Wisconsin Charitable Remainder Inter Vivos Unitrust Agreement

Description

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

Are you presently in a situation where you require documents for potentially business or personal purposes almost every day.

There are numerous legal document templates available online, but finding trustworthy ones is quite challenging.

US Legal Forms offers countless form templates, such as the Wisconsin Charitable Remainder Inter Vivos Unitrust Agreement, designed to comply with federal and state regulations.

Once you find the right form, click Get now.

Select the pricing plan you prefer, fill in the required information to create your account, and pay for your order using PayPal or Visa/Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Wisconsin Charitable Remainder Inter Vivos Unitrust Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

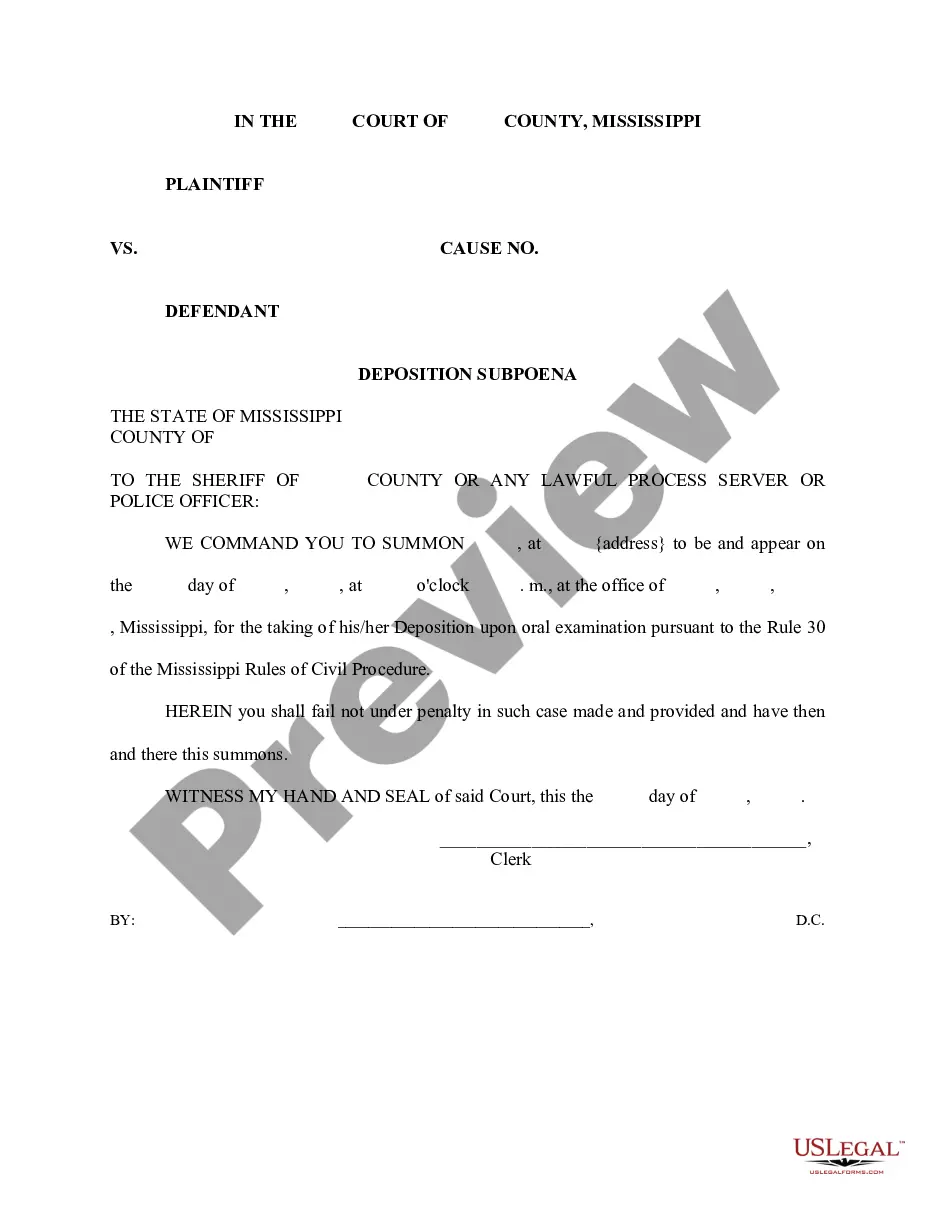

- Utilize the Review button to check the form.

