Washington Private placement of Common Stock

Description

How to fill out Private Placement Of Common Stock?

Choosing the right lawful papers format could be a battle. Of course, there are a variety of layouts available on the net, but how do you obtain the lawful type you need? Utilize the US Legal Forms web site. The assistance offers 1000s of layouts, including the Washington Private placement of Common Stock, that can be used for enterprise and personal requires. All of the types are checked by professionals and fulfill state and federal specifications.

If you are presently authorized, log in to the account and click on the Acquire option to have the Washington Private placement of Common Stock. Make use of your account to search throughout the lawful types you have bought formerly. Go to the My Forms tab of the account and get another copy from the papers you need.

If you are a fresh user of US Legal Forms, here are easy directions that you should comply with:

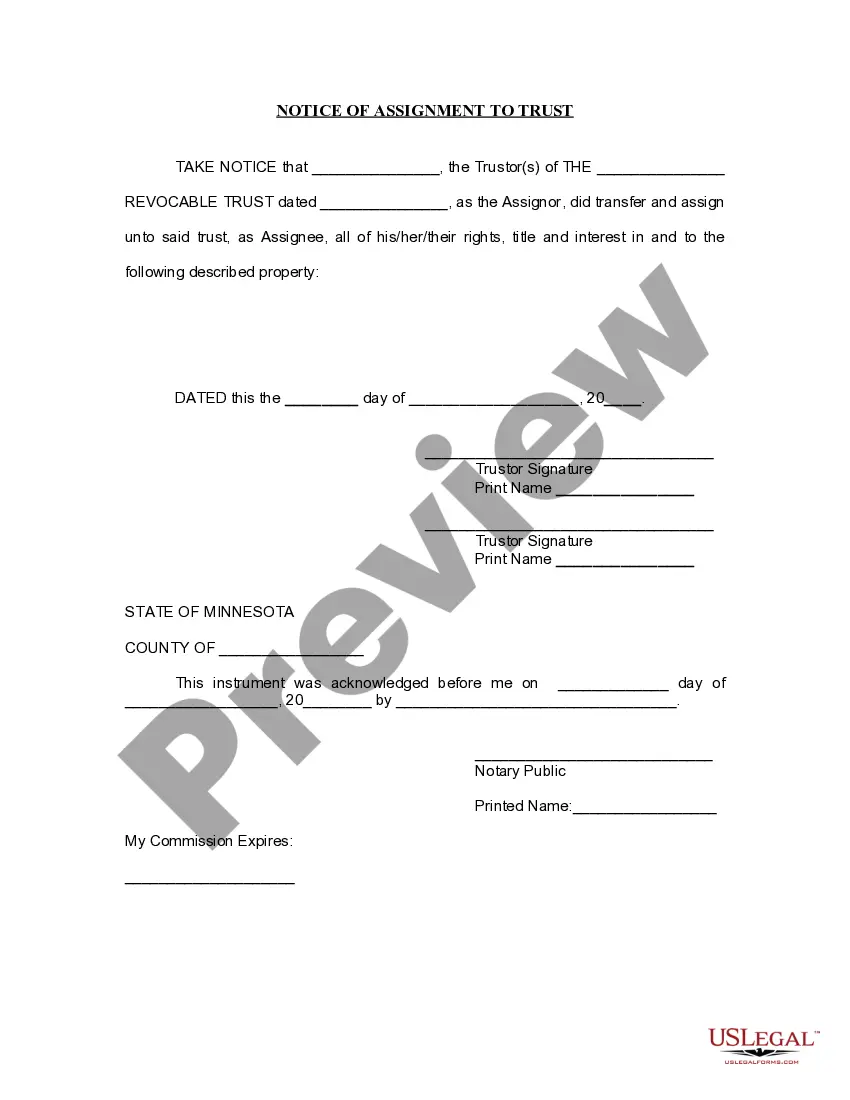

- Very first, be sure you have selected the proper type for your personal area/state. You are able to look through the form making use of the Preview option and study the form outline to guarantee this is the best for you.

- In the event the type does not fulfill your expectations, make use of the Seach discipline to get the proper type.

- Once you are certain that the form is proper, click on the Get now option to have the type.

- Pick the costs strategy you desire and enter the required details. Make your account and pay for your order making use of your PayPal account or Visa or Mastercard.

- Select the file structure and down load the lawful papers format to the system.

- Comprehensive, modify and print out and sign the received Washington Private placement of Common Stock.

US Legal Forms may be the greatest catalogue of lawful types where you can discover a variety of papers layouts. Utilize the service to down load professionally-manufactured documents that comply with express specifications.

Form popularity

FAQ

In comparison to Rule 144A requiring purchasers to be Qualified Institutional Buyers, Section 4(a)(7) applies to a broader category of ?Accredited Investors.? The information requirement is heavier under Section 4(a)(7) because it requires delivery of information to the purchaser whereas Rule 144A only requires that ...

The Section 4(a)(7) exemption is available for private resales of restricted securities to ?accredited investors? where no general solicitation is used and certain information concerning the issuer and the transaction is provided to the Purchaser.

Section 4(a)(7) of the Securities Act is an exemption for security resale transactions.

Section 4(a)(1) of the Act exempts from registration "transactions by any person other than an issuer, underwriter, or dealer." A holder of securities who is not an issuer or a dealer can therefore sell his securities in a private sale without registration if the holder is not an underwriter as "underwriter" is defined ...

Section 3(a)(2) of the Securities Act of 1933 (the ?Securities Act?) exempts from registration under Section 5 of the Securities Act any security issued or guaranteed by a ?bank.? The policy underlying this exemption from the registration requirements of Section 5 of the Securities Act is that banks are highly ...

Unlike IPO, privately sold securities have fewer regulatory requirements to fulfill, making it an easier investment option. In addition, such placement of shares, if done by a private company, does not affect the share price as they are not listed publicly.

What has come to be known as a Section 4(1½) or Section 4(a)(1½) transaction is a private resale of restricted securities that technically relies on the Section 4(a)(1) registration exemption. The Section 4(1½) private resale exemption is not formally established by any written SEC rule or regulation.

A private placement is an offering of unregistered securities to a limited pool of investors. In a private placement, a company sells shares of stock in the company or other interest in the company, such as warrants or bonds, in exchange for cash.