Washington Cable Disconnect Service Contract - Self-Employed Independent Contractor

Description

How to fill out Cable Disconnect Service Contract - Self-Employed Independent Contractor?

Locating the appropriate authorized document template can be a challenge.

Clearly, there are numerous formats available online, but how can you acquire the legal form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the Washington Cable Disconnect Service Contract - Self-Employed Independent Contractor, that can be utilized for business and personal purposes.

If the form does not meet your needs, use the Search field to find the appropriate document.

- Each of the forms is reviewed by experts and complies with state and federal regulations.

- If you are already a registered user, Log In to your account and hit the Download button to obtain the Washington Cable Disconnect Service Contract - Self-Employed Independent Contractor.

- Utilize your account to browse through the legal forms you have acquired previously.

- Visit the My documents section of your account to download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

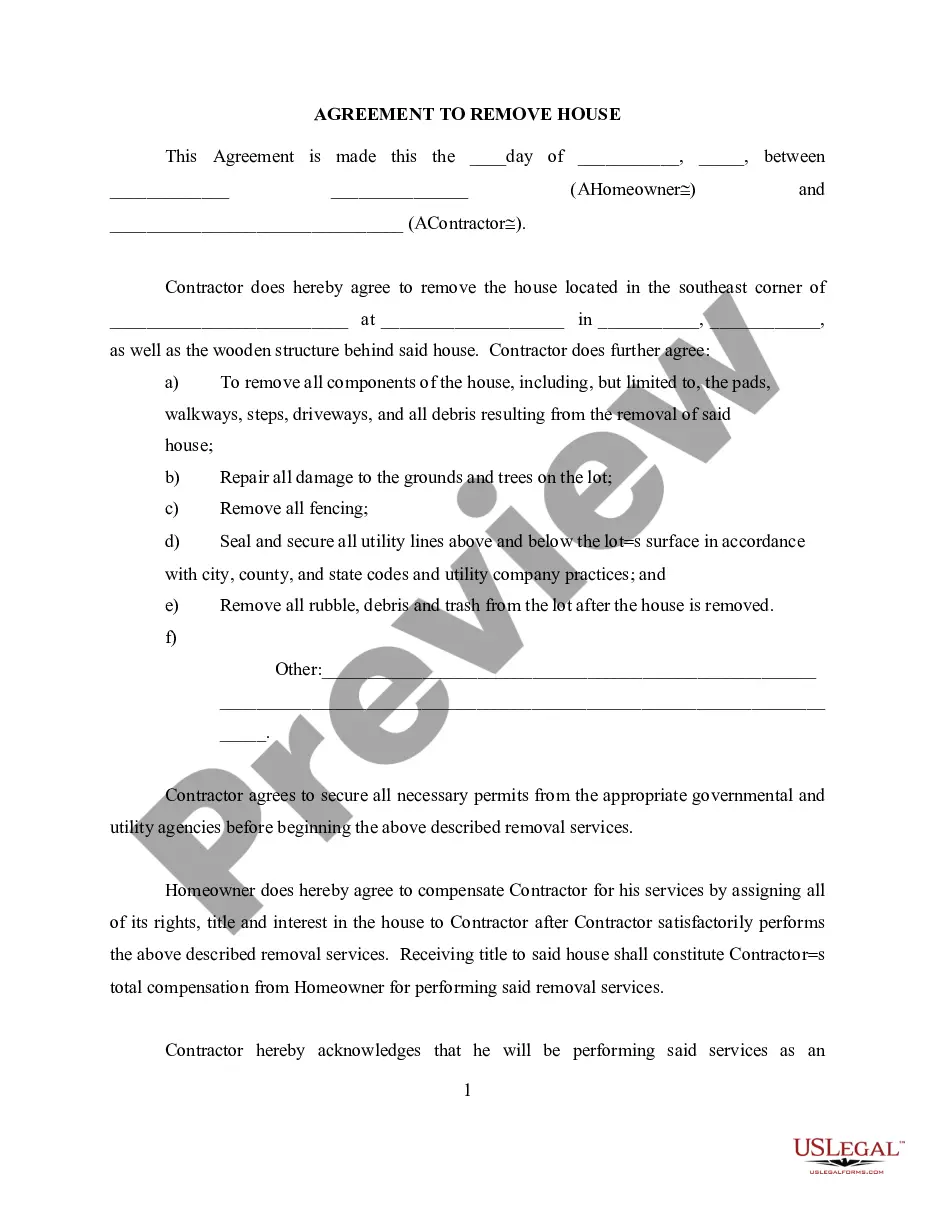

- First, make sure you have selected the correct form for your city/state. You can browse the form using the Preview button and read the form description to confirm this is the correct one for you.

Form popularity

FAQ

To prove you are an independent contractor, you need to gather documentation that supports your status. This can include a signed contract indicating your role, records of payments received, or tax forms like the 1099. Additionally, you can present any business licenses or permits you hold that relate to your work. If you are using a Washington Cable Disconnect Service Contract - Self-Employed Independent Contractor, make sure you keep a copy of it as evidence of your professional arrangement.

To fill out an independent contractor agreement, begin by entering the date and names of both parties involved. Clearly state the services to be provided, along with payment details and timelines. Specific clauses about liability and conflict resolution should be included, particularly in relation to the Washington Cable Disconnect Service Contract - Self-Employed Independent Contractor. Utilizing uslegalforms can guide you through this process, ensuring accuracy and completeness.

Writing an independent contractor agreement requires a clear outline of the working relationship. Start with the scope of services, payment details, and the duration of the contract. It's important to also address confidentiality and termination clauses, especially within the framework of a Washington Cable Disconnect Service Contract - Self-Employed Independent Contractor. Using uslegalforms can simplify the process and help you include all necessary legal components.

