Washington Self-Employed Utility Services Contract

Description

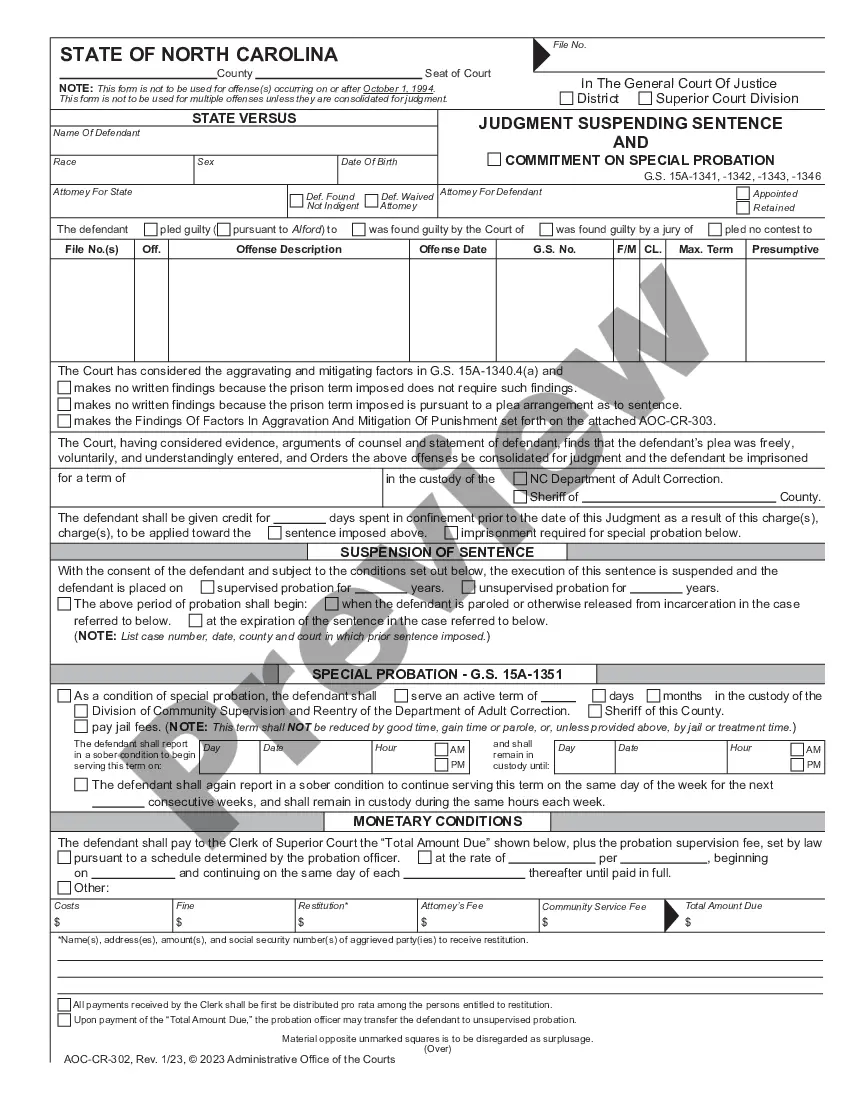

How to fill out Self-Employed Utility Services Contract?

US Legal Forms - one of the largest collections of official templates in the United States - provides a variety of legal document templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Washington Self-Employed Utility Services Contract in moments.

If you already have a subscription, Log In and download the Washington Self-Employed Utility Services Contract from the US Legal Forms library. The Download option will appear on each form you view. You have access to all previously downloaded forms from the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple instructions to get started: Ensure you have selected the correct form for your city/county. Click the Preview button to review the form’s content. Check the form description to verify that you have selected the correct document. If the form doesn’t meet your needs, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the pricing plan you prefer and enter your details to register for an account. Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction. Choose the format and download the form to your device. Make edits. Fill out, modify, and print and sign the downloaded Washington Self-Employed Utility Services Contract.

- Each format you add to your account has no expiration date and is yours permanently.

- If you wish to download or print another version, simply visit the My documents section and click on the form you want.

- Access the Washington Self-Employed Utility Services Contract with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that satisfy your business or personal needs and requirements.

- Enjoy the convenience of having all legal forms at your fingertips.

- Experience a seamless process from selection to download.

Form popularity

FAQ

Freelancing without a contract is possible, but it is not recommended. A Washington Self-Employed Utility Services Contract provides essential legal protection and clarity regarding your work. Without a contract, you may struggle to enforce payment terms or address scope changes. To ensure a smooth working relationship, always strive to have a written agreement in place.

Working without a contract can expose you to various risks, including payment issues and lack of clarity on job expectations. In the absence of a Washington Self-Employed Utility Services Contract, you may face challenges in proving the terms of your agreement. This situation can lead to disputes that could have been avoided with proper documentation. It's always best to formalize your arrangements to safeguard your interests.

While it is not illegal to work without a signed contract, doing so can lead to misunderstandings and disputes. A Washington Self-Employed Utility Services Contract clearly defines the scope of work and payment terms, which benefits both parties. It is always advisable to have a written agreement to protect your rights and ensure clarity. If you find yourself in a dispute, having a contract can be crucial for resolution.

Establishing yourself as an independent contractor involves creating a professional brand and building a client base. First, you should create a business plan that outlines your services and target market. Utilizing a Washington Self-Employed Utility Services Contract can provide a solid foundation for your agreements. Building relationships through networking and online platforms can also help you gain visibility and attract clients.

To become an independent contractor in Washington, you need to choose your business structure and register it with the state. Obtaining a Washington Self-Employed Utility Services Contract can help you outline the terms of your work and protect your interests. Additionally, you should familiarize yourself with tax obligations and consider obtaining the necessary liability insurance. Networking and marketing your services can also help you find clients.

To be self-employed in Washington, you must register your business and obtain any necessary licenses. You should also consider obtaining a Washington Self-Employed Utility Services Contract to formalize your agreements. It's essential to keep accurate records for tax purposes and ensure compliance with local regulations. Consulting with a legal professional can provide clarity on specific obligations.

When writing a contract for a 1099 employee, focus on outlining the specific services they will provide, compensation details, and deadlines. It's crucial to indicate that the individual is an independent contractor to clarify the nature of the relationship. A Washington Self-Employed Utility Services Contract can serve as a solid foundation for this type of agreement, ensuring clarity and compliance.

To write a simple employment contract, start with the basic information about both parties and the role being filled. Clearly outline job responsibilities, payment arrangements, and any other relevant terms. If you need a straightforward approach, using a Washington Self-Employed Utility Services Contract template can help you create an effective document without unnecessary complexity.

You can write your own legally binding contract, provided it meets specific legal requirements. Make sure to include essential elements such as the parties involved, the services rendered, and payment terms. To ensure your contract is compliant and effective, consider using a Washington Self-Employed Utility Services Contract template available on uslegalforms.

Yes, having a contract is essential when you are self-employed. A contract protects both you and your clients by clearly outlining expectations and responsibilities. A Washington Self-Employed Utility Services Contract can provide the necessary legal framework to define your working relationship and avoid any potential disputes.