Washington Visiting Professor Agreement - Self-Employed Independent Contractor

Description

How to fill out Visiting Professor Agreement - Self-Employed Independent Contractor?

Are you currently in a position where you will require documents for either business or personal reasons almost every workday.

There are numerous legal document templates accessible online, but finding ones you can trust isn't simple.

US Legal Forms offers a vast array of form templates, including the Washington Visiting Professor Agreement - Self-Employed Independent Contractor, which are designed to comply with state and federal regulations.

Once you find the appropriate form, click Purchase now.

Choose the pricing plan you desire, enter the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Washington Visiting Professor Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct city/state.

- Use the Review button to evaluate the form.

- Read the description to confirm you have selected the correct document.

- If the form isn't what you're looking for, utilize the Search section to find the document that fits your needs.

Form popularity

FAQ

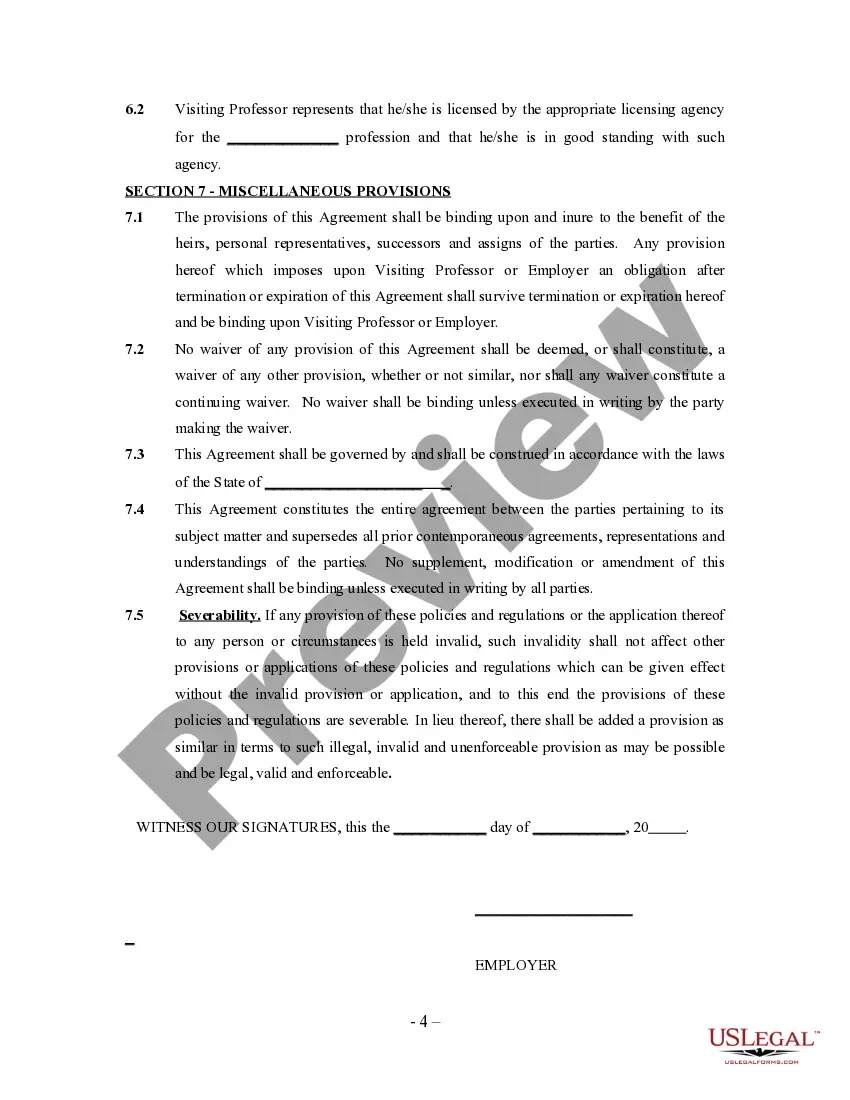

Filling out a declaration of independent contractor status form is a straightforward process. Start by gathering your personal information, such as your name, address, and tax identification number. Next, provide details about the nature of your work as outlined in the Washington Visiting Professor Agreement - Self-Employed Independent Contractor. Finally, ensure you accurately state your relationship details, confirming your independent status without any employer-employee implications. For additional guidance, consider using resources available on the uslegalforms platform to streamline your experience.

