Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift

Description

How to fill out Acknowledgment By Charitable Or Educational Institution Of Receipt Of Gift?

US Legal Forms - one of the largest collections of legal documents in the country - offers a variety of legal document templates that you can download or create.

By using the website, you can discover thousands of documents for business and personal purposes, organized by categories, states, or keywords. You can obtain the most recent forms like the Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift within moments.

If you possess a monthly subscription, Log In and download the Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift from the US Legal Forms library. The Download option will appear on each document you view. You can access all previously downloaded forms in the My documents section of your account.

Select the format and download the document to your device. Make edits. Fill out, modify, and print and sign the downloaded Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

Every format you save in your account does not expire and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the document you need. Access the Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift with US Legal Forms, the most extensive compilation of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are straightforward guidelines to help you get started.

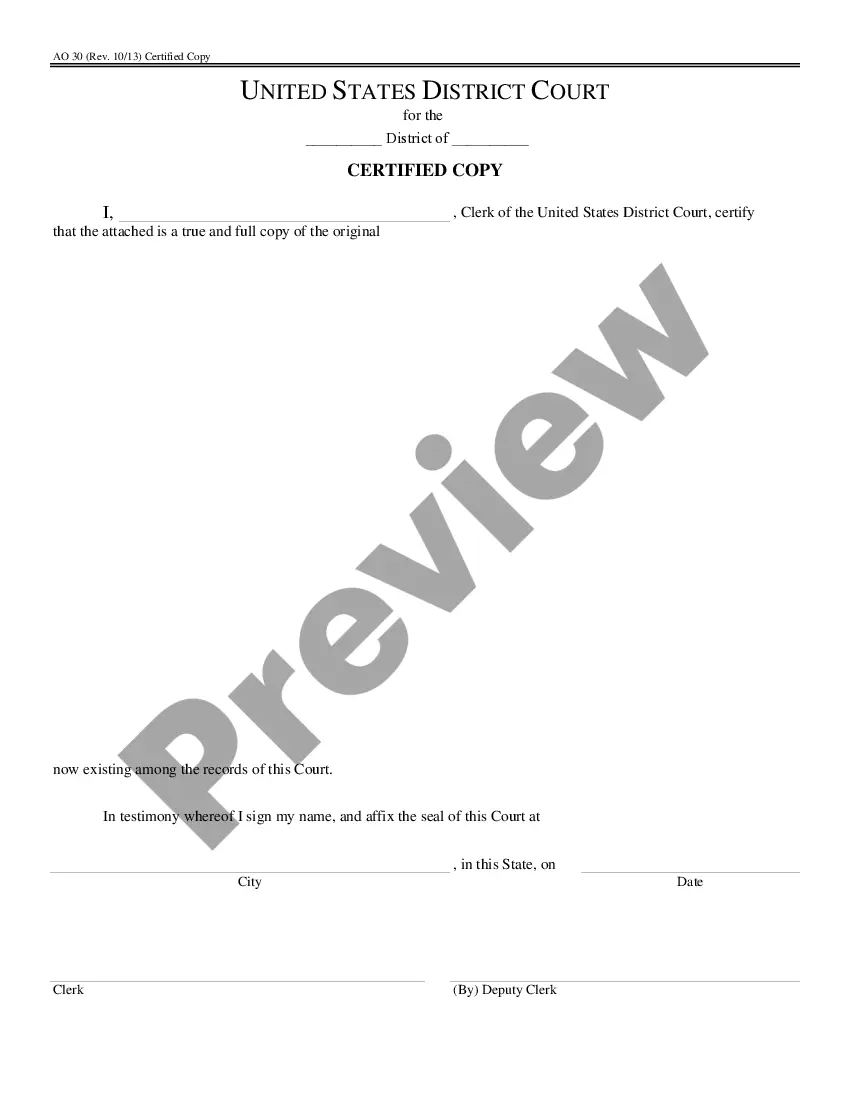

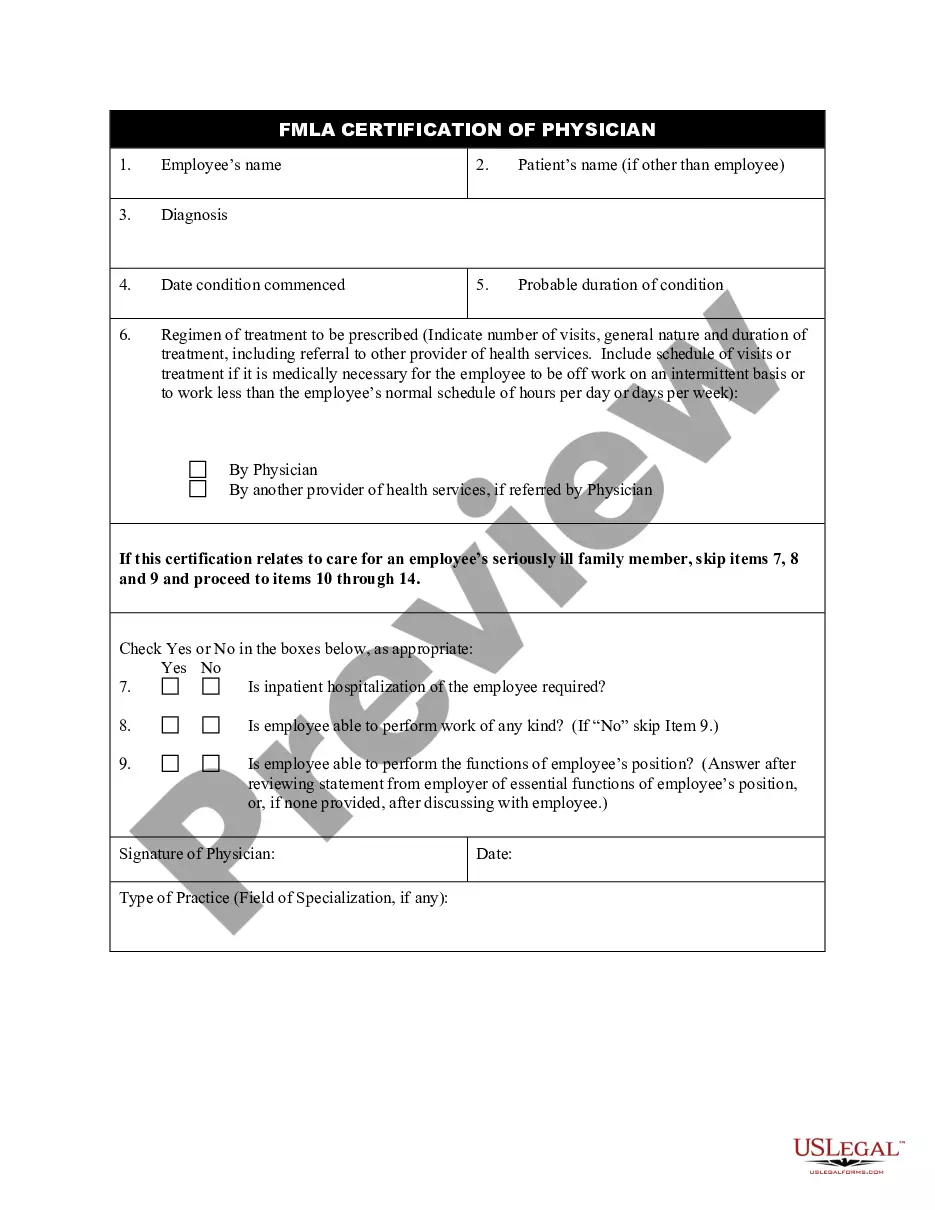

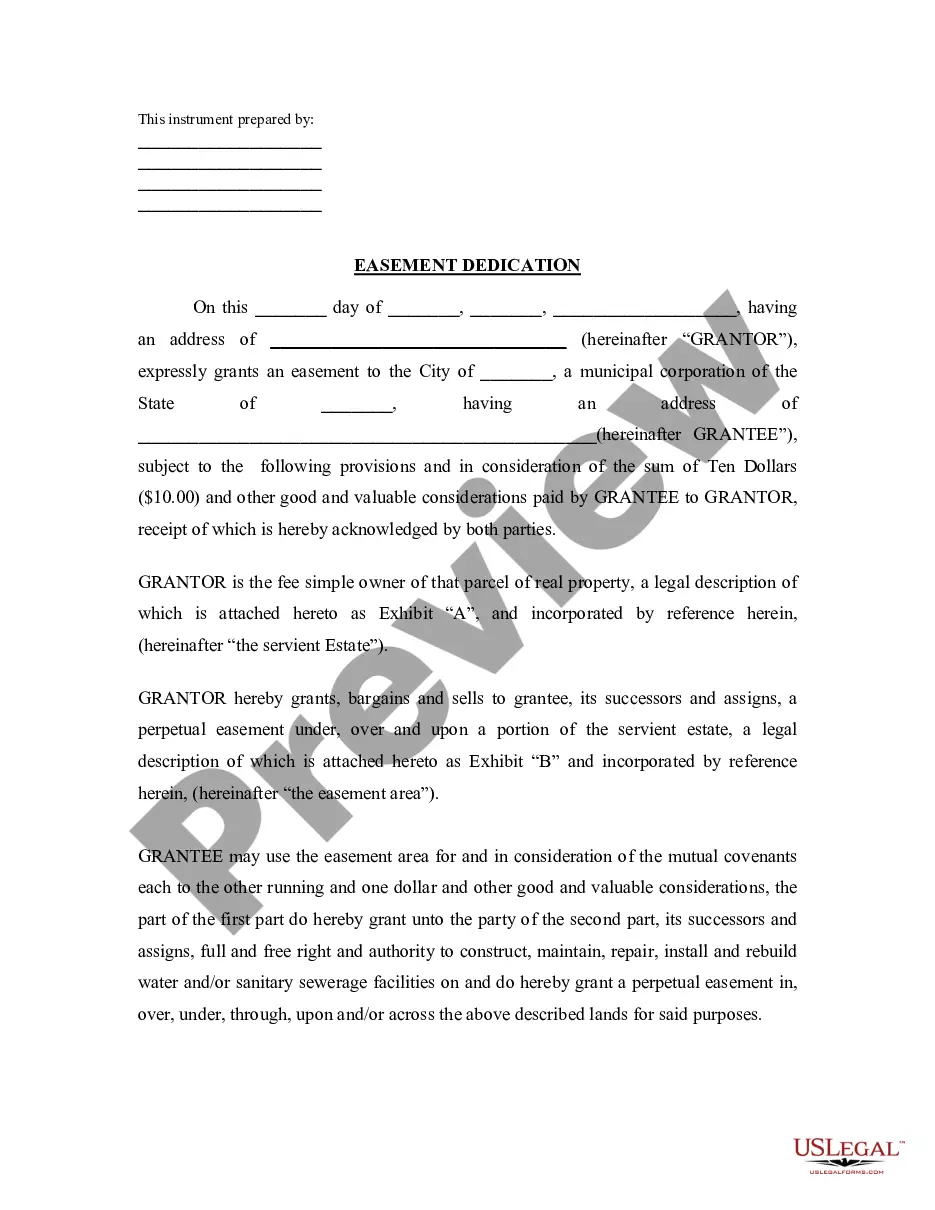

- Ensure you have selected the correct document for your city/state. Click on the Preview option to examine the document's content.

- Review the document details to confirm that you have chosen the right document.

- If the document does not meet your requirements, utilize the Search box at the top of the screen to find one that does.

- If you are satisfied with the document, confirm your choice by clicking the Get now button. Then, select your preferred pricing plan and provide your information to register for an account.

- Process the payment. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Form popularity

FAQ

