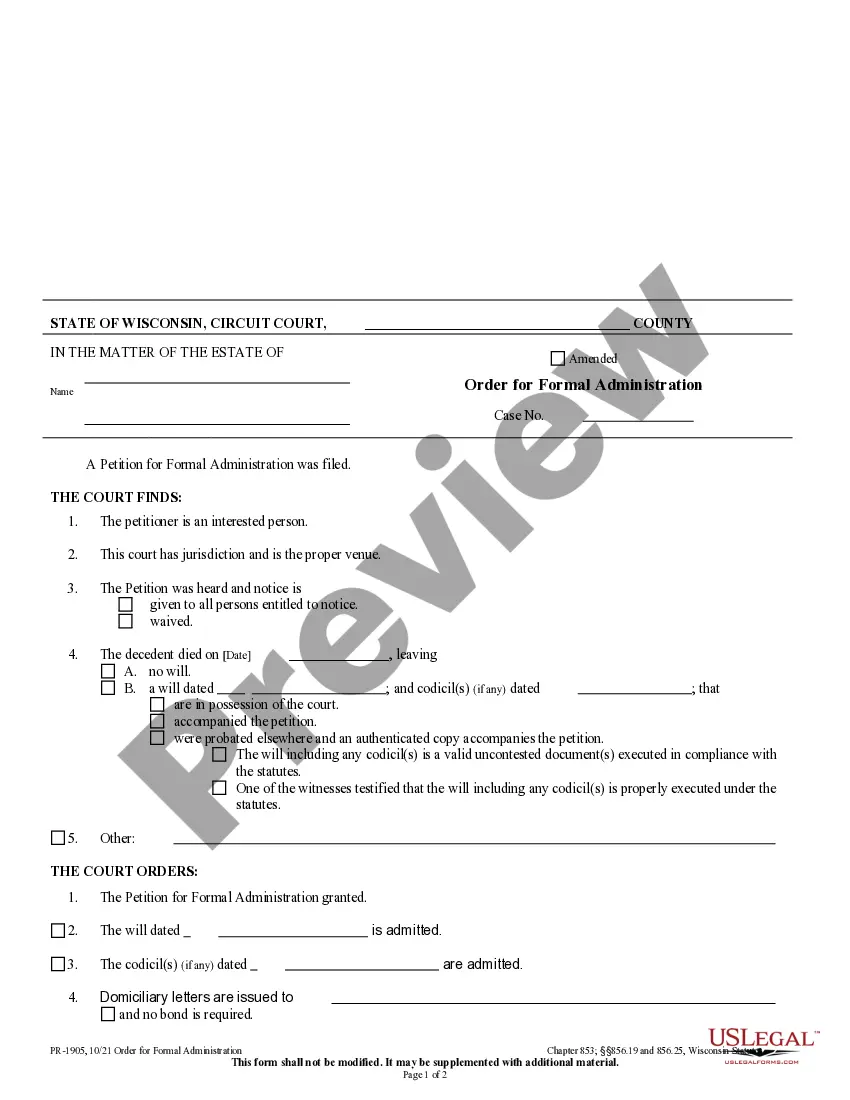

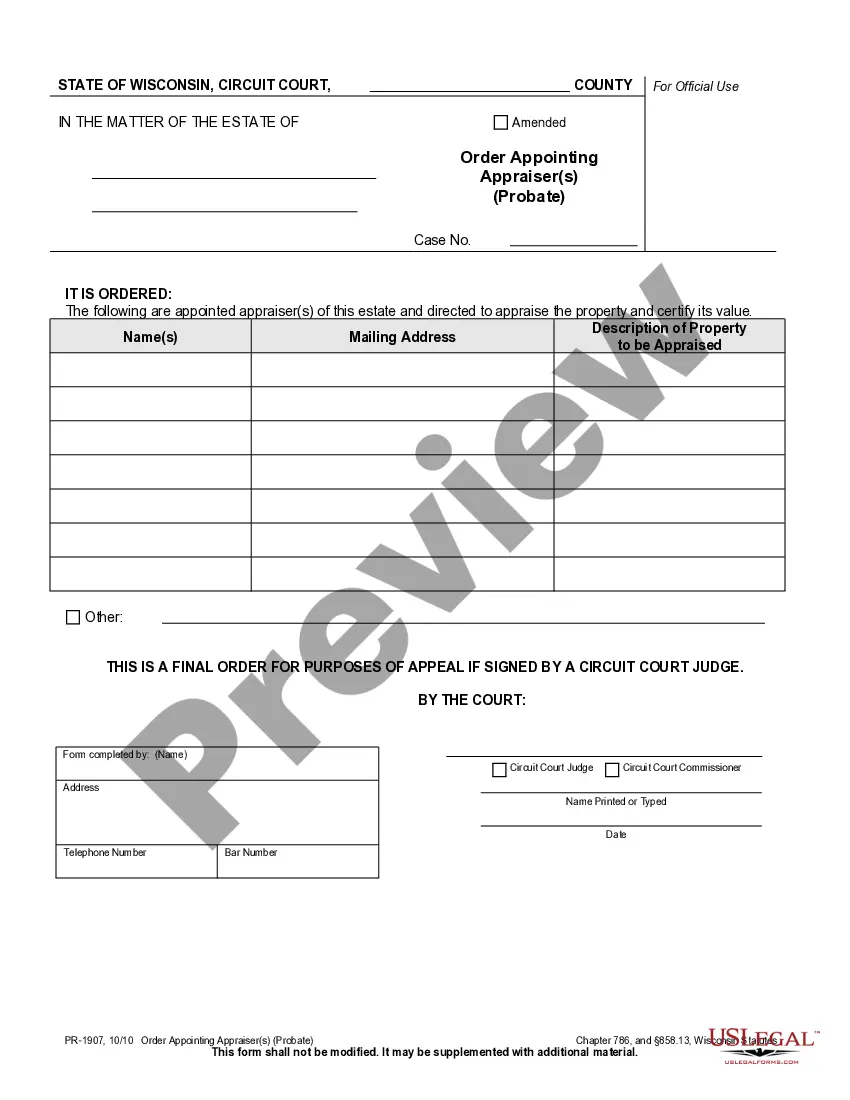

Wisconsin Order Appointing Appraiser(s) is an official court document issued by a Wisconsin court, typically in the context of a foreclosure action, that appoints one or more qualified appraisers to appraise a property. The order is issued by the court and sets forth the appraiser(s) name, qualifications, and fee. It also states the description of the property to be appraised, the date and method of payment to the appraiser(s), and any other instructions the court deems necessary. There are two types of Wisconsin Order Appointing Appraiser(s): (1) Appraiser(s) of Real Estate, and (2) Appraiser(s) of Personal Property. The order is typically issued by the court after a creditor files a motion requesting the court to appoint an appraiser, and the court finds it necessary to do so.

Wisconsin Order Appointing Appraiser(s)

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Wisconsin Order Appointing Appraiser(s)?

How much time and resources do you often spend on composing official documentation? There’s a better way to get such forms than hiring legal experts or wasting hours browsing the web for a suitable blank. US Legal Forms is the top online library that offers professionally drafted and verified state-specific legal documents for any purpose, such as the Wisconsin Order Appointing Appraiser(s).

To get and prepare a suitable Wisconsin Order Appointing Appraiser(s) blank, follow these simple instructions:

- Examine the form content to ensure it meets your state regulations. To do so, read the form description or use the Preview option.

- If your legal template doesn’t meet your requirements, locate a different one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Wisconsin Order Appointing Appraiser(s). Otherwise, proceed to the next steps.

- Click Buy now once you find the correct document. Choose the subscription plan that suits you best to access our library’s full service.

- Create an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is totally safe for that.

