Wisconsin Agreement to Assign Lease to Incorporators Forming Corporation

Description

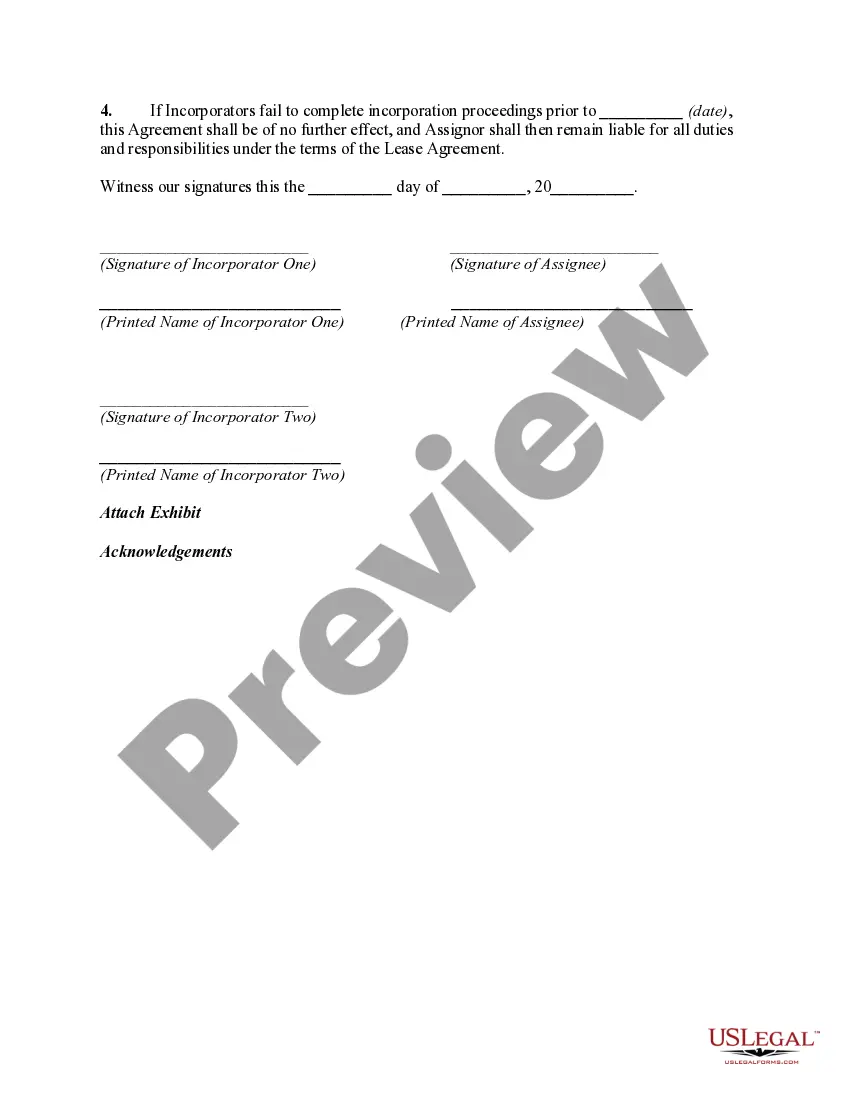

How to fill out Agreement To Assign Lease To Incorporators Forming Corporation?

Finding the appropriate legal document template can be rather challenging. It goes without saying that there are numerous templates available online, but how do you find the legal document you need.

Utilize the US Legal Forms website. The service offers a multitude of templates, including the Wisconsin Agreement to Assign Lease to Incorporators Forming Corporation, which can be utilized for both business and personal purposes. All forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Get option to obtain the Wisconsin Agreement to Assign Lease to Incorporators Forming Corporation. Use your account to search through the legal forms you have previously ordered. Go to the My documents tab in your account to retrieve another copy of the document you need.