To write a receipt for a charitable donation, start by clearly stating the name of your organization and its tax-exempt status. Include the date of the donation, the amount contributed, and a description of any goods or services provided in exchange for the donation. Additionally, ensure that you provide a Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift to confirm the receipt of the contribution. This documentation is essential for both the donor's tax records and your organization's accountability.

A gift acknowledgement is a document that verifies the receipt of a donation by a charitable or educational institution. It typically includes essential information such as the donor's name, the amount donated, and the date of the donation. This acknowledgement is crucial for donors seeking tax deductions and for institutions wanting to maintain accurate records. By adhering to the Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift, organizations can streamline this process effectively.

An example of an acknowledgement letter includes a brief introduction, a clear statement of the gift received, and a note of thanks. For instance, the letter might state, 'Thank you for your generous donation of $500 received on January 15, 2023.' Such letters can also include the institution's mission and how the funds will be used. Utilizing the Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift ensures all necessary elements are included.

The purpose of an acknowledgement letter is to formally recognize and thank a donor for their contribution. It serves as a record of the donation, which can be useful for tax filing and personal records. Furthermore, it helps strengthen the relationship between the donor and the institution by showing appreciation and transparency. Emphasizing the Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift enhances this process.

Donation acknowledgement letters are not legally required, but they are highly recommended for both charities and donors. These letters provide proof of the donation and can support tax deductions for the donor. Additionally, they foster goodwill and transparency between the institution and its contributors. Utilizing the Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift helps keep these practices standardized.