- Download your Wisconsin Order Appointing Appraiser(s) on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously downloaded documents that you securely store in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as frequently as you need.

Save time and effort preparing formal paperwork with US Legal Forms, one of the most reliable web services. Join us now!

Form popularity

FAQ

How do I file a claim against an estate? A standard claim form (PR-1819) can be obtained online from Wisconsin Courts. The completed form, along with the statutory $3 filing fee, must be filed with the Register in Probate prior to the expiration of the claims date.

Wisconsin probate laws require an estate to be settled within 18 months.

In Wisconsin, the estate executor is known as a "personal representative". Subject to approval of the court, executor fees are set at 2% of the net value of the estate assets, or a rate agreed with the decedent or the majority interest of the heirs.

Creditors have four months from the date of notification to file any claims against the assets. Creditors are barred from filing lawsuits against the estate until the four-month limit has expired.

A Formal Administration requires the assistance of an attorney. Informal Administration may be granted without an attorney's assistance. Informal Administration is the administration of the decedent's estate without continuous court supervision, and is supervised by a Probate Registrar.

Domiciliary Letters are written proof that a person is authorized by the court to act as Personal Representative on behalf of the estate. Letters are issued as part of opening the probate case for an estate.

893.93 (1) (c), which bars all claims against a decedent or the estate if administration not commenced within 6 years after death.

Is probate required in Wisconsin? Probate is required in Wisconsin if you have a Will and an estate worth $50,000 or more. It is a statutory law in Wisconsin that a Will for an estate of $50,000 or more must be verified as authentic and distributions carried out in ance with the terms of the Will.