Washington Stone Contractor Agreement - Self-Employed

Description

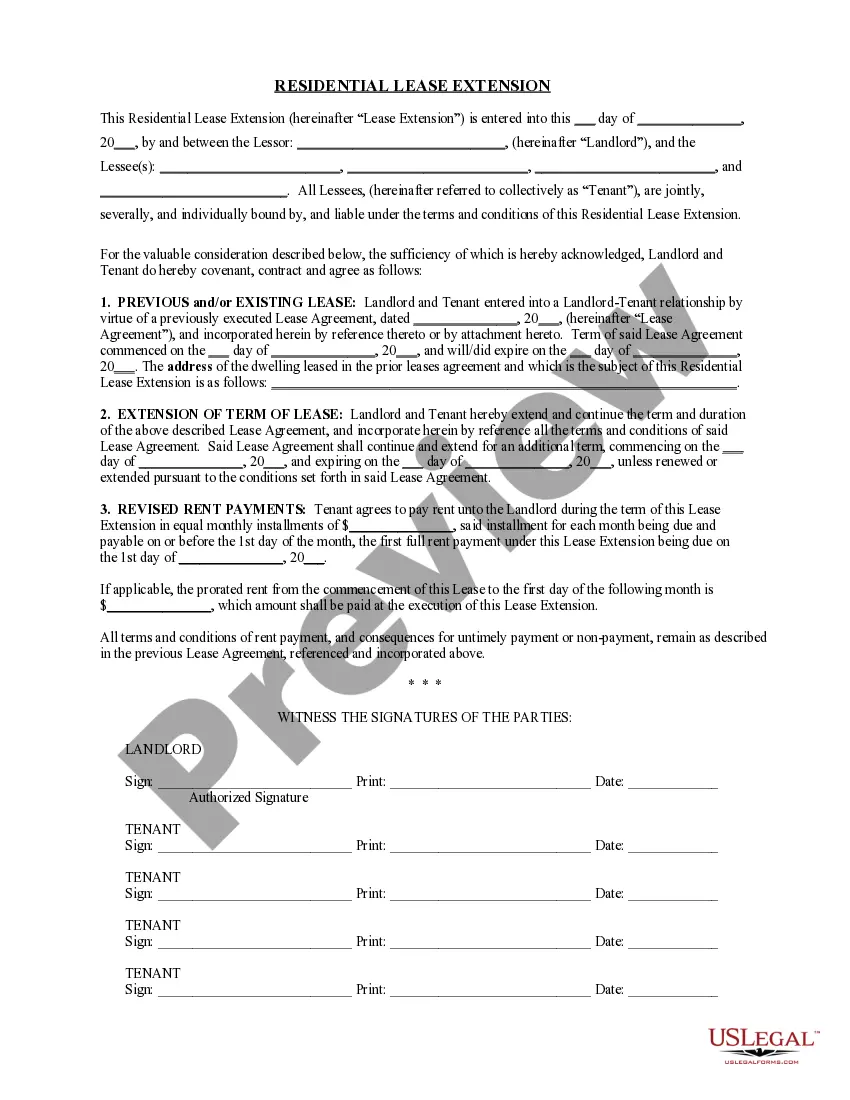

How to fill out Stone Contractor Agreement - Self-Employed?

If you require to complete, download, or create valid document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site’s straightforward and user-friendly search to locate the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have identified the form you need, select the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to obtain the Washington Stone Contractor Agreement - Self-Employed in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to access the Washington Stone Contractor Agreement - Self-Employed.

- You can also access forms you previously acquired in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Don’t forget to check the details.

- Step 3. If you are dissatisfied with the form, utilize the Search area at the top of the screen to find alternative forms in the legal form format.

Form popularity

FAQ

Yes, a self-employed person can have a contract. In fact, having a formal agreement is essential to protecting your interests and clarifying expectations. A Washington Stone Contractor Agreement - Self-Employed can outline key details such as payment structure, project specifications, and deadlines. Utilizing platforms like US Legal Forms can provide you with the resources necessary to create a legally binding contract that meets your specific needs.

To create an independent contractor agreement, first outline the scope of work, including specific tasks and deadlines. Next, clearly define the payment terms, ensuring to include method and schedule of payments. Additionally, include terms regarding confidentiality and ownership of work products. Using a service like US Legal Forms can simplify the process, providing templates for a Washington Stone Contractor Agreement - Self-Employed that you can customize to fit your needs.

Receiving a 1099 form typically indicates self-employment status. This form signals that you earned income as a contractor rather than as a traditional employee. If you are using the Washington Stone Contractor Agreement - Self-Employed, understanding your tax responsibilities and rights is essential.

Contract work can be classified differently from traditional employment. While contract workers complete tasks under an agreement, they typically do not receive employee benefits. This distinction is important for those using a Washington Stone Contractor Agreement - Self-Employed, as it clearly defines the nature of the working relationship.

Writing an independent contractor agreement requires clarity and attention to detail. Start by outlining the scope of work, payment terms, and deadlines. Incorporating elements from the Washington Stone Contractor Agreement - Self-Employed can guide your structure, ensuring you cover essential elements that protect both parties involved.

The terms self-employed and independent contractor are frequently used interchangeably, yet they can carry slightly different meanings. Self-employed emphasizes your overall status, while independent contractor highlights your specific working relationship on a project basis. To articulate the nuances of your work arrangement accurately, consider using the Washington Stone Contractor Agreement - Self-Employed.

Indeed, a contractor is often considered self-employed. This classification enables individuals to work based on contracts rather than a fixed salary. Understanding this distinction is crucial for those looking to utilize the Washington Stone Contractor Agreement - Self-Employed, as it outlines the rights and responsibilities associated with self-employment.

Yes, a contractor typically falls under the category of self-employed individuals. When you work on a project basis without a long-term employer relationship, you operate independently. This means you have the freedom to manage your own schedule and workload, which is a distinct advantage of the Washington Stone Contractor Agreement - Self-Employed.

To fill out a Washington Stone Contractor Agreement - Self-Employed, start by entering the names and contact information of both parties. Next, specify the scope of work, payment schedule, and any provisions regarding termination or dispute resolution. Making use of platforms like US Legal Forms can guide you in completing this agreement correctly and efficiently.

Filling out an independent contractor form requires you to provide your personal information, including your name, address, and tax identification number. Then, include the details of your services, payment terms, and any project deadlines. When using a template for a Washington Stone Contractor Agreement - Self-Employed, fill in the blanks with accurate information to ensure clarity and legality.