Wisconsin Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts

Description

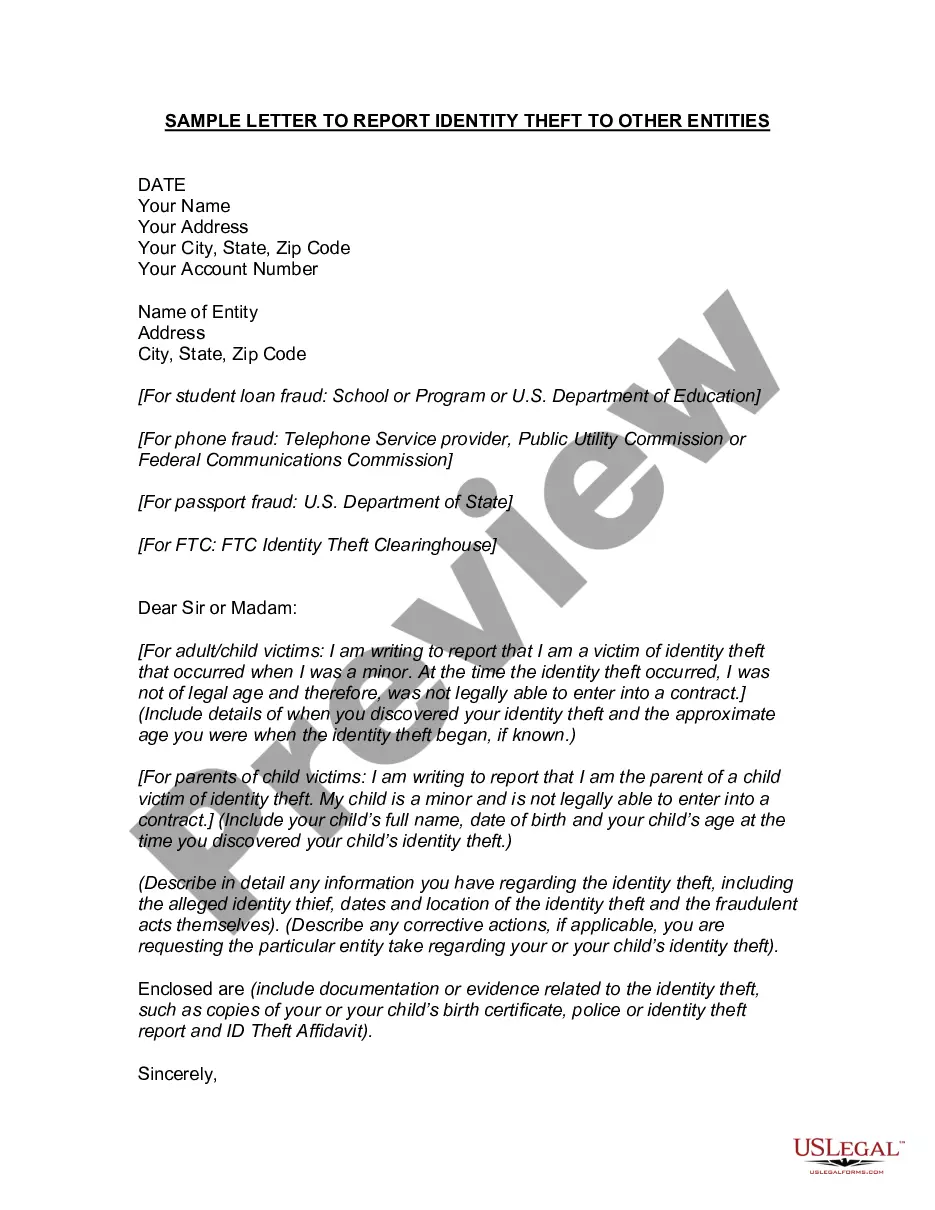

How to fill out Letter To Creditors Notifying Them Of Identity Theft Of Minor For New Accounts?

You can spend hours online searching for the legal document template that meets the state and federal requirements you require.

US Legal Forms offers thousands of legal templates that are reviewed by professionals.

You can obtain or print the Wisconsin Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts from my service.

If available, utilize the Preview button to browse through the document template as well. To find another version of the form, use the Search field to locate the template that meets your needs and requirements. Once you have found the template you want, click on Buy now to proceed. Select the pricing plan you prefer, enter your credentials, and register for your account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to purchase the legal form. Select the document format and download it to your device. Make edits to your document if necessary. You can fill out, modify, sign, and print the Wisconsin Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can fill out, modify, print, or sign the Wisconsin Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts.

- Every legal document template you purchase is yours indefinitely.

- To get another copy of a purchased form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for the state/region of your choice.

- Check the form description to ensure you have chosen the right form.

Form popularity

FAQ

ID theft victims should reach out to law enforcement Copies of bills or collection notices. Credit reports with fraudulent charges. Bank or credit card statements.

To file an identity theft complaint: file online, download an identity theft complaint form, or contact the Consumer Protection Hotline by phone at (800) 422-7128 or email at DATCPHotline@wi.gov?.

Violation of this law is a class H felony including up to 6 years in jail and a $10,000 fine.

If you've been the victim of identity theft, you can take steps to reclaim your good name and restore your credit. To make certain that you do not become responsible for any debts incurred in your name by an identity thief, you must prove that you didn't create the debt.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

There may be a $10 fee each time you lift the freeze. We can help you take the steps you need to resolve problems caused by identity theft. You can file an identity theft complaint by calling and requesting a complaint form at 1-800-422- 7128 or obtain one online at .datcp.wi.gov.

Steps to take if your identity was stolen Alert your bank or credit card companies immediately. ... Change your passwords and enable two-factor authentication. ... Continue monitoring your financial statements and accounts. ... Google yourself. ... Notify law enforcement. ... Set up a fraud alert or credit freeze.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.