Washington Loan Commitment Form and Variations

Description

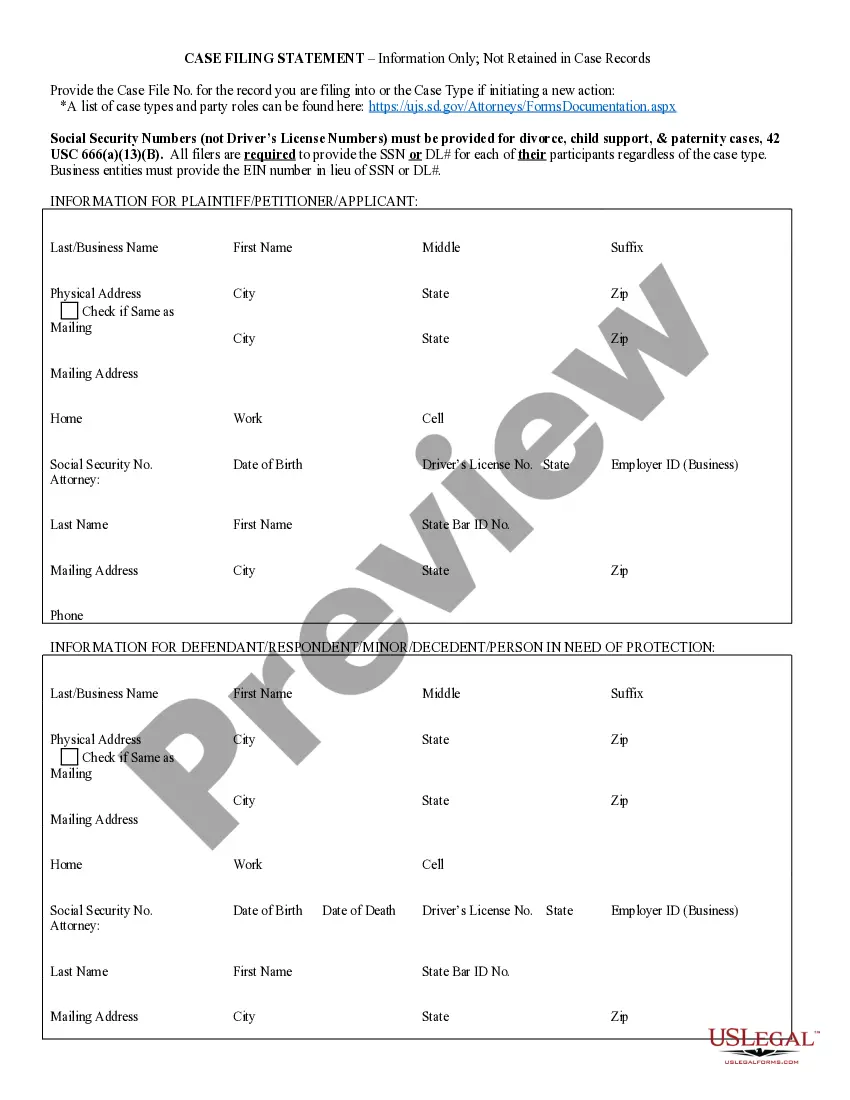

How to fill out Loan Commitment Form And Variations?

If you have to comprehensive, obtain, or printing legal papers web templates, use US Legal Forms, the biggest assortment of legal kinds, that can be found on-line. Use the site`s basic and practical lookup to obtain the paperwork you will need. Different web templates for business and person reasons are sorted by classes and says, or search phrases. Use US Legal Forms to obtain the Washington Loan Commitment Form and Variations in just a handful of clicks.

When you are presently a US Legal Forms client, log in in your accounts and click on the Download button to have the Washington Loan Commitment Form and Variations. Also you can entry kinds you in the past acquired in the My Forms tab of your respective accounts.

If you are using US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the shape for the correct city/country.

- Step 2. Utilize the Preview option to check out the form`s content. Never overlook to see the information.

- Step 3. When you are not satisfied with the develop, use the Search discipline on top of the display to locate other types in the legal develop template.

- Step 4. After you have identified the shape you will need, click the Acquire now button. Pick the prices strategy you like and put your qualifications to sign up on an accounts.

- Step 5. Process the purchase. You can use your Мisa or Ьastercard or PayPal accounts to complete the purchase.

- Step 6. Select the format in the legal develop and obtain it on your gadget.

- Step 7. Comprehensive, modify and printing or indicator the Washington Loan Commitment Form and Variations.

Each legal papers template you buy is your own eternally. You might have acces to each develop you acquired inside your acccount. Go through the My Forms area and decide on a develop to printing or obtain yet again.

Remain competitive and obtain, and printing the Washington Loan Commitment Form and Variations with US Legal Forms. There are thousands of professional and state-specific kinds you may use for the business or person requirements.

Form popularity

FAQ

The must-have details in your loan commitment letter are the lender's and borrower's information, loan type and amount, repayment agreement, and loan expiration.

Loan modification is a change made to the terms of an existing loan by a lender. It may involve a reduction in the interest rate, an extension of the length of time for repayment, a different type of loan, or any combination of the three.

The final approval usually occurs after all the conditions outlined in the commitment letter have been satisfied. At that point, the lender thoroughly reviews the documentation and confirms that all requirements have been met.

A loan commitment is an agreement by a commercial bank or other financial institution to lend a business or individual a specified sum of money. A loan commitment is useful for consumers looking to buy a home or a business planning to make a major purchase.

Contents of Commitment Letter The loan amount. The agreed upon loan repayment period. The interest rate for the loan. Date of lock expiration (if the loan is locked in) for the interest rate.

Loan modifications are a long-term mortgage relief option for borrowers experiencing financial hardship, such as loss of income due to illness. A modification typically changes the loan's rate or term (or both) to make monthly payments more affordable.

A loan commitment generally is given to an individual or business in the form of a letter from a lending institution, which may be a commercial bank, mortgage bank, or credit union. The letter spells out the financial institution's promise to lend a certain amount under certain terms in the future.

A letter of commitment is a formal binding agreement between a lender and a borrower. It outlines the terms and conditions of the loan and the nature of the prospective loan.

The Bottom Line Most lenders agree to modifications only if you're at immediate risk of foreclosure. A loan modification can also help you change the terms of your loan if your home loan is underwater. Contact your lender if you think you qualify for a modification.

A loan commitment is a letter from a lender indicating your eligibility for a home loan. In essence, it is the lender's promise to fund the loan as stated by the terms in the letter. You receive a loan commitment letter once your application has been reviewed and the underwriting process is complete.