Washington Utilization by a REIT of partnership structures in financing five development projects

Description

How to fill out Utilization By A REIT Of Partnership Structures In Financing Five Development Projects?

Are you currently in the place that you will need files for possibly organization or specific functions nearly every time? There are tons of legitimate document layouts available online, but discovering ones you can depend on is not simple. US Legal Forms provides a huge number of kind layouts, such as the Washington Utilization by a REIT of partnership structures in financing five development projects, that are published in order to meet federal and state needs.

In case you are currently knowledgeable about US Legal Forms site and also have a merchant account, basically log in. Following that, you are able to down load the Washington Utilization by a REIT of partnership structures in financing five development projects web template.

Unless you provide an profile and want to start using US Legal Forms, adopt these measures:

- Find the kind you will need and ensure it is for your correct town/region.

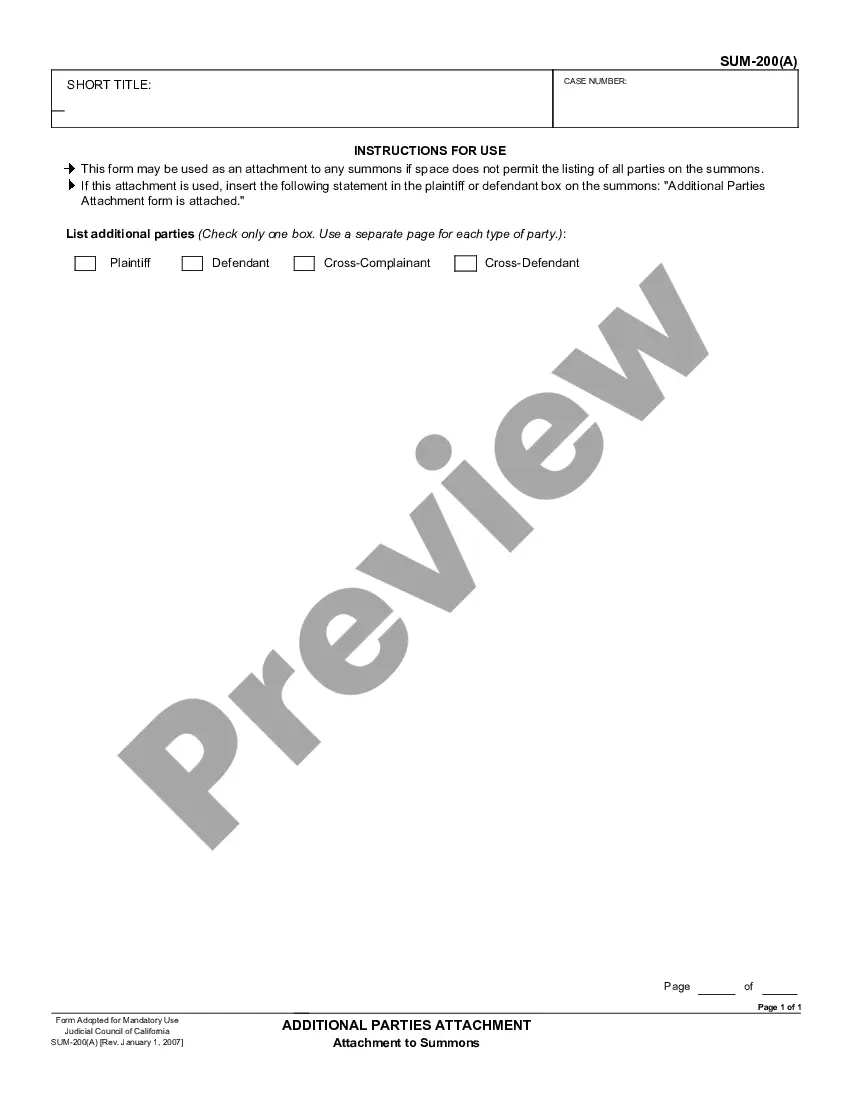

- Use the Review option to analyze the form.

- Browse the outline to actually have chosen the correct kind.

- If the kind is not what you`re searching for, use the Research area to obtain the kind that meets your requirements and needs.

- Once you discover the correct kind, just click Get now.

- Opt for the rates strategy you desire, submit the specified details to make your bank account, and pay money for your order making use of your PayPal or bank card.

- Choose a convenient paper format and down load your copy.

Discover each of the document layouts you have purchased in the My Forms food selection. You can aquire a extra copy of Washington Utilization by a REIT of partnership structures in financing five development projects any time, if required. Just select the needed kind to down load or produce the document web template.

Use US Legal Forms, one of the most considerable collection of legitimate kinds, to save lots of efforts and prevent blunders. The services provides appropriately made legitimate document layouts which can be used for a range of functions. Create a merchant account on US Legal Forms and commence making your lifestyle a little easier.

Form popularity

FAQ

Real estate fund strategies are often categorized into one or a combination of the following types. Real Estate Development Funds. Joint Venture Real Estate Funds. Structured Finance Real Estate Funds. Opportunistic/ Special Opportunity Funds. Distressed Asset Funds. Multi-Strategy Funds. Closed-End Structure.

There are three types of REITs: Equity REITs. Most REITs are equity REITs, which own and manage income-producing real estate. ... Mortgage REITs. ... Hybrid REITs.

Though they're different groupings, all REITs are structured as C-corporations for tax purposes that are allowed a special tax deduction for dividends paid from taxable income. For a REIT to receive a dividend paid deduction (DPD), they are required to make an election and adhere to certain rules and compliance.

There are three types of REITs: Equity REITs. Most REITs are equity REITs, which own and manage income-producing real estate. ... Mortgage REITs. ... Hybrid REITs.

How must a real estate company be organized to qualify as a REIT? A U.S. REIT must be formed in one of the 50 states or the District of Columbia as an entity taxable for federal purposes as a corporation. It must be governed by directors or trustees and its shares must be transferable.

REITs are companies that own, operate, or finance income-producing properties. Equity REITs own and operate properties and generate revenue primarily through rental income.

REIT JVs are typically two-party partnerships established to divide and share in the ownership or development of real estate. In one type of JV, the REIT partners with an entity such as an insurance company, private owner or pension fund that seeks to own a long-term interest in a property.

There are two main types of real estate investment trusts (REITs) that investors can buy: equity REITs and mortgage REITs. Equity REITs own and operate properties, while mortgage REITs invest in mortgages and related assets.