This is an Order to File Standard Form, to be used by the Courts in the State of Wisconsin. This form is used to order litigants to file the required standard form.

Wisconsin Order to File Standard Form

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

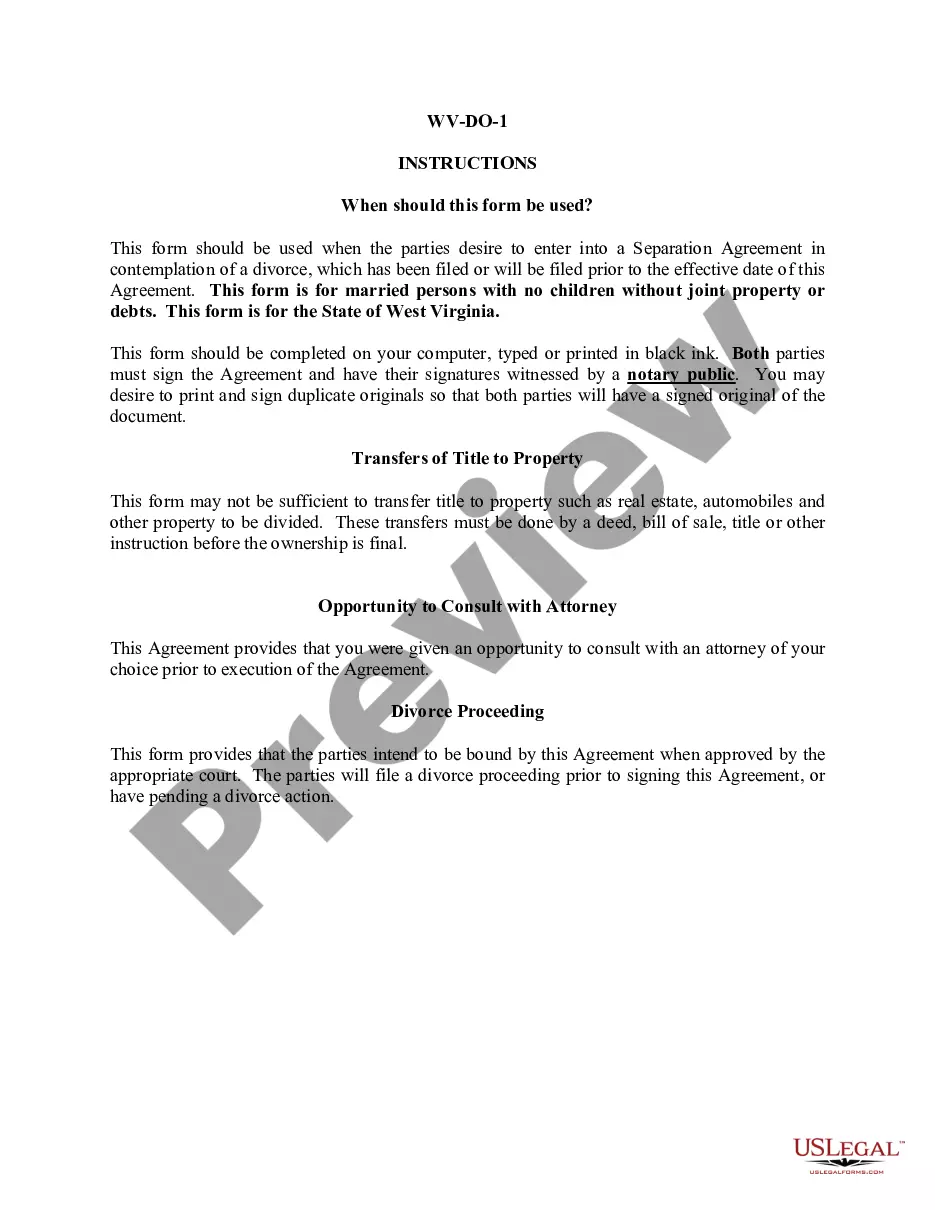

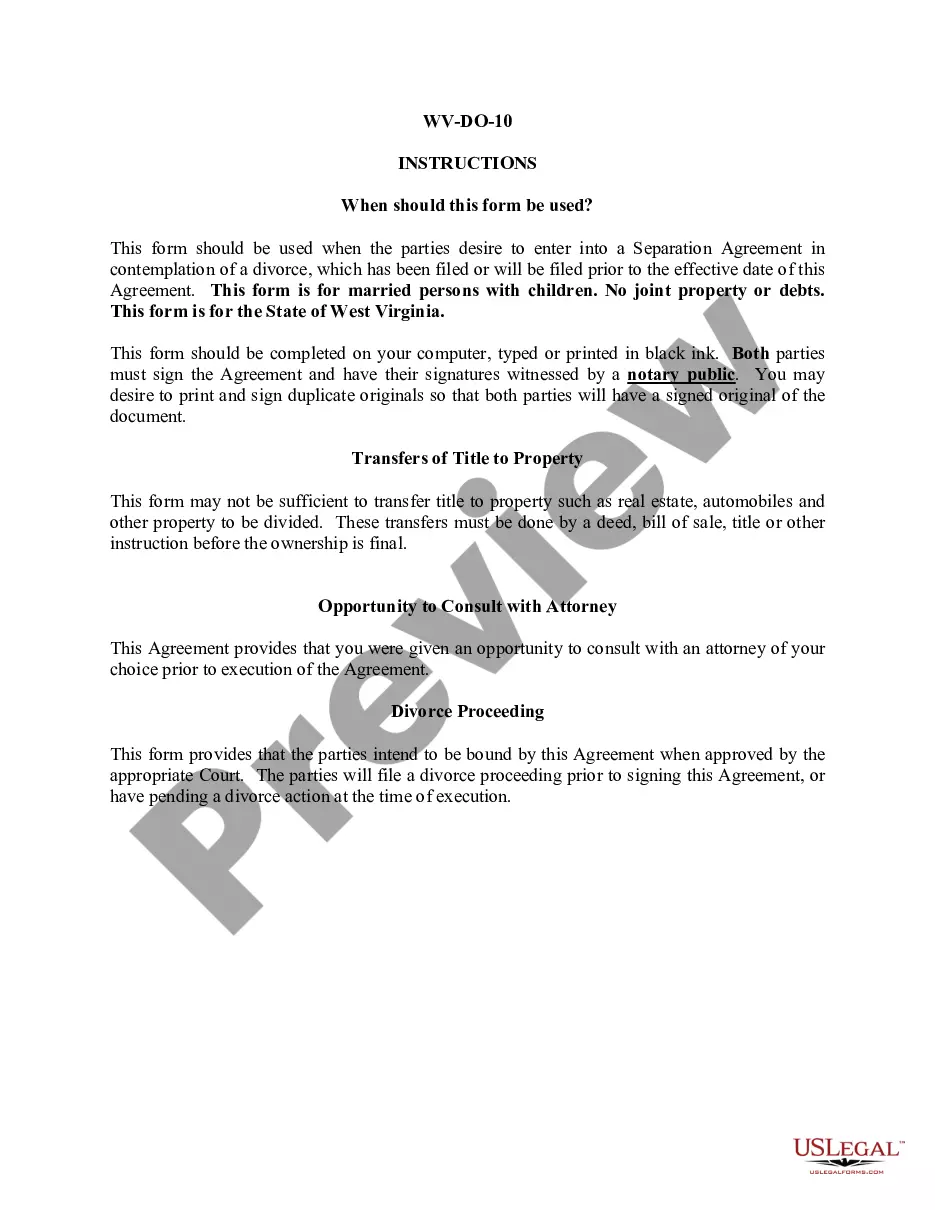

How to fill out Wisconsin Order To File Standard Form?

Out of the large number of services that offer legal samples, US Legal Forms offers the most user-friendly experience and customer journey when previewing templates prior to buying them. Its extensive library of 85,000 samples is grouped by state and use for efficiency. All the forms available on the service have already been drafted to meet individual state requirements by accredited lawyers.

If you already have a US Legal Forms subscription, just log in, look for the form, click Download and obtain access to your Form name from the My Forms; the My Forms tab holds all your downloaded forms.

Keep to the guidelines listed below to get the document:

- Once you discover a Form name, make certain it’s the one for the state you really need it to file in.

- Preview the form and read the document description prior to downloading the template.

- Look for a new sample through the Search field in case the one you have already found isn’t correct.

- Simply click Buy Now and choose a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the template.

Once you have downloaded your Form name, it is possible to edit it, fill it out and sign it in an web-based editor that you pick. Any form you add to your My Forms tab can be reused multiple times, or for as long as it continues to be the most up-to-date version in your state. Our service provides quick and easy access to samples that fit both legal professionals and their clients.

