Wisconsin Corporation - Transfer of Stock

Description

How to fill out Corporation - Transfer Of Stock?

You have the capability to spend hours online searching for the authentic document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that are vetted by experts.

You can effortlessly download or print the Wisconsin Corporation - Transfer of Stock from the service.

If available, utilize the Review button to look through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you will be able to complete, modify, print, or sign the Wisconsin Corporation - Transfer of Stock.

- Each legal document template you acquire is yours permanently.

- To obtain an additional copy of any purchased form, go to the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms site, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/town of your choice.

- Check the form description to ensure you have chosen the correct type.

Form popularity

FAQ

The Uniform Stock Transfer Act is designed to standardize the process of transferring stock across states, promoting uniformity and ease of transactions. This act complements local laws, including those in Wisconsin, to ensure that stock transfers are secure and recognized legally. By understanding the Wisconsin Corporation - Transfer of Stock in conjunction with the Uniform Stock Transfer Act, individuals can navigate ownership transfers with greater confidence.

Yes, transferring ownership in a corporation through stock is generally easier compared to other business structures. This method allows shares to be bought, sold, or traded without the need for complicated legal processes. When you consider a Wisconsin Corporation - Transfer of Stock, you will find that this system simplifies the ownership transition, making it more efficient for all parties involved.

A stock transfer is primarily used to record the change of ownership of shares from one individual or entity to another. This process is crucial for corporations as it allows for flexibility in ownership and investment. When dealing with a Wisconsin Corporation - Transfer of Stock, a clear and documented transfer promotes transparency and builds trust among shareholders.

The Stock Transfer Act of 1963 provides a legal framework for the transfer of stock in corporations. This legislation aims to simplify the process of transferring ownership rights, ensuring that such transactions are clear and legally binding. For anyone involved in the Wisconsin Corporation - Transfer of Stock, understanding this act is essential to effectively navigate ownership changes.

Yes, you can set up an S Corp on your own, but navigating the process can be complex. You must complete the necessary paperwork, including state and federal tax forms, and ensure compliance with local laws. A platform like US Legal Forms can simplify this process by providing templates and guidance, helping you manage your Wisconsin Corporation - Transfer of Stock smoothly.

To qualify as an S Corp in Wisconsin, your corporation must meet specific criteria. You need to have no more than 100 shareholders, all of whom must be U.S. citizens or residents. Additionally, your corporation can only have one class of stock and must be formed in the U.S. These requirements ensure compliance and facilitate the efficient transfer of stock within your Wisconsin Corporation.

The primary difference between an LLC and an S Corp in Wisconsin lies in their structure and taxation. An LLC offers flexibility in management and is taxed like a sole proprietorship or partnership. In contrast, an S Corp provides benefits like pass-through taxation and limits on self-employment taxes. Understanding these differences is key for your Wisconsin Corporation - Transfer of Stock.

To form an S Corp in Wisconsin, you need to start by registering your corporation with the state. First, choose a unique name for your business, then file Articles of Incorporation with the Department of Financial Institutions. After the state approves your filing, you can elect S Corp status by submitting Form 2553 to the IRS. This process is essential for establishing your Wisconsin Corporation - Transfer of Stock effectively.

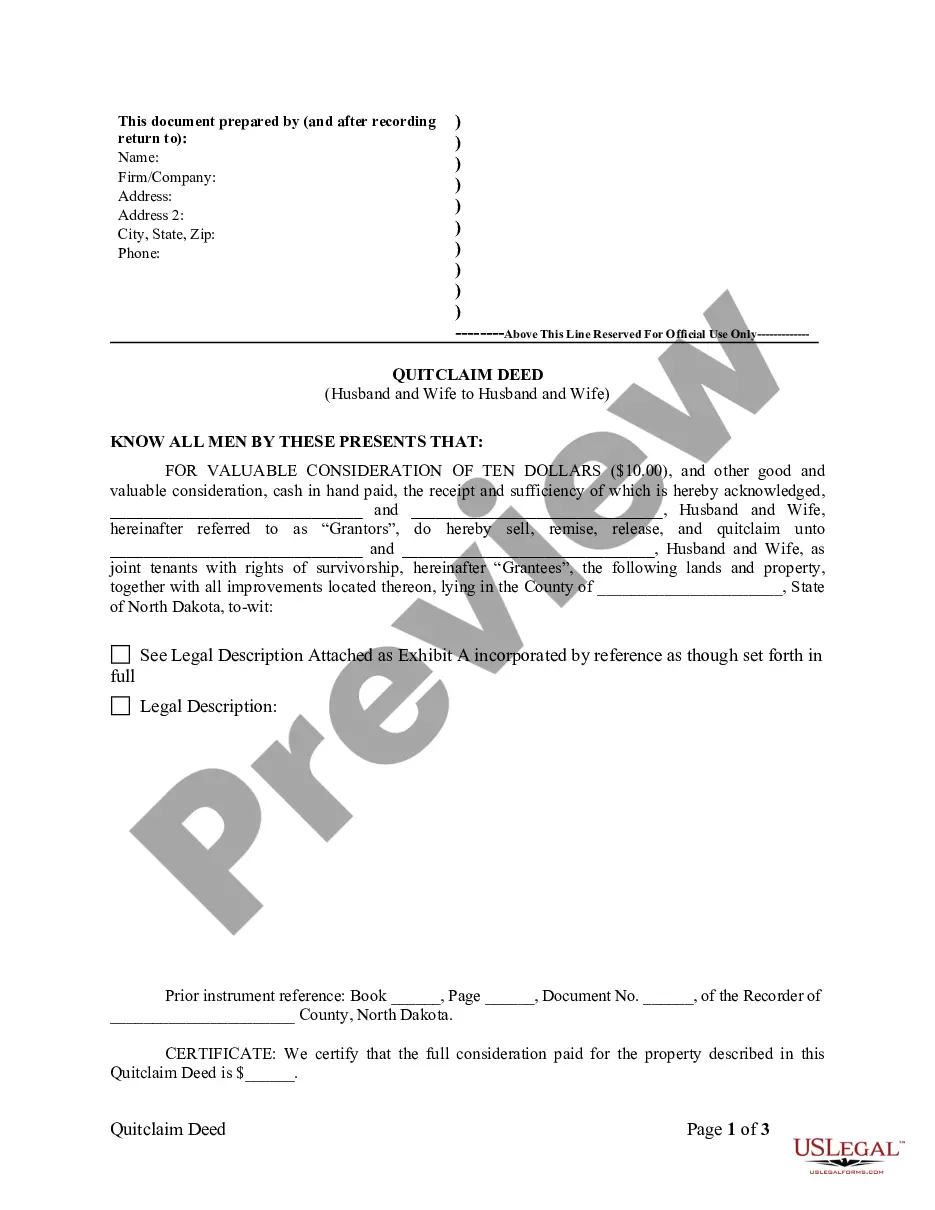

Filling out a stock transfer form requires a few key details. You need to enter the name of the current stockholder, the name of the new stockholder, and specifics about the shares being transferred. Additionally, you must sign and date the form to validate the transaction. By using a reliable resource like US Legal Forms, you can find templates and guidance tailored to Wisconsin Corporation - Transfer of Stock, making the process straightforward.

To transfer ownership of stock within a Wisconsin Corporation, you must first complete a stock transfer form. This document typically requires information about the stockholder, the stock certificate, and the new owner. Once you fill out the form, you should submit it to your corporation’s secretary or designated officer for processing. This process ensures that the transfer complies with the legal regulations governing Wisconsin Corporation - Transfer of Stock.