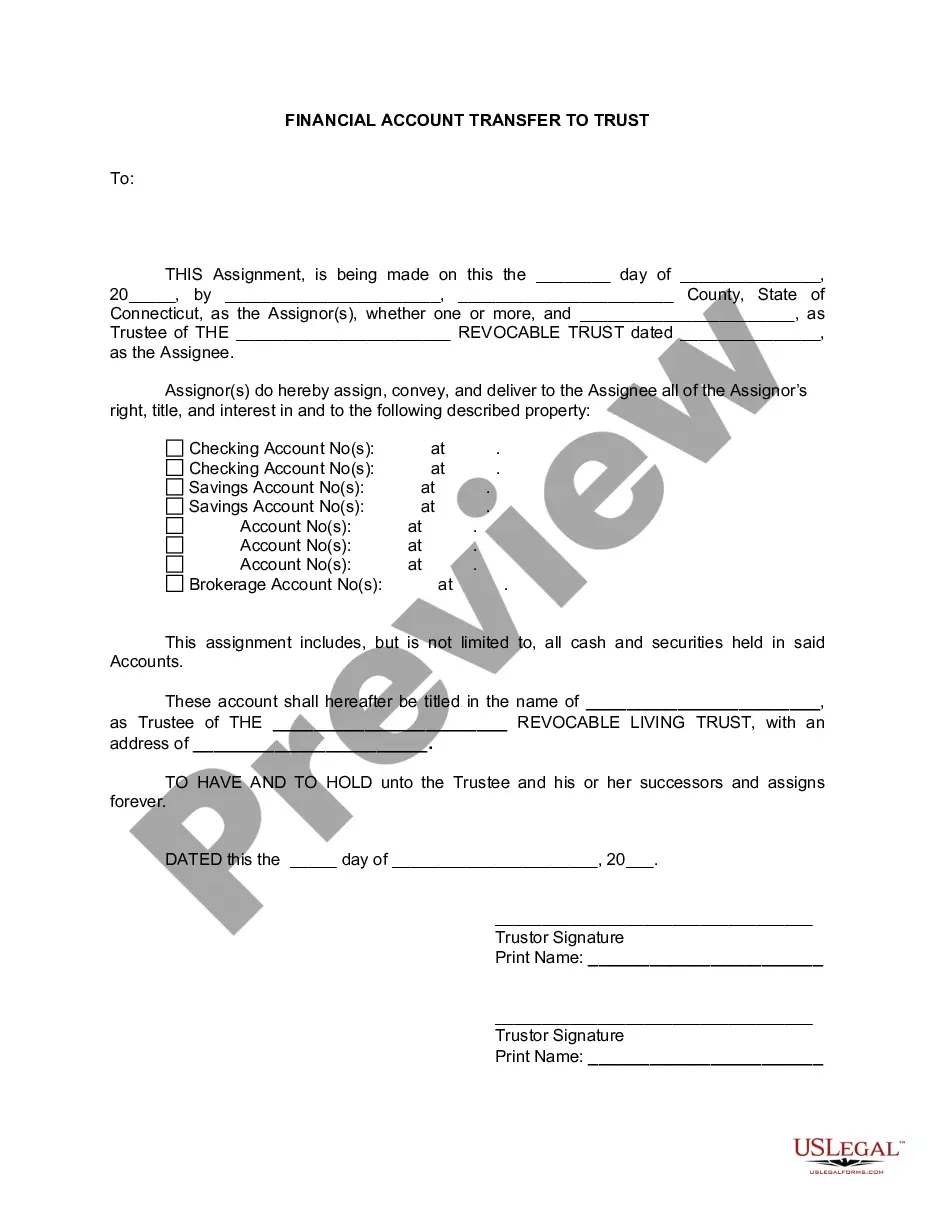

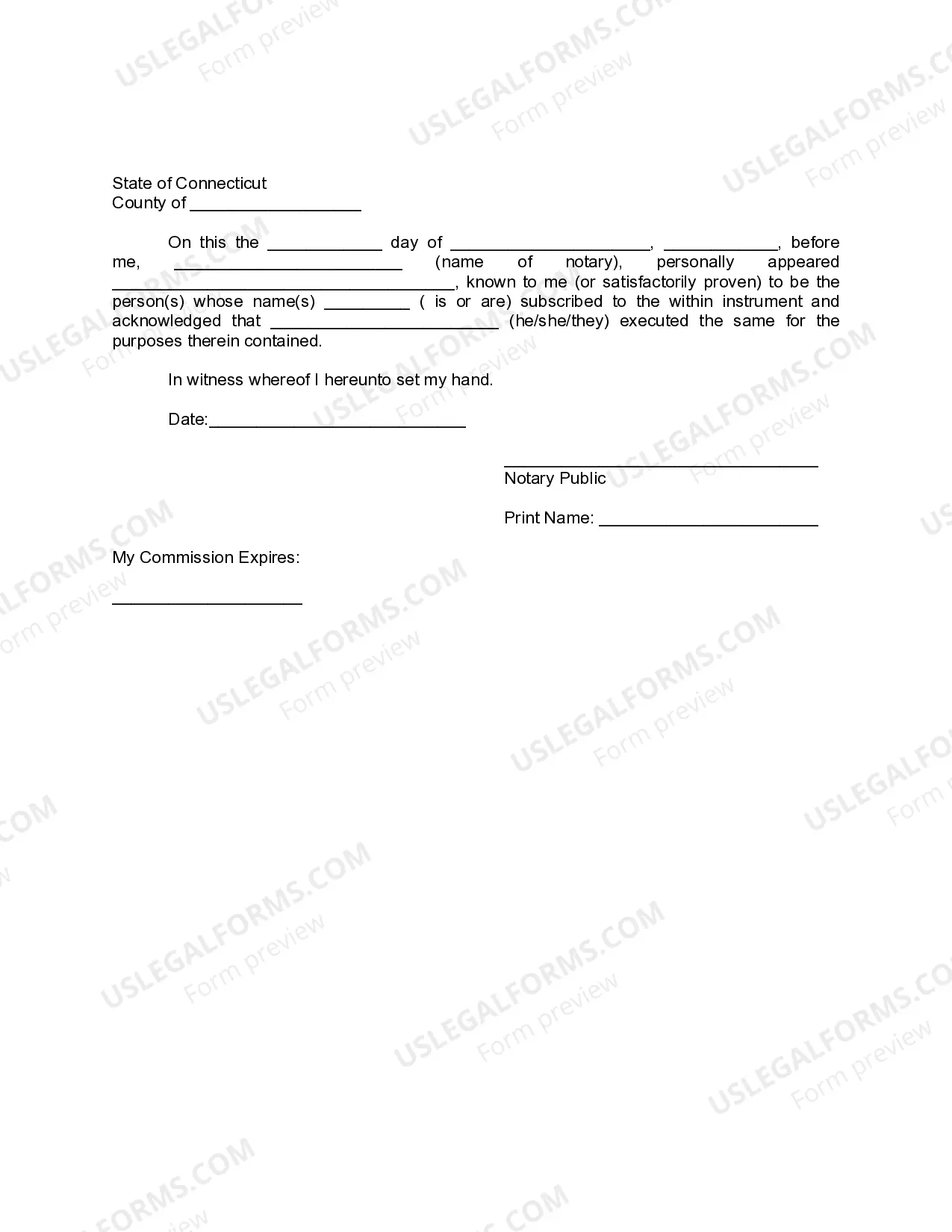

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Connecticut Financial Account Transfer to Living Trust

Description

How to fill out Connecticut Financial Account Transfer To Living Trust?

The more documents you have to create - the more stressed you are. You can find thousands of Connecticut Financial Account Transfer to Living Trust templates on the internet, but you don't know which of them to trust. Get rid of the headache to make detecting samples more straightforward using US Legal Forms. Get accurately drafted forms that are written to satisfy state specifications.

If you have a US Legal Forms subscribing, log in to the account, and you'll find the Download button on the Connecticut Financial Account Transfer to Living Trust’s web page.

If you have never tried our service before, complete the registration procedure using these recommendations:

- Ensure the Connecticut Financial Account Transfer to Living Trust applies in the state you live.

- Double-check your decision by reading through the description or by using the Preview function if they are available for the chosen document.

- Click on Buy Now to begin the sign up procedure and choose a rates program that meets your expectations.

- Insert the asked for info to create your profile and pay for your order with your PayPal or credit card.

- Pick a practical document formatting and acquire your example.

Access every sample you obtain in the My Forms menu. Simply go there to prepare new version of your Connecticut Financial Account Transfer to Living Trust. Even when having properly drafted forms, it’s nevertheless important that you consider requesting the local attorney to double-check completed form to make certain that your document is correctly filled in. Do more for less with US Legal Forms!