Washington Notice of Violation of Fair Debt Act - Letter To Attorney Generals Office

Description

How to fill out Notice Of Violation Of Fair Debt Act - Letter To Attorney Generals Office?

Have you been in a place where you need to have papers for both business or person uses virtually every time? There are tons of legal document themes available online, but locating kinds you can rely on isn`t straightforward. US Legal Forms delivers thousands of kind themes, like the Washington Notice of Violation of Fair Debt Act - Letter To Attorney Generals Office, which are published to meet state and federal specifications.

When you are currently acquainted with US Legal Forms website and have a free account, simply log in. Afterward, you are able to download the Washington Notice of Violation of Fair Debt Act - Letter To Attorney Generals Office format.

Unless you have an profile and want to begin to use US Legal Forms, adopt these measures:

- Discover the kind you require and ensure it is to the proper city/county.

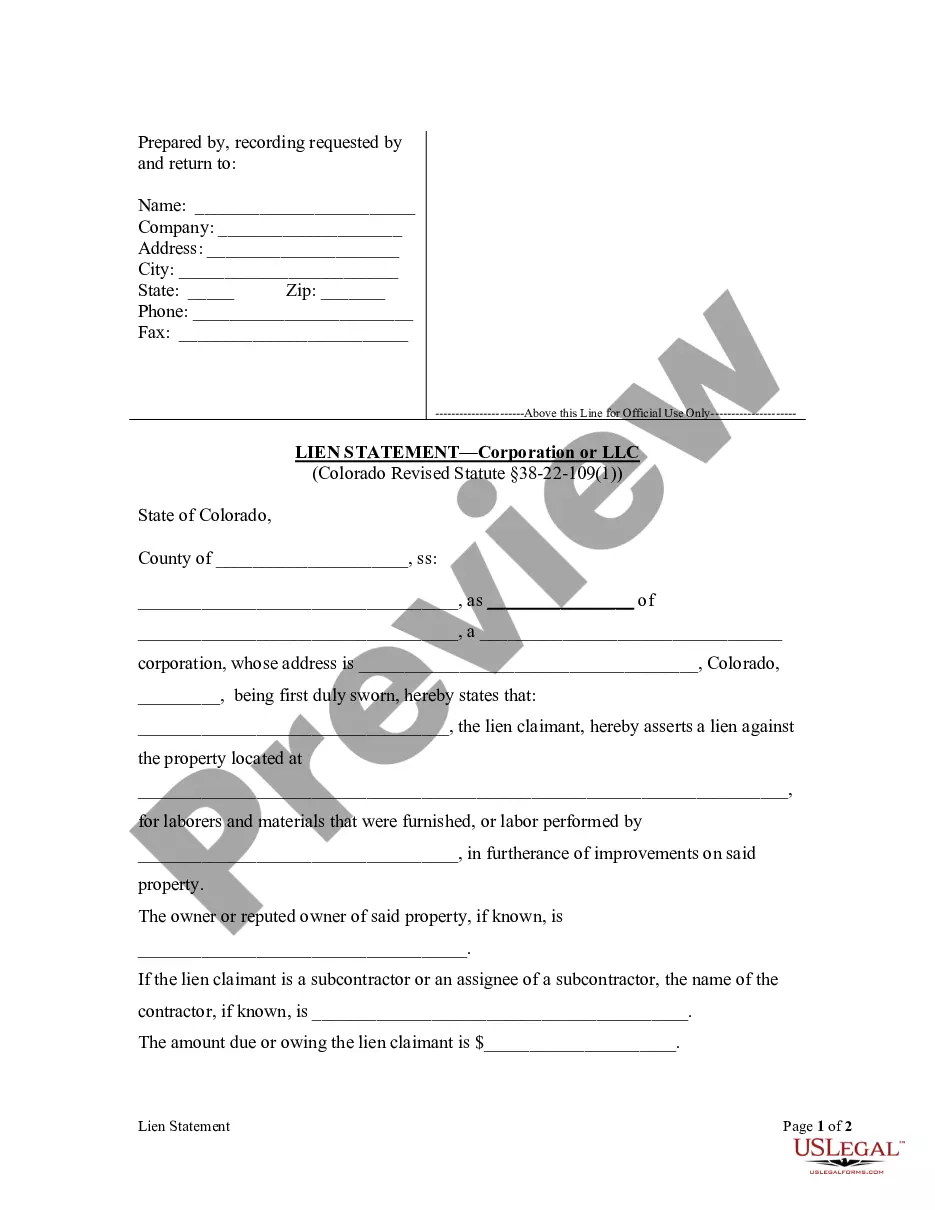

- Make use of the Preview key to analyze the form.

- Browse the outline to actually have chosen the right kind.

- When the kind isn`t what you are seeking, take advantage of the Search discipline to get the kind that suits you and specifications.

- Whenever you obtain the proper kind, just click Get now.

- Pick the prices program you want, fill out the desired info to make your money, and buy your order making use of your PayPal or credit card.

- Choose a hassle-free paper structure and download your duplicate.

Discover all the document themes you possess purchased in the My Forms menu. You can get a additional duplicate of Washington Notice of Violation of Fair Debt Act - Letter To Attorney Generals Office at any time, if possible. Just go through the required kind to download or produce the document format.

Use US Legal Forms, one of the most substantial selection of legal types, to conserve time and stay away from blunders. The support delivers expertly produced legal document themes that you can use for a variety of uses. Make a free account on US Legal Forms and commence making your daily life a little easier.

Form popularity

FAQ

In order to defend against this lawsuit, you must respond to the complaint by stating your defense in writing, and by serving a copy upon the person signing this summons within 20 days after the service of this summons, excluding the day of service, or a default judgment may be entered against you without notice.

A debt validation letter should include the name of your creditor and how much you owe, The letter will include information about when you need to pay the debt and how to dispute it.

Follow these three steps to respond to a Complaint and Summons in Washington and avoid a default judgment: Answer each issue listed in the Complaint. Assert affirmative defenses. File the Answer with the court, and serve the plaintiff.

In Washington, the statute of limitations on debt collection lawsuits is six years after the date of default or last payment on the debt account.

In Washington State, debt collectors can file a legal action to recover unpaid debt. If you are being sued for an outstanding debt, then there are certain steps that you can take to protect yourself. Properly responding to a debt collection lawsuit can help get you back on the path to financial stability.

You must fill out an Answer, serve the other side's attorney, and file your Answer form with the court within 30 days. If you don't, the creditor can ask for a default. If there's a default, the court won't let you file an Answer and can decide the case without you.

Dear debt collector: I am responding to your contact about collecting a debt. You contacted me by [phone/mail], on [date] and identified the debt as [any information they gave you about the debt]. You can contact me about this debt, but only in the way I say below.

Responding to a debt collection letter depends on the type of debt your creditors are claiming you owe. If you feel the amount of the proposed debt is correct and you can afford to pay it, do so. This will be a sufficient form of response and should halt any collection activity.