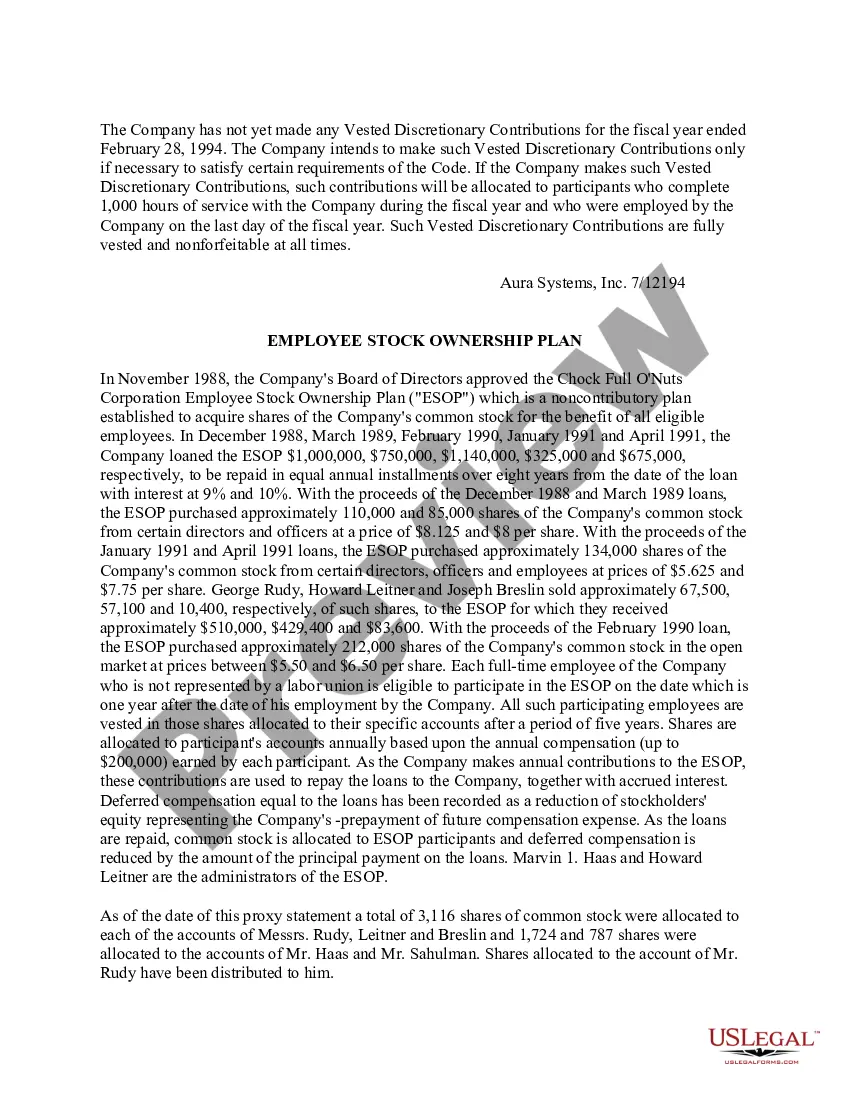

Washington Employee Stock Ownership Plan of Aura Systems, Inc.

Description

How to fill out Employee Stock Ownership Plan Of Aura Systems, Inc.?

US Legal Forms - one of the biggest libraries of authorized forms in America - offers a wide array of authorized file layouts it is possible to obtain or print out. Utilizing the web site, you can get a large number of forms for business and individual reasons, categorized by classes, suggests, or key phrases.You can get the newest versions of forms much like the Washington Employee Stock Ownership Plan of Aura Systems, Inc. within minutes.

If you have a registration, log in and obtain Washington Employee Stock Ownership Plan of Aura Systems, Inc. through the US Legal Forms library. The Down load switch will appear on each and every develop you perspective. You have access to all earlier delivered electronically forms within the My Forms tab of your own account.

If you would like use US Legal Forms the first time, here are straightforward recommendations to get you began:

- Be sure you have selected the best develop for your town/area. Click the Preview switch to review the form`s content material. See the develop outline to ensure that you have chosen the right develop.

- In the event the develop does not satisfy your specifications, make use of the Lookup industry on top of the display to find the one that does.

- In case you are pleased with the form, validate your decision by visiting the Buy now switch. Then, pick the pricing strategy you like and offer your accreditations to register for the account.

- Method the purchase. Utilize your charge card or PayPal account to accomplish the purchase.

- Pick the structure and obtain the form on your own gadget.

- Make modifications. Fill up, modify and print out and sign the delivered electronically Washington Employee Stock Ownership Plan of Aura Systems, Inc..

Each design you put into your bank account lacks an expiry date and is also your own property eternally. So, if you want to obtain or print out an additional backup, just proceed to the My Forms section and then click about the develop you require.

Gain access to the Washington Employee Stock Ownership Plan of Aura Systems, Inc. with US Legal Forms, the most extensive library of authorized file layouts. Use a large number of skilled and condition-particular layouts that meet up with your organization or individual requires and specifications.

Form popularity

FAQ

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

Equity and Debt of the Company ESOPs can impact the cost of equity capital of a company as they often issue new stocks for ESOP, increasing the number of outstanding shares. As a result, it dilutes the existing shareholders' ownership stake and impacts the company's overall market capitalisation.

ESOPs can be a good retirement benefit for employees, providing an additional source of income in the form of company stock. It also aligns their interests with those of the company. However, investing too heavily in one stock is risky. Diversification is necessary.

ESOPs encourage employees to give their all as the company's success translates into financial rewards. They also help staff to feel more appreciated and better compensated for the work they do.

ESOPs are inflexible in some respects? While ESOPs are flexible in many ways, they are subject to legal constraints. ESOP rules require that contributions be allocated based on relative compensation (ignoring compensation above a certain level) or some more level formula.

How Do You Start an ESOP? To set up an ESOP, you'll have to establish a trust to buy your stock. Then, each year you'll make tax-deductible contributions of company shares, cash for the ESOP to buy company shares, or both. The ESOP trust will own the stock and allocate shares to individual employee's accounts.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

There are many advantages to ESOPs, including the following: Flexibility: Shareholders have the option of withdrawing funds slowly over time or only selling a portion of their shares. They can stay active even after releasing their portion of the company.