Washington Auditor Agreement - Self-Employed Independent Contractor

Description

How to fill out Auditor Agreement - Self-Employed Independent Contractor?

If you wish to obtain, download, or create legal document templates, utilize US Legal Forms, the most extensive selection of legal forms available online. Take advantage of the site's straightforward and user-friendly search to find the documents you require.

Different templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to access the Washington Auditor Agreement - Self-Employed Independent Contractor with just a few clicks.

If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to locate the Washington Auditor Agreement - Self-Employed Independent Contractor. You can also access forms you have previously downloaded from the My documents tab of your account.

Every legal document template you obtain is yours to keep for years. You will have access to every form you downloaded within your account. Check the My documents section and select a form to print or download again.

Stay ahead and download and print the Washington Auditor Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Step 1. Ensure you have selected the form for the correct city/state.

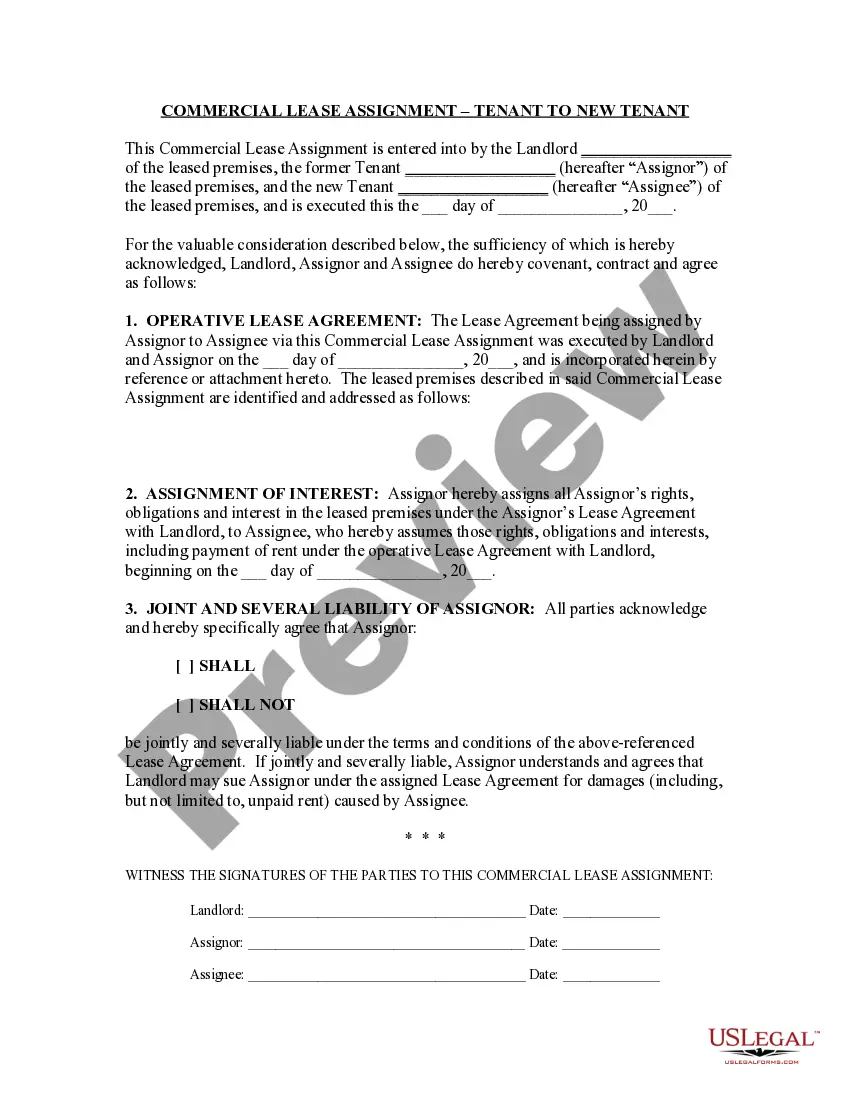

- Step 2. Use the Preview option to review the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose your preferred pricing plan and provide your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Washington Auditor Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

To fill out an independent contractor form, first gather the necessary information, such as your legal name, business name, and tax identification number. Provide a detailed description of the services you will provide, including timelines and rates. It's crucial to ensure that all sections adhere to the guidelines of the Washington Auditor Agreement - Self-Employed Independent Contractor. You can use resources like uslegalforms to find templates that simplify this process.

Filling out an independent contractor agreement involves several key steps. Begin by entering the names and addresses of both parties and specifying the scope of work clearly. Next, include sections for payment details, deadlines, and any intellectual property rights. To effectively complete the Washington Auditor Agreement - Self-Employed Independent Contractor, ensure you review each section for accuracy and compliance with state regulations.

In Washington state, independent contractors typically do not require workers' compensation coverage unless they work in certain high-risk industries. However, it's important to verify your specific situation, as other rules may apply depending on the nature of your work. Working as a Washington Auditor Agreement - Self-Employed Independent Contractor means you are responsible for your insurance needs. Therefore, assessing your coverage options can safeguard you in case of injuries or accidents.

To write an independent contractor agreement, start by clearly identifying the parties involved, including their names and addresses. Next, outline the specific services to be performed, along with payment terms, deadlines, and any necessary confidentiality clauses. Including a section on the termination of the agreement can also be beneficial. The Washington Auditor Agreement - Self-Employed Independent Contractor should comply with state laws and protect both parties' interests.

Creating an independent contractor agreement involves several key steps. Firstly, outline the scope of work, payment terms, and timelines clearly in the document. Make sure to include the Washington Auditor Agreement - Self-Employed Independent Contractor elements that define the relationship, responsibilities, and expectations for both parties. You can simplify this process by using services like US Legal Forms, which provide customizable templates to ensure that all essential details are covered.

Typically, the independent contractor writes the agreement, but both parties can collaborate on its creation. This approach ensures that the Washington Auditor Agreement - Self-Employed Independent Contractor reflects the specific terms and conditions that both the contractor and the client agree upon. If you're unsure about drafting the agreement, you can turn to platforms like US Legal Forms, which offer templates and resources to make the process easier. Consulting with a legal professional is also a wise choice.

To provide proof of employment as a self-employed independent contractor, you can use a variety of documents. Commonly accepted forms include your Washington Auditor Agreement - Self-Employed Independent Contractor, tax returns showing income from your contract work, and invoices you submitted to your clients. Additionally, you might consider providing bank statements that reflect payments received. These documents help establish your status as a legitimate independent contractor.

The 7 minute rule in Washington state refers to the guideline that allows a self-employed independent contractor to use a specific calculation for determining the time spent on a job. This rule helps auditors assess billable hours accurately when you engage in contract work. Understanding this concept is crucial for those operating under a Washington Auditor Agreement - Self-Employed Independent Contractor. Utilizing resources and templates from uslegalforms can assist you in drafting agreements that comply with this guideline.