Yes, independent contractors in Washington state often need a business license to operate legally. The requirements can vary based on the nature of the services provided and the location of the business. It is essential to check local regulations to ensure compliance. If you are drafting a Washington Visiting Professor Agreement - Self-Employed Independent Contractor, be sure to consider these licensing requirements to support your entrepreneurial journey.

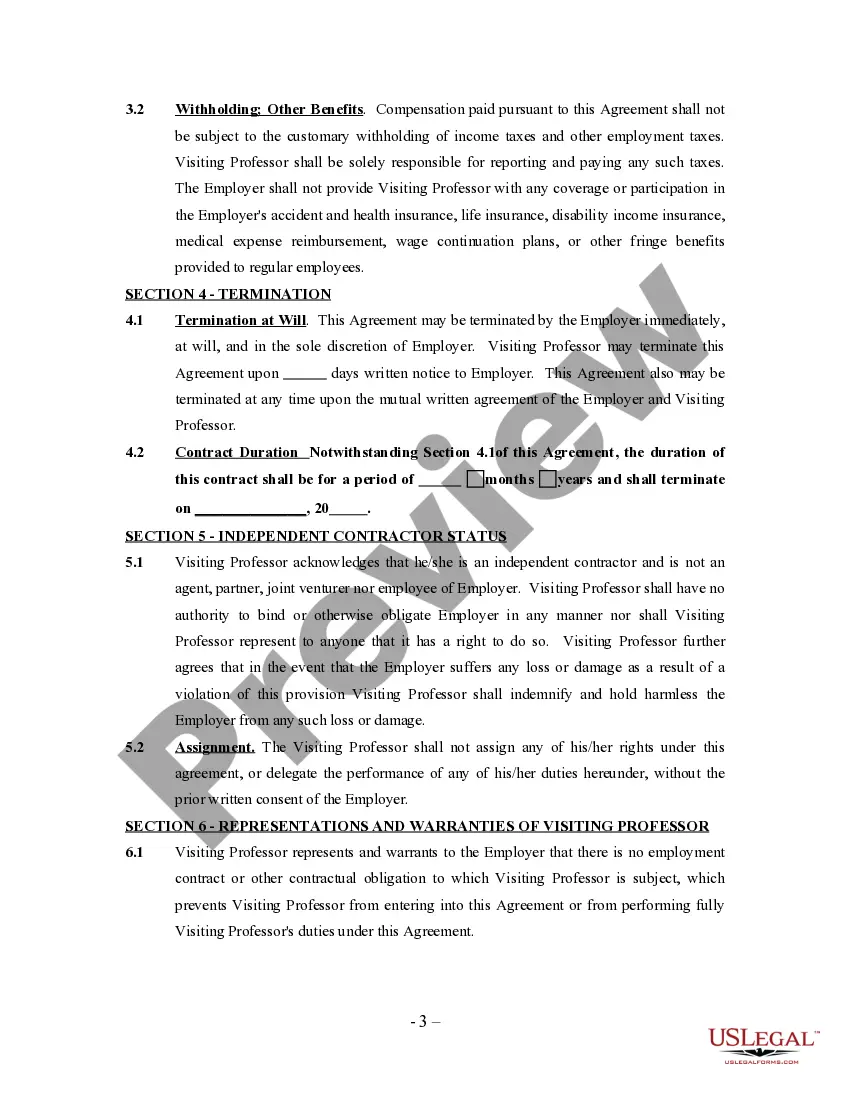

