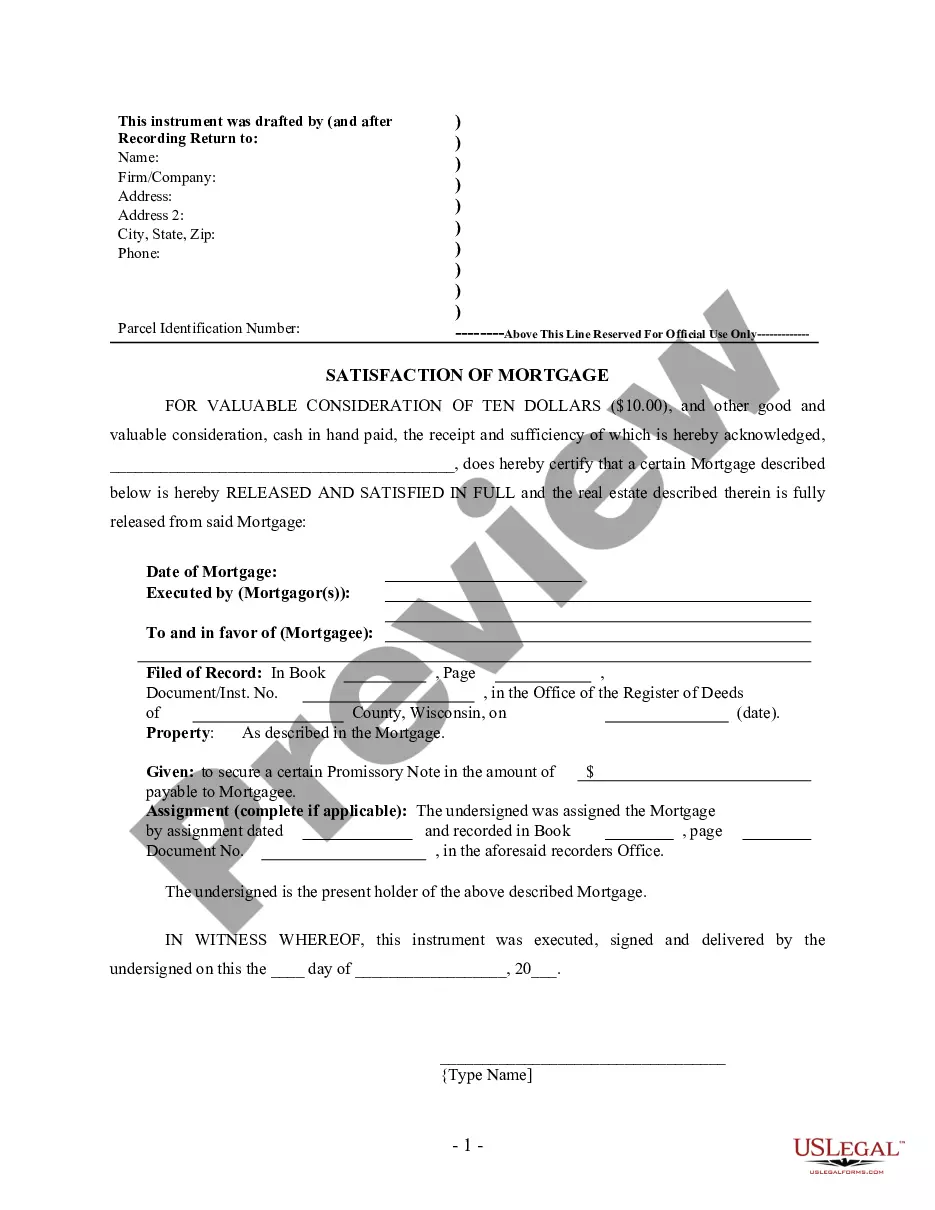

With this Satisfaction, Cancellation or Release of Mortgage Package,you will find the forms and letters necessary for the satisfaction or release of a mortgage for the state of Wisconsin. The described real estate is therefore released from the mortgage.

Included in your package are the following forms:

1. Satisfaction, Release or Cancellation of a Deed of Trust by a Corporation;

2. Satisfaction, Release or Cancellation of a Deed of Trust by an Individual;

3. Letter of Notice to Borrower of Status of Mortgage;

4. Letter to Recording Office for Recording Satisfaction of a Mortgage