Washington Collections Agreement - Self-Employed Independent Contractor

Description

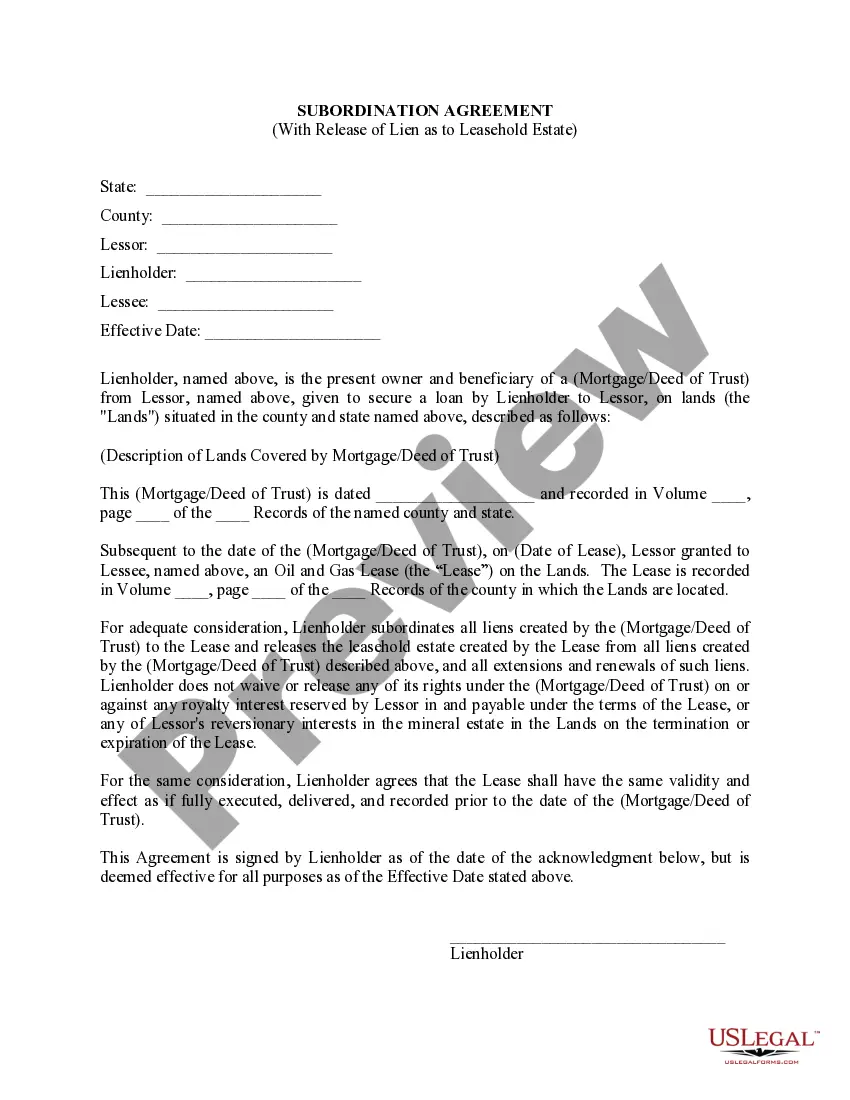

How to fill out Collections Agreement - Self-Employed Independent Contractor?

Are you currently in a location where you frequently need documents for either business or personal purposes? There are many legal document templates available online, but finding trustworthy ones can be challenging. US Legal Forms offers thousands of form templates, such as the Washington Collections Agreement - Self-Employed Independent Contractor, designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms site and have your account, simply Log In. Then, you can download the Washington Collections Agreement - Self-Employed Independent Contractor template.

If you do not have an account and want to start using US Legal Forms, follow these steps: Obtain the form you need and ensure it is for the correct city/state. Use the Review button to examine the form. Read the description to ensure you have selected the proper form. If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements. Once you find the correct form, click Purchase now. Select the pricing plan you want, fill in the necessary information to create your account, and place an order using your PayPal or credit card. Choose a convenient file format and download your copy. Access all of the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Washington Collections Agreement - Self-Employed Independent Contractor at any time, if needed. Click the desired form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid mistakes.

- The service offers professionally crafted legal document templates suitable for various purposes.

- Create your account on US Legal Forms and start simplifying your life.

Form popularity

FAQ

Independent contractors typically need to fill out forms such as the AW-9 for tax identification, and a detailed independent contractor agreement that outlines the terms of the job. Additionally, you may require invoices for billing clients. Using platforms like uslegalforms can provide templates and guidance for these forms, making it easier to comply with your Washington Collections Agreement - Self-Employed Independent Contractor.

To fill out an independent contractor agreement, begin with your name and the client's name, along with essential details about the scope of work. Specify payment terms, including rates and deadlines, to ensure clarity. Completing this agreement accurately aligns with your Washington Collections Agreement - Self-Employed Independent Contractor, formalizing your professional relationship and protecting your interests.

Accepting payment as a self-employed independent contractor can be done through various methods, including checks, bank transfers, or online payment platforms like PayPal. Ensure you provide clear instructions to clients on how to send payments. This approach helps streamline the payment process and aligns well with your Washington Collections Agreement - Self-Employed Independent Contractor, ensuring timely payments for your services.

To fill out the AW-9 form as a self-employed independent contractor, you will need to provide your name, business name (if applicable), and Taxpayer Identification Number (TIN). Make sure to check the box to indicate that you are not subject to backup withholding. After completing the form, keep it for your records and provide a copy to the businesses that hire you, especially when handling a Washington Collections Agreement - Self-Employed Independent Contractor.

Washington state has specific laws governing debt collection practices to protect consumers. Debt collectors must adhere to the Washington State Collection Agency Act, which sets forth guidelines on how debts can be collected and prohibits harassment. When dealing with debts as a self-employed independent contractor, understanding these laws can help you navigate collections effectively. A well-structured Washington Collections Agreement - Self-Employed Independent Contractor can also address payment terms clearly to prevent issues.

Writing an independent contractor agreement is straightforward. Start by outlining the scope of work, payment terms, and deadlines. Make sure to include key elements such as confidentiality, termination clauses, and any necessary legal disclaimers. For a comprehensive Washington Collections Agreement - Self-Employed Independent Contractor, you might consider using resources from USLegalForms to ensure all important aspects are covered.

Yes, independent contractors typically need a business license in Washington state. This requirement helps ensure compliance with local regulations and establishes credibility with clients. You can easily obtain a business license through the Washington State Department of Revenue. If you're drafting a Washington Collections Agreement - Self-Employed Independent Contractor, including your license details may enhance your professionalism.

Yes, an independent contractor is generally considered self-employed because they operate their own business and provide services to clients. This classification means they are responsible for their taxes and business expenses. When you draft a Washington Collections Agreement - Self-Employed Independent Contractor, it can clarify your self-employment status and protect your interests. This agreement can help you navigate the complexities of your independent work effectively.

In Washington state, independent contractors typically do not need workers' compensation insurance unless they meet certain criteria. However, some contractors may choose to obtain coverage for added protection against work-related injuries. It's wise to review your specific situation and the terms of your Washington Collections Agreement - Self-Employed Independent Contractor to determine insurance needs. Consulting with a legal professional can provide clarity on your responsibilities.

Yes, Non-Disclosure Agreements (NDAs) are enforceable in Washington state, provided they meet certain legal requirements. An NDA protects confidential information and requires clear terms about what is considered confidential and the duration of the obligation. For independent contractors, having a Washington Collections Agreement - Self-Employed Independent Contractor that includes NDA clauses can further secure your work and relationships. Ensure all parties understand the agreement to maintain its enforceability.