Washington Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II

Description

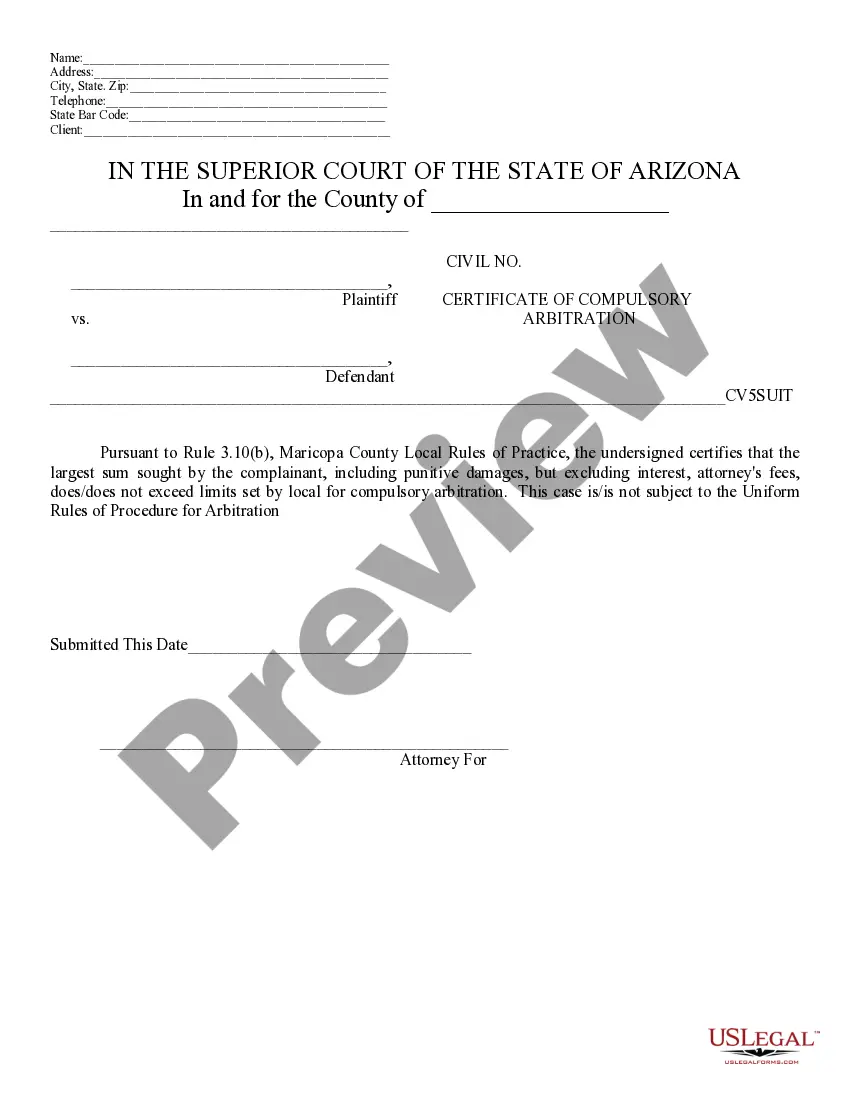

How to fill out Class C Distribution Plan And Agreement Between Putnam Mutual Funds Corp And Putnam High Yield Trust II?

If you wish to comprehensive, down load, or produce authorized record templates, use US Legal Forms, the greatest selection of authorized forms, which can be found on the Internet. Utilize the site`s simple and handy research to get the documents you require. Numerous templates for business and personal purposes are sorted by types and states, or key phrases. Use US Legal Forms to get the Washington Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II in a few click throughs.

In case you are already a US Legal Forms buyer, log in to your accounts and click the Obtain option to obtain the Washington Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II. Also you can accessibility forms you formerly acquired within the My Forms tab of your own accounts.

If you work with US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have selected the form for the proper metropolis/nation.

- Step 2. Make use of the Preview choice to look through the form`s information. Never forget about to read the outline.

- Step 3. In case you are unsatisfied with the type, use the Research field on top of the monitor to locate other versions from the authorized type template.

- Step 4. Upon having identified the form you require, click the Acquire now option. Choose the rates program you like and put your accreditations to register for the accounts.

- Step 5. Approach the deal. You can use your bank card or PayPal accounts to perform the deal.

- Step 6. Choose the formatting from the authorized type and down load it on your product.

- Step 7. Total, revise and produce or sign the Washington Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II.

Each authorized record template you buy is your own property forever. You may have acces to every single type you acquired within your acccount. Go through the My Forms area and pick a type to produce or down load again.

Contend and down load, and produce the Washington Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II with US Legal Forms. There are thousands of expert and state-certain forms you can use for your business or personal requirements.

Form popularity

FAQ

Class A shares involve paying a fee when you purchase your shares. Class B shares impose a fee when you sell your shares. Class C shares impose a fee while holding the shares, such as 0.5% of the value of the share per period.

In Series C rounds, investors inject capital into successful businesses in an effort to receive more than double that amount back. Series C funding focuses on scaling the company, growing as quickly and successfully as possible. One possible way to scale a company could be to acquire another company.

Class C shares don't impose a front-end sales charge on the purchase, so the full dollar amount that you pay is invested. Often Class C shares impose a small charge (often 1 percent) if you sell your shares within a short time, usually one year. Mutual Funds | FINRA.org finra.org ? investing ? investment-products finra.org ? investing ? investment-products

Most mutual funds fall into one of four main categories ? money market funds, bond funds, stock funds, and target date funds. Each type has different features, risks, and rewards. Money market funds have relatively low risks.

Shares of the same fund offer different shareholder rights and obligations, such as different fee and load charges. Common share classes are A (front-end load), B (deferred fees), C (no sales charge and a relatively high annual 12b-1 fee).

Class C shares of a Fund acquired through automatic reinvestment of dividends or distributions will convert to Class A shares of the Fund on the Conversion Date pro rata with the converting Class C shares of the Fund that were not acquired through reinvestment of dividends or distributions. sec.gov ? Archives ? edgar ? data sec.gov ? Archives ? edgar ? data

The mutual fund trust is created by one or more Sponsors, who bring in the initial capital for the mutual fund business. HDFC is the sponsor of HDFC Mutual Fund. The beneficiaries of the mutual fund trust are the investors who invest in various schemes of the mutual fund. The collectively become the beneficiaries. Mutual Funds - IndiaInfoline indiainfoline.com ? what-are-mutual-funds indiainfoline.com ? what-are-mutual-funds