Washington Self-Employed Lighting Services Contract

Description

How to fill out Self-Employed Lighting Services Contract?

If you need to finalize, download, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms, which are accessible online.

Employ the site’s simple and user-friendly search to locate the documents you require. Various templates for commercial and personal purposes are categorized by types and categories, or keywords.

Utilize US Legal Forms to acquire the Washington Self-Employed Lighting Services Contract in just a few clicks.

Step 5. Process the payment. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Select the format of your legal form and download it to your device. Step 7. Complete, edit, and print or sign the Washington Self-Employed Lighting Services Contract. Every legal document template you obtain is yours permanently. You have access to all forms you saved in your account. Click the My documents section and choose a form to print or download again. Complete and download, and print the Washington Self-Employed Lighting Services Contract with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are currently a US Legal Forms user, sign in to your account and click on the Download button to access the Washington Self-Employed Lighting Services Contract.

- You can also view forms you have previously saved within the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/region.

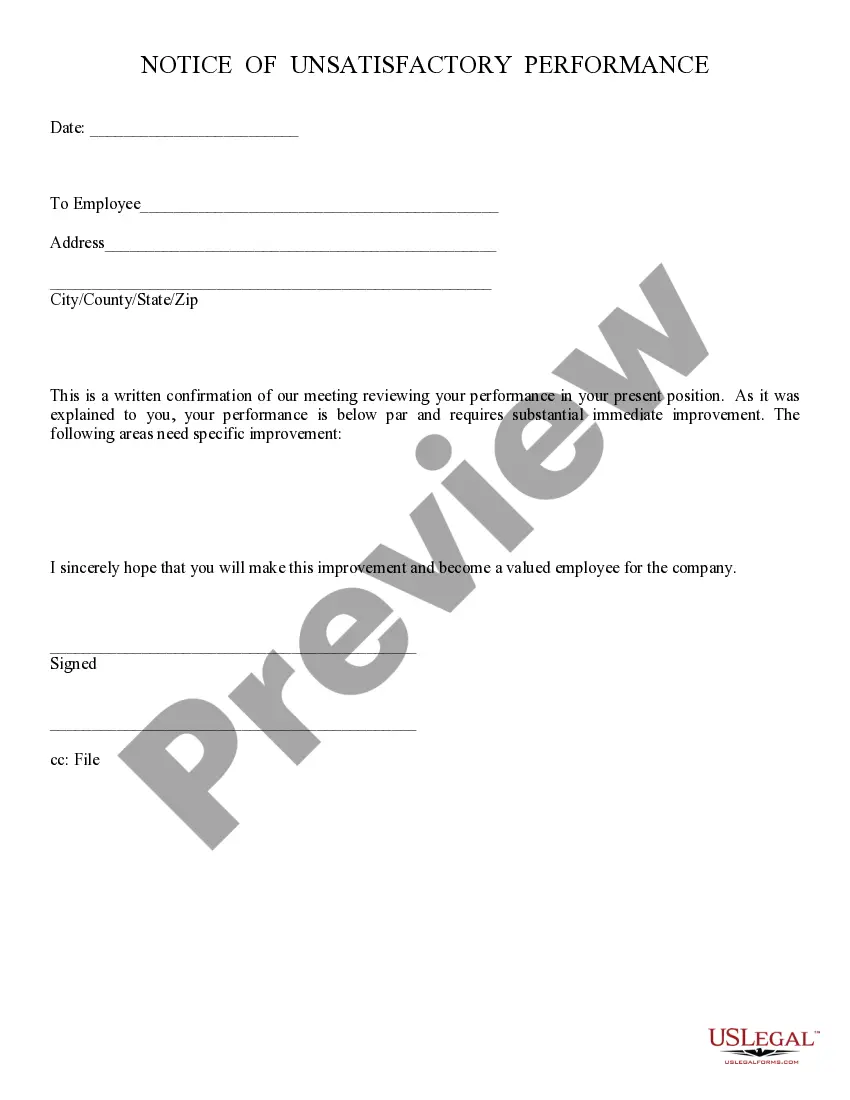

- Step 2. Utilize the Review option to examine the form’s content. Don’t forget to read the summary.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find different versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

Form popularity

FAQ

Yes, as an independent contractor in Washington, you generally need a business license to operate legally. This requirement ensures that you comply with state regulations and can help protect your rights as a contractor. Utilizing a Washington Self-Employed Lighting Services Contract can also support your business operations and client relationships.

Being self-employed means you work for yourself, while an independent contractor refers to a specific type of self-employment where you provide services to clients under a contract. Both roles share similarities, but the key difference lies in the contractual relationship with clients. A well-drafted Washington Self-Employed Lighting Services Contract can help clearly define this relationship.

In Washington, independent contractors often need a business license, depending on the nature of their work. Having a business license legitimizes your services and can improve your credibility with clients. It is advisable to review the requirements specific to your field, especially when creating a Washington Self-Employed Lighting Services Contract.

Yes, registering your business is a crucial step if you are working as an independent contractor. This registration not only provides legal protection but also allows you to open a business bank account and obtain necessary permits. A solid Washington Self-Employed Lighting Services Contract can further enhance your professional image.

Yes, if you operate as an independent contractor in Washington, you typically need to register with the state. This registration helps establish your business identity and is beneficial for tax purposes. Additionally, having a Washington Self-Employed Lighting Services Contract can clarify the terms of your work with clients.

Establishing yourself as an independent contractor involves several key steps. First, define your services and target market to focus your efforts effectively. Then, create a Washington Self-Employed Lighting Services Contract that details your offerings, payment terms, and expectations with clients. Finally, promote your services through networking, online platforms, and social media to build your reputation and attract clients.

To become an independent contractor in Washington state, you need to register your business with the Washington Secretary of State. Next, obtain any required licenses or permits that pertain to your specific field, such as those for lighting services. After that, consider creating a Washington Self-Employed Lighting Services Contract to outline your service agreements clearly. This contract will protect you and your clients, ensuring a professional relationship.

L&I does not automatically cover independent contractors unless they opt into the system or have employees. If you are working under a Washington Self-Employed Lighting Services Contract and are concerned about coverage, consider your options carefully. You may want to explore policies that provide protection for your business and your clients, ensuring that you maintain a safe and compliant work environment.

The main difference lies in the level of control and independence. An independent contractor operates under a Washington Self-Employed Lighting Services Contract, meaning they have more control over their work and schedule. An employee, on the other hand, works under the direction of an employer, who dictates the work process and hours. Understanding this distinction can help you navigate your obligations and rights within the state.

Independent contractors in Washington state typically do not need workers' compensation insurance unless they work in certain high-risk industries. However, if you enter into a Washington Self-Employed Lighting Services Contract and have employees, you need to secure coverage. It is always best to check your specific situation to ensure compliance with state regulations.