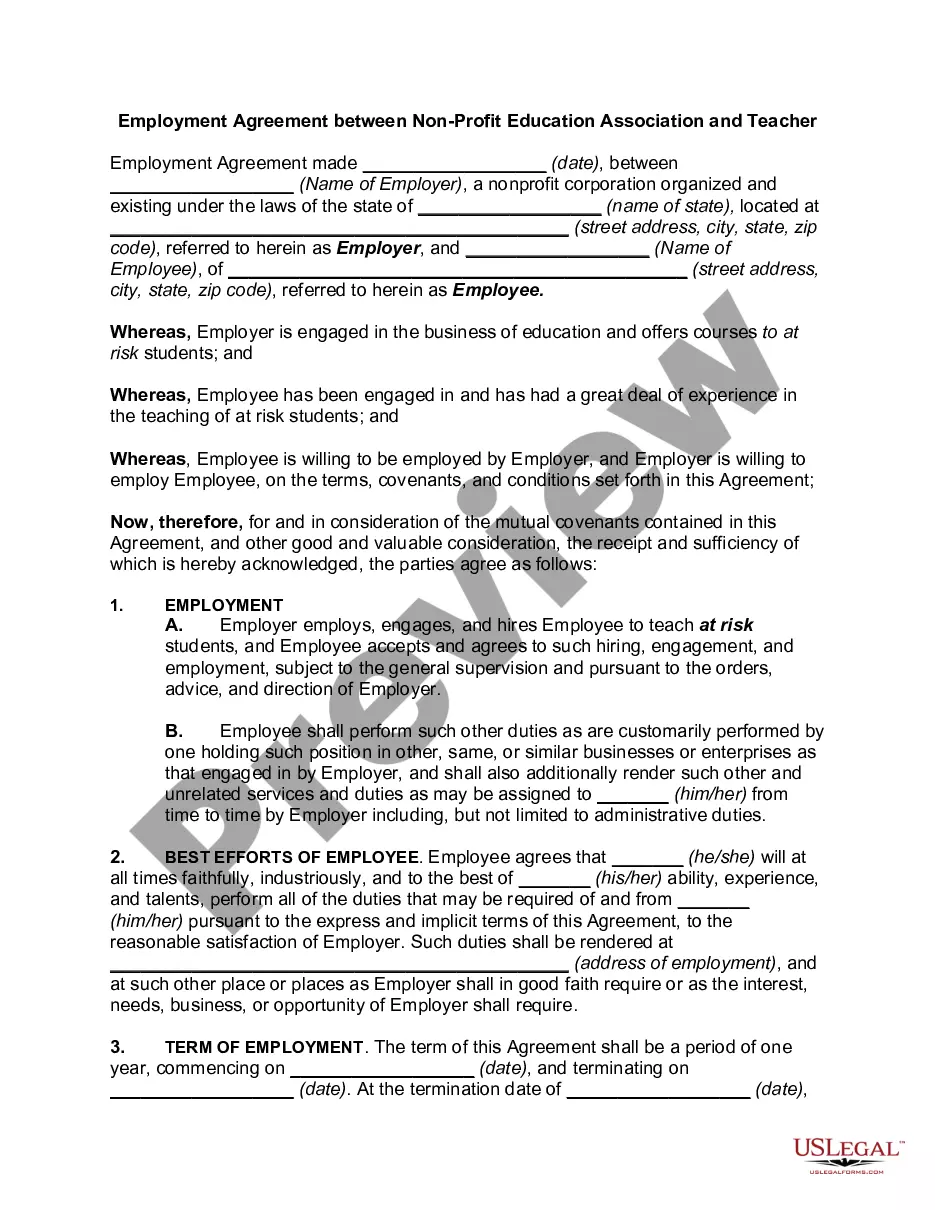

Adjunct professors can be classified as independent contractors, depending on the terms of their employment. Institutions may hire them to teach specific courses without the long-term commitment of full-time faculty. Understanding the distinction is crucial as it impacts benefits, taxation, and rights. When drafting a Washington Visiting Professor Agreement - Self-Employed Independent Contractor, clarity on this classification helps ensure compliance with labor regulations.