Form popularity

FAQ

But this year, the IRS won't start accepting 2020 tax returns until February 12, 2021. While we're almost there, that's still 16 days later than last year.

For the second year in a row, you have additional time to file your federal taxes. On March 17th, the Treasury Department and Internal Revenue Service announced that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15, 2021 to May 17, 2021.

Download them from IRS.gov. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

During the tax filing season, many libraries and post offices offer free tax forms to taxpayers. Some libraries also have copies of commonly requested publications. Many large grocery stores, copy centers and office supply stores have forms you can photocopy or print from a CD.

Call or visit any of the Department of Revenue offices located throughout the state. Request forms by calling (608) 266-1961.

The 2020 Wisconsin State Income Tax Return for Tax Year 2020 (Jan. 1 - Dec. 31, 2020) can be e-Filed together with the IRS Income Tax Return by April 15, 2021 May 17, 2021 due date. If you file a tax extension you can e-File your Taxes until October 15, 2021 without a late filing penalty.

The federal tax filing deadline postponement to May 17, 2021, only applies to individual federal income returns and tax (including tax on self-employment income) payments otherwise due April 15, 2021, not state tax payments or deposits or payments of any other type of federal tax.

Wisconsin residents now have until July 15, 2020, to file their state returns and pay any state tax they owe for 2019. As with the federal deadline extension, Wisconsin won't charge interest on unpaid balances between April 15 and July 15, 2020.

Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.