A gift acknowledgement letter is a formal document issued by a charitable or educational institution to confirm the receipt of a donation. This letter typically outlines the details of the gift, including the amount and date received. For donors, this letter serves as essential documentation for tax purposes. Understanding the Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift can help ensure compliance with state requirements.

A contemporaneous written acknowledgment of a charitable gift must contain specific details to be considered valid. It should include the donor's name, the amount of the gift, a description of any goods or services received in exchange, and the date of the contribution. By ensuring these elements are present, you create a proper Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift, which is essential for the donor's tax records and your organization's compliance.

To acknowledge receipt of a donation, promptly send a written acknowledgment to the donor. This letter should include the donor's name, the amount of the donation, and a statement of appreciation for their support. By providing this Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift, you not only fulfill legal requirements but also strengthen your relationship with the donor, encouraging future support.

To acknowledge a gift from a donor-advised fund, you should first confirm the details of the donation with the fund administrator. Once confirmed, you can send a written acknowledgment that includes the donor's name, the date of the gift, and the amount contributed. This Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift helps the donor maintain accurate records for tax purposes and demonstrates your appreciation for their generosity.

A written acknowledgment for a charitable contribution typically includes the name of the donor, the date of the contribution, and a description of the gift. For example, it may state, 'Thank you for your generous gift of $500 to our organization on January 15, 2023. Your support plays a vital role in our mission.' This Wisconsin Acknowledgment by Charitable or Educational Institution of Receipt of Gift serves as a formal record for both the donor and the organization.