Wisconsin Bill of Sale for a Coin Collection

Description

How to fill out Bill Of Sale For A Coin Collection?

US Legal Forms - one of the best collections of legal documents in the United States - provides an array of legal templates that you can download or print.

While utilizing the website, you will find thousands of templates for business and personal purposes, categorized by type, state, or keywords. You can locate the most current versions of templates like the Wisconsin Bill of Sale for a Coin Collection in just moments.

If you already possess a monthly subscription, Log In and obtain the Wisconsin Bill of Sale for a Coin Collection from your US Legal Forms library. The Download button will be visible on every form you view. You have access to all previously acquired templates within the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form onto your device. Make edits. Complete, modify, and print and sign the acquired Wisconsin Bill of Sale for a Coin Collection. Every template you add to your account does not have an expiration date and is yours indefinitely. Thus, to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Wisconsin Bill of Sale for a Coin Collection with US Legal Forms, the most extensive selection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- Ensure you have selected the correct form for the city/state.

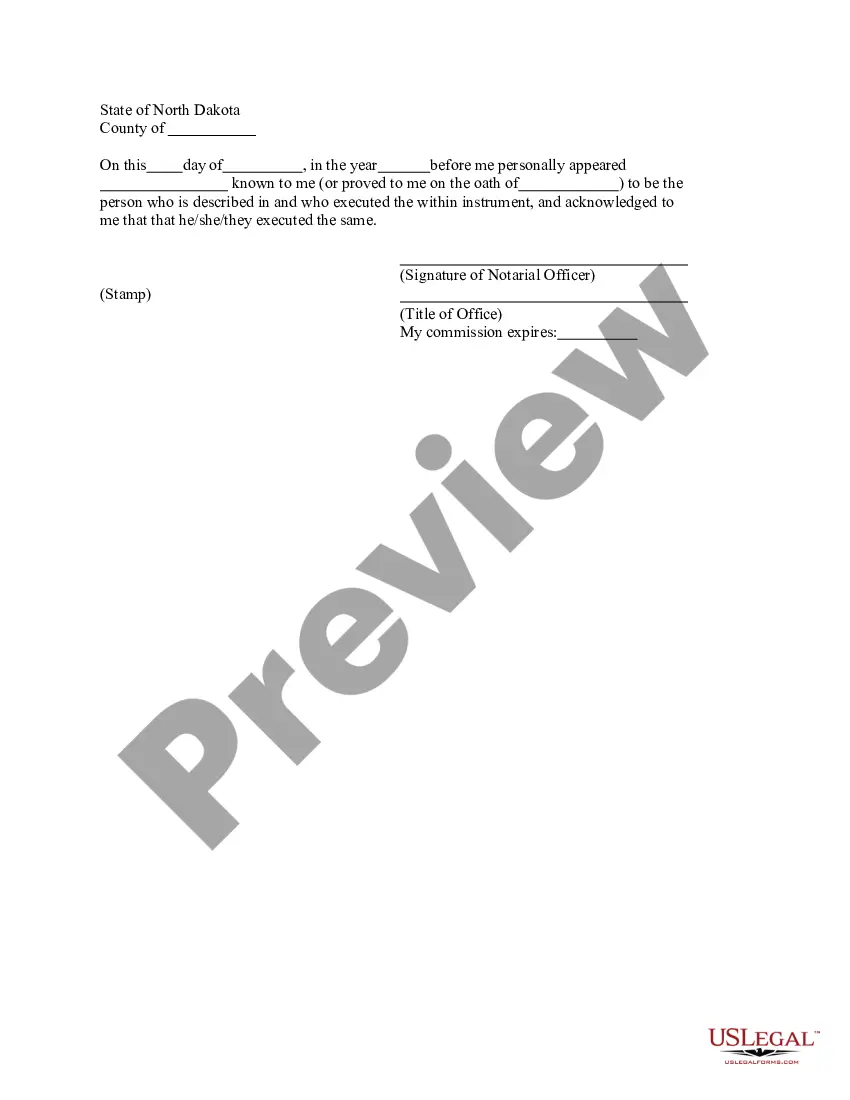

- Use the Preview button to examine the contents of the form.

- Review the form description to ensure you have selected the right one.

- If the form does not suit your requirements, utilize the Search field at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking on the Get now button.

- Then, select the payment plan you prefer and provide your details to create an account.

Form popularity

FAQ

In Wisconsin, a bill of sale does not need to be notarized to be considered legal, including a Wisconsin Bill of Sale for a Coin Collection. However, having the document notarized can provide an added layer of security and trust during the transaction. Notarization may be especially helpful in disputes or if you decide to sell the collection later, as it serves as proof of both parties’ intentions.

Yes, a handwritten bill of sale can be perfectly acceptable, especially for a transaction like a Wisconsin Bill of Sale for a Coin Collection. The key is that it must still include all the necessary information, such as the names of both parties, a description of the coins, and their signatures. However, using a standard template can help you avoid missing important details and ensure that all legal requirements are met.

To transfer ownership of a car in Wisconsin, you need to complete a bill of sale, which officially records the transaction. The bill should include the seller's and buyer's information, along with the vehicle details. In addition, make sure to submit the relevant forms to the Wisconsin Department of Transportation. Using a Wisconsin Bill of Sale for a Coin Collection can also simplify any future transactions related to collectibles.

Yes, a handwritten bill of sale is acceptable in Wisconsin, provided it includes essential details like the buyer's and seller's names, a description of the coin collection, and the sale amount. However, using a professionally formatted Wisconsin Bill of Sale for a Coin Collection can help avoid misunderstandings. It provides a clear record of the transaction that is easy to read and reference. Consider utilizing uslegalforms for a streamlined process.

If you do not have a bill of sale, it can complicate transactions and ownership verification. Without this important document, you may face challenges when trying to prove ownership of your coin collection. To avoid these issues, consider creating a Wisconsin Bill of Sale for a Coin Collection using a reliable service like uslegalforms. This ensures your transaction is documented properly.

Yes, Wisconsin law requires a bill of sale for certain transactions, particularly for vehicles and personal items like coin collections. A Wisconsin Bill of Sale for a Coin Collection serves as proof of ownership and the terms of sale. This document protects both the buyer and the seller by clearly outlining the details of the transaction. Having a proper bill of sale also helps during future ownership transfers.

Yes, Wisconsin requires a bill of sale for car transactions to ensure proper ownership transfer. This document protects both buyer and seller by clearly stating the terms of the sale. If you're handling other sales, like a coin collection, having a Wisconsin Bill of Sale for a Coin Collection can also provide similar benefits, reinforcing clarity in transactions. It is always wise to keep your records organized and up to date.

To sell an old coin collection effectively, consider options such as auction houses, online marketplaces, or coin dealers. Each method has its pros and cons, so choosing one that aligns with your goals is essential. You can use a Wisconsin Bill of Sale for a Coin Collection to document your transaction, providing security and clarity for both parties involved. Researching current market values can also enhance your selling strategy.

In Wisconsin, gold coins are usually exempt from sales tax under the state's rules for collectibles. However, the specific application of tax can depend on various factors related to the coin's value and purpose of sale. When you create a Wisconsin Bill of Sale for a Coin Collection, it is important to clarify these details to avoid any confusion. Always consult with a tax professional for the best advice.

Selling your entire coin collection requires planning and understanding the current market. Start by taking inventory of your coins and assessing their value, then consider whether to sell to a dealer or at an auction. A Wisconsin Bill of Sale for a Coin Collection offers a formal record for this significant transaction, ensuring that both you and the buyer are protected. Utilizing a reliable platform, like uslegalforms, can help you create this essential document easily.