Wisconsin Debtor's Answer Non-Earnings Garnishment (Small Claims) is a legal process where a creditor can attempt to collect a debt from a debtor. This type of garnishment is used for debts of $10,000 or less and is an alternative to wage garnishment. The creditor must file a complaint in small claims court to initiate the process. If the debtor fails to respond to the complaint, the court can issue a judgment in favor of the creditor. The creditor then serves the debtor with an Order of Non-Earnings Garnishment, which requires the debtor to provide information about their non-earnings assets to the creditor. The debtor has the right to challenge the Order of Non-Earnings Garnishment and can file a Debtor's Answer to the Order of Non-Earnings Garnishment. There are three types of Wisconsin Debtor's Answer Non-Earnings Garnishment (Small Claims): 1. Motion to Vacate: The debtor can file a Motion to Vacate the Order of Non-Earnings Garnishment if they believe the judgment was improper. 2. Claim of Exemptions: The debtor can file a Claim of Exemptions if they believe that some of their assets are exempt from garnishment. 3. Motion for Relief from Judgment: The debtor can file a Motion for Relief from Judgment if they believe that they should not be held liable for the debt.

Wisconsin Debtor's Answer Non-Earnings Garnishment (Small Claims)

Description

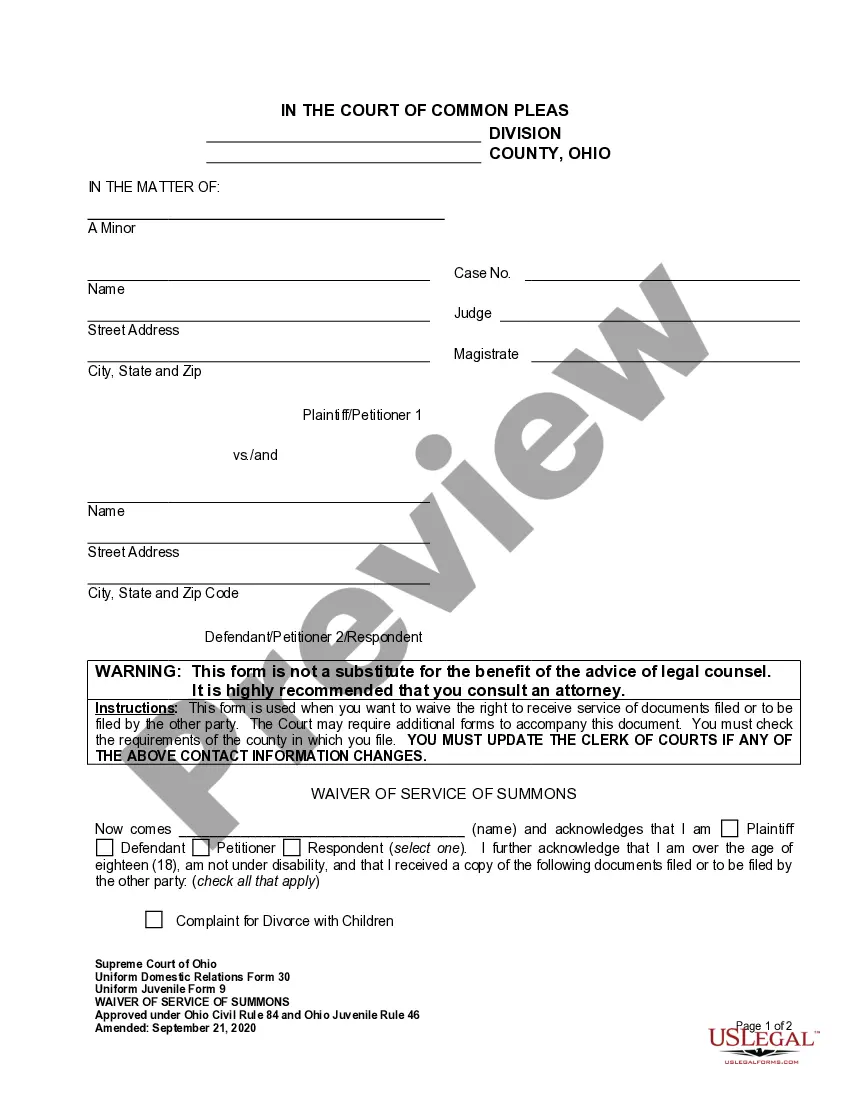

How to fill out Wisconsin Debtor's Answer Non-Earnings Garnishment (Small Claims)?

Handling official paperwork requires attention, precision, and using properly-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Wisconsin Debtor's Answer Non-Earnings Garnishment (Small Claims) template from our library, you can be certain it meets federal and state regulations.

Working with our service is simple and quick. To get the required document, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to get your Wisconsin Debtor's Answer Non-Earnings Garnishment (Small Claims) within minutes:

- Make sure to attentively look through the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for an alternative official blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Wisconsin Debtor's Answer Non-Earnings Garnishment (Small Claims) in the format you prefer. If it’s your first experience with our website, click Buy now to continue.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to submit it electronically.

All documents are drafted for multi-usage, like the Wisconsin Debtor's Answer Non-Earnings Garnishment (Small Claims) you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

What is a non-earnings garnishment? A non-earnings garnishment is when the court orders a person or entity (garnishee), who is not an employer of the debtor but who owes money to the debtor, to pay a judgment creditor for an amount owed by the debtor to the creditor.

After a creditor has obtained a judgment against you to begin garnishing your wages, one way to put an immediate stop to it is by filing for bankruptcy protection.

The disclosure fee is $35 for periodic garnishments, and $1 for non-periodic garnishments. The garnishee must be served within 182 days from the date the writ is issued.

(1) The creditor shall pay a $15 fee to the garnishee for each earnings garnishment or each stipulated extension of that earnings garnishment. This fee shall be included as a cost in the creditor's claim in the earnings garnishment.

After a creditor has obtained a judgment against you to begin garnishing your wages, one way to put an immediate stop to it is by filing for bankruptcy protection.

812.01 Commencement of garnishment. (1) Any creditor may proceed against any person who is indebted to or has any property in his or her possession or under his or her control belonging to such creditor's debtor or which is subject to satisfaction of an obligation described under s.

By law, you are entitled to an exemption of not less than 80% of your disposable earnings. Your "disposable earnings" are those remaining after social security and federal and state income taxes are withheld.

Wisconsin imposes stricter limits than federal law, limiting a garnishment to 20% in most cases. The creditor will continue to garnish your wages until the debt is paid off, or you take some measure to stop the garnishment, such as claiming an exemption with the court.