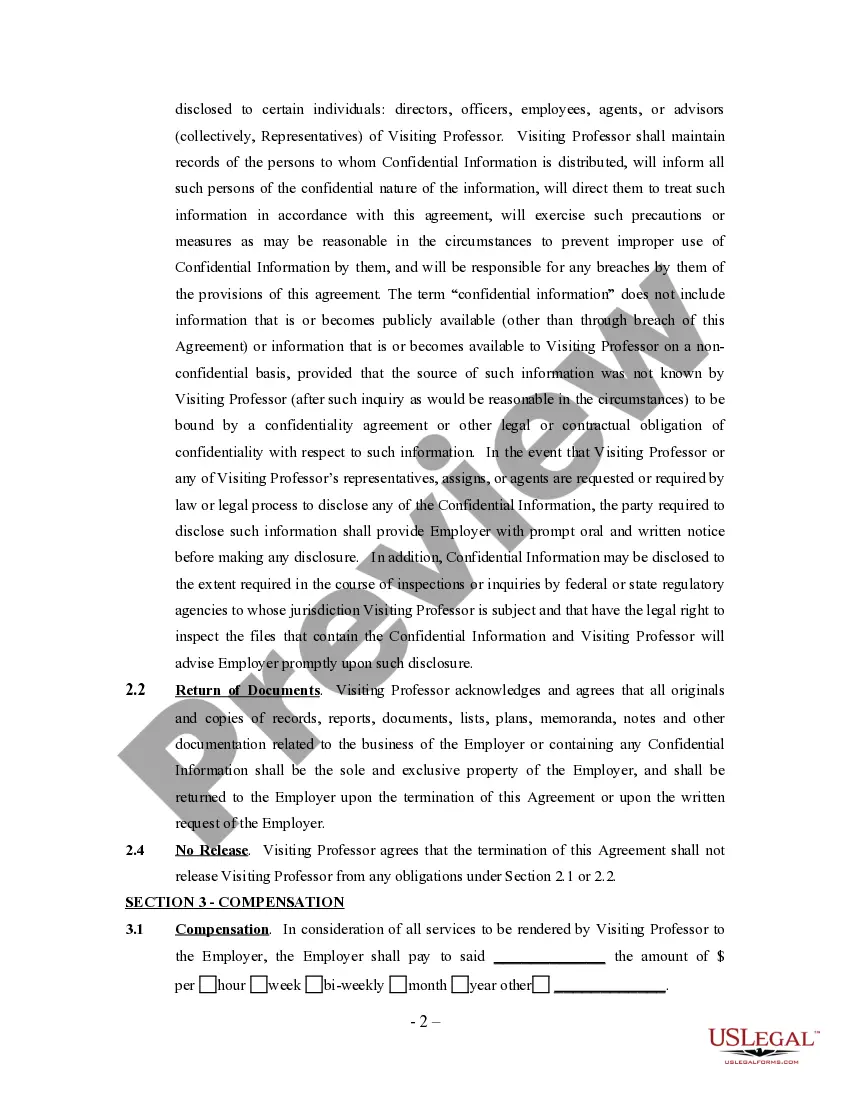

Creating an independent contractor agreement involves outlining the terms of the working relationship between the parties. Begin by defining the scope of work, payment terms, and duration of the agreement. It is important to include clauses related to confidentiality and termination. For a comprehensive Washington Visiting Professor Agreement - Self-Employed Independent Contractor, consider using our platform, US Legal Forms, which offers customizable templates tailored to specific needs.

Often, adjunct professors are classified as independent contractors, but this can vary by institution. They usually teach specific courses without the same benefits or responsibilities as full-time employees. If you're considering the Washington Visiting Professor Agreement - Self-Employed Independent Contractor, be aware that this arrangement can provide greater flexibility in your schedule and teaching methodologies. Clarifying your contract with the institution helps ensure mutual understanding of your role.

Professors can be either employees or independent contractors, depending on their work arrangements. Those under a full-time faculty position typically work as employees, while adjunct or temporary instructors often operate as independent contractors. The Washington Visiting Professor Agreement - Self-Employed Independent Contractor is relevant for those in non-tenure-track positions who want flexibility and autonomy in their teaching roles. Understanding your classification can help you navigate your rights and responsibilities.

Yes, independent contractors are considered self-employed. This classification means they work for themselves rather than being an employee of a company or institution. Under the Washington Visiting Professor Agreement - Self-Employed Independent Contractor, understanding your status helps clarify your tax obligations and benefits. This status can also influence your eligibility for certain grants and funding opportunities.

Yes, independent contractors can deduct travel expenses related to their work. This includes costs for transportation, lodging, and meals when traveling for business purposes. When it comes to the Washington Visiting Professor Agreement - Self-Employed Independent Contractor, it's essential to keep thorough records of these expenses for tax purposes. Always consult a tax professional to maximize your deductions accurately.

To fill out an independent contractor agreement, begin by inputting your details and those of the contracting party. In the context of a Washington Visiting Professor Agreement - Self-Employed Independent Contractor, describe the specific services you will provide. Clearly state payment conditions, timelines, and any other necessary legal terms. Lastly, ensure both parties sign the agreement to validate it and maintain a copy for your records.

Writing an independent contractor agreement involves a few key steps. Start by clearly identifying the parties involved, and then outline the scope of work as defined in the Washington Visiting Professor Agreement - Self-Employed Independent Contractor. Include payment terms, deadlines, and confidentiality clauses where necessary. This comprehensive outline ensures both parties have a clear understanding of their rights and responsibilities.