Select the document format and download the legal document template to your device. Complete, edit, print, and sign the acquired Wisconsin Agreement to Assign Lease to Incorporators Forming Corporation. US Legal Forms is indeed the largest repository of legal forms where you can discover a wide range of document templates. Utilize the service to obtain professionally crafted documents that adhere to state specifications.

- First, ensure you have selected the correct form for your specific city/region.

- You can review the form using the Review option and read the form information to confirm it is suitable for you.

- If the form does not meet your requirements, make use of the Search field to find the appropriate form.

- Once you are confident that the form is suitable, click the Get now option to acquire the form.

- Choose the pricing plan you prefer and enter the required information.

- Create your account and pay for your order using your PayPal account or credit card.

Form popularity

FAQ

In Wisconsin, notarization of a lease is not always required unless specifically stated in the lease terms. However, it can help strengthen the validity of the document and protect all parties involved. Utilizing a properly formatted Wisconsin Agreement to Assign Lease to Incorporators Forming Corporation can ensure all legalities are covered.

An assignable lease is one that permits the tenant to transfer their lease rights to another individual or business. This flexibility benefits tenants who may need to relocate or change business strategies. For clarity on the process, the Wisconsin Agreement to Assign Lease to Incorporators Forming Corporation can serve as a vital tool.

To assign a lease, start by reviewing your lease agreement for any restrictions on assignment. Next, seek written consent from your landlord to ensure compliance. Lastly, prepare the Wisconsin Agreement to Assign Lease to Incorporators Forming Corporation, detailing the terms of the assignment and informing all parties involved.

The most common commercial lease agreement is the 'net lease,' where the tenant pays a portion of the property expenses in addition to rent. This setup often includes costs like property taxes, insurance, and maintenance. For those looking to assign a commercial lease, utilizing the Wisconsin Agreement to Assign Lease to Incorporators Forming Corporation can streamline the process.

Lease transfer involves the tenant relinquishing their interest in the lease, while lease assignment allows the original tenant to maintain responsibilities but pass on the rights to another party. In an assignment, the original tenant may still be liable if the new tenant fails to meet lease obligations. Understanding this distinction can help ensure compliance with the Wisconsin Agreement to Assign Lease to Incorporators Forming Corporation.

Lease assignment refers to the process where a tenant transfers their rental rights and obligations to another party. This often occurs when individuals need to move before their lease ends, allowing the new tenant to step into the original tenant's role. In the context of the Wisconsin Agreement to Assign Lease to Incorporators Forming Corporation, this document is essential for formalizing such arrangements.

Yes, 2-year leases are legal in Wisconsin, as long as they comply with state lease laws. Both parties must agree to the terms, and it is advisable to document everything clearly in writing. This approach protects the rights of all parties involved and minimizes disputes. If you are forming a corporation, using the Wisconsin Agreement to Assign Lease to Incorporators Forming Corporation can facilitate lease agreements that suit your business needs.

Wisconsin Form 5S is a tax document used by S Corporations to report income, deductions, and credits for the state tax return. It ensures that S Corporations comply with income tax regulations while allowing for the benefits of pass-through taxation. It is essential to file this form accurately to avoid complications. Incorporating the Wisconsin Agreement to Assign Lease to Incorporators Forming Corporation can help in organizing your corporate structure effectively.

A Notice of Assessment in Wisconsin is a notification from the Department of Revenue indicating adjustments to your tax liability. It details the reasons for the changes, including the amount owed or refunded. Understanding this notice is crucial to ensure compliance and manage your tax obligations effectively. For incorporated businesses, referencing the Wisconsin Agreement to Assign Lease to Incorporators Forming Corporation may demonstrate how business activities can impact assessments.

Yes, if you earn income in Wisconsin, you typically need to file a state tax return. This requirement applies to sole proprietors, partnerships, and corporations. Filing on time is important to avoid penalties. Using the Wisconsin Agreement to Assign Lease to Incorporators Forming Corporation could provide assistance in maintaining accurate records for tax purposes.