal guarantee binds an individual’s personal assets, while a corporate guarantee extends the obligation to a business entity. In contrast, a limited guarantee restricts the guarantor’s liability to a predefined amount, such as in a Wisconsin Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. Knowing these categories helps you choose the right option for your needs.

A limited guarantor is someone whose liability is restricted to a specific amount or a set of conditions outlined in the guaranty agreement. In the framework of a Wisconsin Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, a limited guarantor is not fully liable for all debts but only to the point defined in the agreement. This protection allows individuals or businesses to limit their financial exposure. Understanding these terms is essential before proceeding.

To fill out a personal guarantee, start by providing your personal information, including your name and address. Next, clearly state the amount you are guaranteeing and specify the obligations for which the guarantee applies. When dealing with a Wisconsin Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, be sure to highlight any limitations associated with your liability. Lastly, sign the document where indicated, and keep a copy for your records.

The liability of a guarantor can be co-extensive, meaning that it matches the primary obligation of the borrower. In the context of a Wisconsin Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, this means that the guarantor may be responsible for the same amount of debt. However, the specific terms in the guaranty agreement will define the extent of the liability. It is crucial to review all the terms to understand your obligations fully.

One downside of being a guarantor is the potential for personal financial risk, especially if the primary borrower defaults on their obligations. Under a Wisconsin Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, this risk can extend to significant personal assets. It’s crucial for prospective guarantors to weigh these risks against the benefits before proceeding.

The rights of a guarantor include the right to seek repayment from the borrower if they have to fulfill the debt, and to be informed of any default situations. Furthermore, under a Wisconsin Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, the guarantor can contest the enforceability of the guarantee if it was not properly executed. Knowing these rights ensures that guarantors can effectively advocate for themselves.

Guarantors have the right to receive documentation that details the debt and the obligations they are guaranteeing. Additionally, under a Wisconsin Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, they are entitled to be informed about any changes in the borrower's circumstances which could affect their obligation. Understanding these rights is vital for protecting their interests.