Filling out an independent contractor form involves providing essential information such as your name, address, and Social Security number. Make sure to specify the type of work you will perform under the Washington Cable Disconnect Service Contract - Self-Employed Independent Contractor agreement. Don’t forget to include relevant tax information. If you're unsure, seeking guidance from uslegalforms could streamline the process and ensure compliance.

To write a contract for a 1099 employee as a Washington Cable Disconnect Service Contract - Self-Employed Independent Contractor, start by clearly defining the nature of the work. Include payment terms, deadlines, and any specific job responsibilities. It is essential to outline both parties' rights and obligations, ensuring clarity to avoid future disputes. Leveraging platforms like uslegalforms can help you create a comprehensive contract tailored to your needs.

It is not illegal to terminate a 1099 contract, but adherence to the terms of the Washington Cable Disconnect Service Contract - Self-Employed Independent Contractor is essential. Ensure you follow proper procedures for termination, as mismanagement could lead to disputes or legal issues. Understanding the specifics of your contract can guide you in making an informed decision.

To get out of a service contract, first, examine the terms of your Washington Cable Disconnect Service Contract - Self-Employed Independent Contractor. Look for any provisions regarding cancellation or termination. If no such clauses exist, communicating your concerns and negotiating an exit strategy with the contractor may yield a favorable outcome.

In Washington state, independent contractors generally do not need workers' compensation unless they choose to obtain it. However, specific situations may arise depending on the nature of the work outlined in your Washington Cable Disconnect Service Contract - Self-Employed Independent Contractor. It's essential to understand your rights and responsibilities for safeguarding your interests.

To politely terminate a contract with a contractor, begin by expressing your appreciation for their work. Clearly explain your reasons for termination and refer to the Washington Cable Disconnect Service Contract - Self-Employed Independent Contractor if necessary. Ending on a positive note can leave the door open for potential collaborations in the future.

To terminate a contract with an independent contractor, first, consult the Washington Cable Disconnect Service Contract - Self-Employed Independent Contractor. Identify any termination clauses and adhere to the agreed-upon process. Communicating your decision promptly and professionally can help maintain a positive relationship and facilitate future engagements.