- Examine the overview to ensure you have selected the appropriate form.

- If the form does not meet your expectations, use the Search field to find the form that suits your requirements.

Form popularity

FAQ

A unitrust is a specific type of charitable remainder trust that pays a variable percentage of the trust’s assets to the income beneficiaries each year, whereas a charitable remainder trust could also be a fixed annuity trust. The variability in payments is a key feature of unitrusts. If you're exploring a Wisconsin Charitable Remainder Inter Vivos Unitrust Agreement, this distinction can guide your choice.

The primary purpose of a unitrust is to provide income to beneficiaries while supporting charitable causes. Unitrusts adapt to the value of the assets, allowing for potentially increasing payouts. By establishing a Wisconsin Charitable Remainder Inter Vivos Unitrust Agreement, you ensure that both your income needs and charitable intentions are met.

An inter vivos charitable remainder trust is established during the donor’s lifetime, allowing them to make charitable donations while also receiving income from the trust assets. This type of trust is advantageous for donors seeking immediate tax benefits and income generation. A Wisconsin Charitable Remainder Inter Vivos Unitrust Agreement offers a tailored solution for those interested in such financial strategies.

The maximum term for a charitable remainder unitrust (CRUT) can be up to 20 years or the lifetime of one or more beneficiaries. Legally, the income from the unitrust is distributed within this time frame before the remainder goes to charity. If you are considering a Wisconsin Charitable Remainder Inter Vivos Unitrust Agreement, this timeframe allows flexibility in planning your charitable and income goals.

A charitable remainder trust (CRT) can include both unitrusts and annuity trusts. The key difference is that a charitable remainder unitrust (CRUT) provides variable payments based on the trust's value, while an annuity trust pays a fixed amount. If you're exploring a Wisconsin Charitable Remainder Inter Vivos Unitrust Agreement, knowing this distinction helps you select the option that best fits your financial strategy.

The charitable remainder unitrust deduction is a tax benefit that allows donors to deduct a portion of their contributions to a charitable remainder unitrust from their taxable income. This deduction is based on the present value of the charity’s expected future interest. Understanding this deduction can significantly enhance the benefits of a Wisconsin Charitable Remainder Inter Vivos Unitrust Agreement for your estate planning.

A Charitable Remainder Trust (CRT) provides income to the donor or beneficiaries for a specified term, with the remaining assets going to a charity, while a Charitable Lead Trust (CLT) pays income to a charity for a specified term before the remaining assets go to the donor's heirs. Both serve unique purposes in charitable planning. When looking into a Wisconsin Charitable Remainder Inter Vivos Unitrust Agreement, consider how each option aligns with your financial goals.

Advised Fund (DAF) and a Charitable Remainder Trust (CRT) serve different purposes in charitable giving. A DAF allows donors to make contributions and advise on distributions over time, while a CRT lets donors receive income from their assets during their lifetime with the remainder going to charity. If you are considering a Wisconsin Charitable Remainder Inter Vivos Unitrust Agreement, it’s important to understand the tax implications and benefits of each option.

A Wisconsin Charitable Remainder Inter Vivos Unitrust Agreement typically pays out a fixed percentage of the trust's value each year, which you determine when setting up the trust. Generally, this payout rate can range from 5% to 8%, depending on your preference and requirements. It's important to know that the payout amount can change each year based on the trust's value, providing flexibility and the potential for growth. Consulting with a professional can help you determine the best payout strategy for your needs.

Setting up a Wisconsin Charitable Remainder Inter Vivos Unitrust Agreement involves several key steps. First, you need to decide on the assets you want to transfer into the trust. Next, you should choose a qualified trustee to manage the trust. Finally, you will draft the trust agreement, outlining the distribution of payments to beneficiaries, ensuring it aligns with your charitable goals. Utilizing platforms like US Legal Forms can simplify this process by providing you with the necessary documents and guidance.