Wisconsin Account Stated for Construction Work

Description

How to fill out Account Stated For Construction Work?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

By using the website, you will access thousands of templates for business and personal purposes, organized by categories, states, or keywords. You can get the latest versions of templates such as the Wisconsin Account Stated for Construction Work in moments.

If you already have a subscription, Log In and obtain the Wisconsin Account Stated for Construction Work from the US Legal Forms library. The Download button will be visible on every template you view. You can access all previously obtained templates in the My documents section of your account.

Complete the payment process. Use a credit card or PayPal account to finalize the transaction.

Select the format and download the template to your device. Edit. Fill out, modify, and print and sign the downloaded Wisconsin Account Stated for Construction Work. Each template you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the template you need. Access the Wisconsin Account Stated for Construction Work with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct template for your area/county.

- Click the Review button to examine the template's details.

- Check the template description to confirm that you have selected the right one.

- If the template does not meet your requirements, use the Search field at the top of the page to find one that does.

- If you are satisfied with the template, confirm your choice by clicking the Purchase now button.

- Then, choose the payment plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

Oral agreements are recognized by Wisconsin law if there is a definite and assured promise and a meeting of minds on key terms.

Once the contractor receives payment, they must pay their subs and suppliers within 7 days. This same 7-day deadline applies to all other payments down the chain.

Retention is essentially money promised that is held back by the client to ensure themselves against contractor failure. Usually, retention is set at 3% or 5% of the total work value. That money is deducted from payments made to the contractor, who then deducts it from payments made to any subcontractors.

When the subcontractor does not get paid then they have grounds to pursue the contractor for monies owed. This could be in the form of wages or unpaid invoices for services rendered. In the USA, the owner of the property can be held liable for payment under a Mechanics Lien.

Definition. An agreement between private parties creating mutual obligations enforceable by law. The basic elements required for the agreement to be a legally enforceable contract are: mutual assent, expressed by a valid offer and acceptance; adequate consideration; capacity; and legality.

200dA 'Payment Notice' is the document the contractor (the employer) serves the subcontractor (the employee) providing details of what's payable and why. This is known as the 'Notified Sum' and this is what will be paid on the 'Final Date for Payment' (see below).

Wisconsin's statute of repose for construction projects generally provides that a lawsuit cannot be brought against persons or contractors involved in the improvement of real estate more than ten years from the date of substantial completion of the project. This rule is set forth in §893.89, Wisconsin Statutes.

Pay If Paid: Prohibited in Wisconsin? Depending on how they do business, many Wisconsin contractors may not use or see pay if paid clauses because there is a general belief that Wisconsin law prohibits them. Although Wisconsin law prohibits pay if paid clauses in some contexts, the prohibition is not absolute.

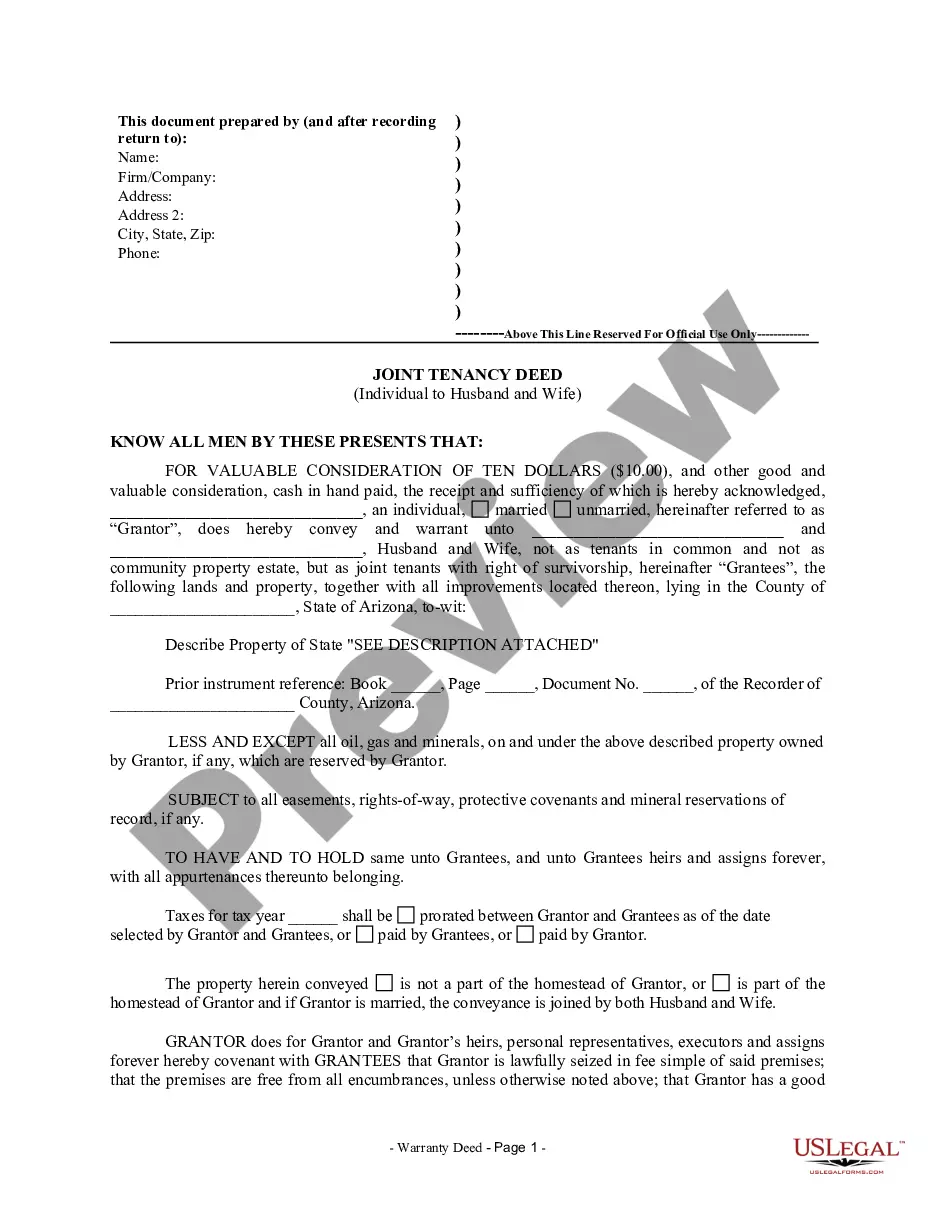

It is a written confirmation of a request for work by one party, the performance of work by the second, and the cost of the work agreed upon.

Paying subcontractorsYou usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.