Washington Approval of Company Stock Award Plan

Description

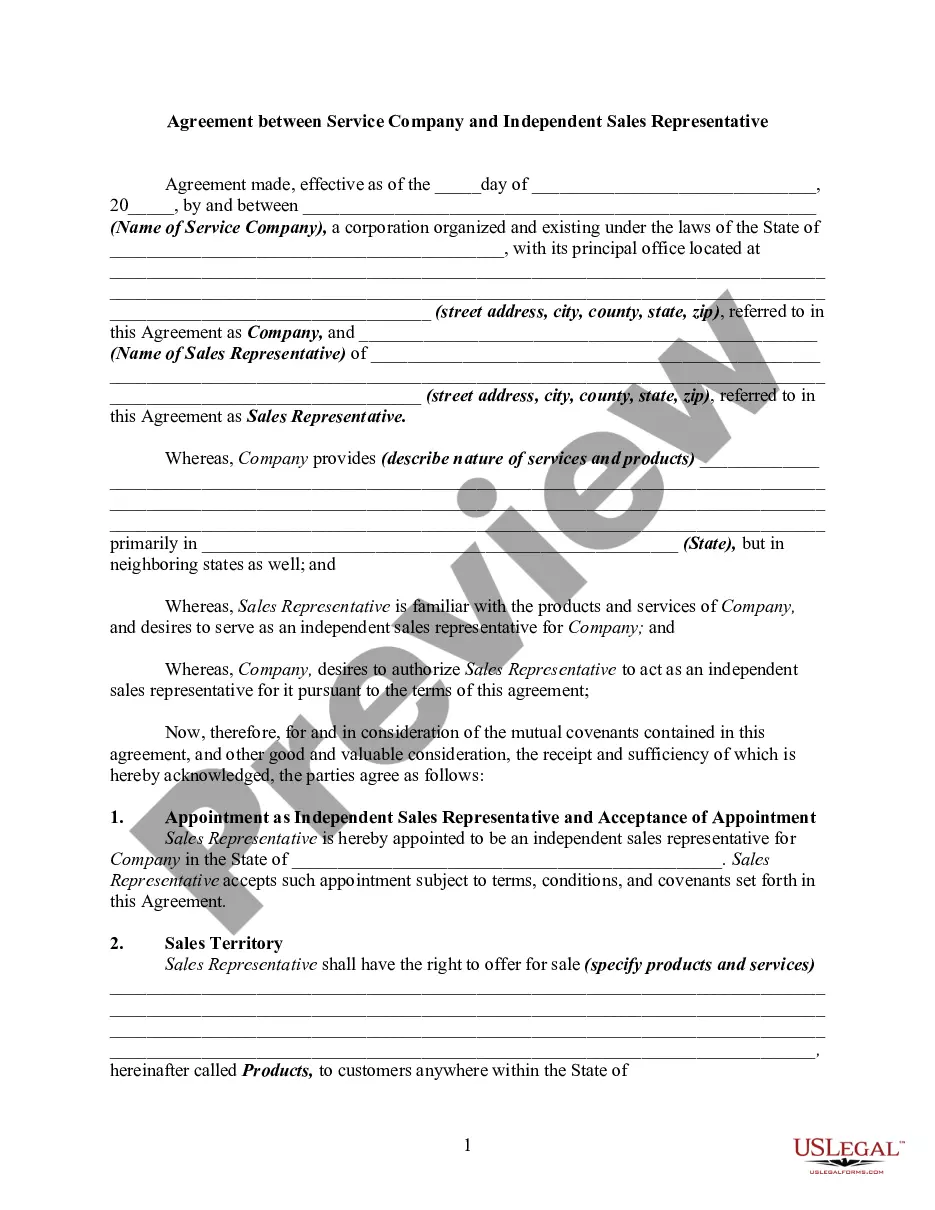

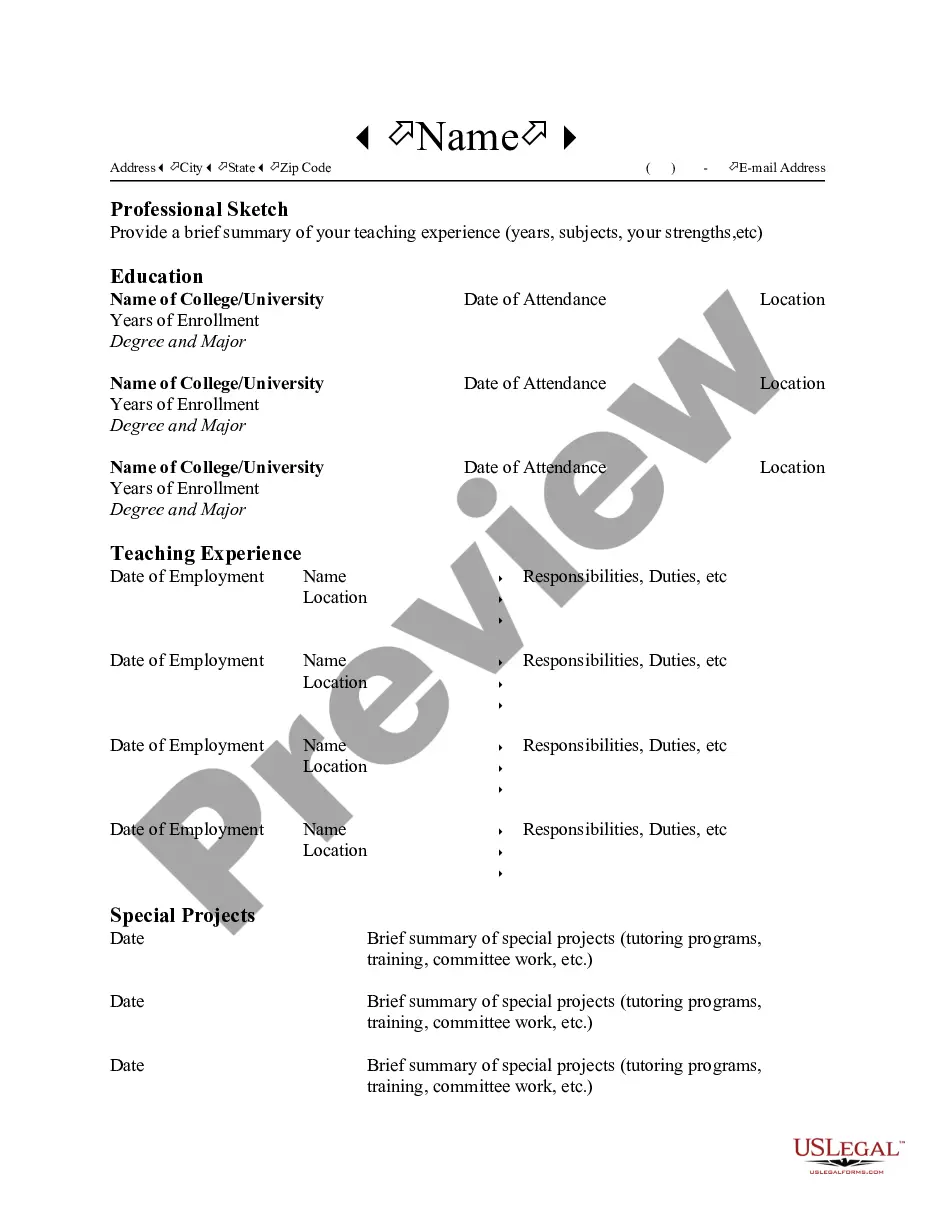

How to fill out Approval Of Company Stock Award Plan?

If you have to complete, download, or printing lawful file themes, use US Legal Forms, the greatest variety of lawful kinds, which can be found on-line. Use the site`s easy and hassle-free research to find the papers you need. Various themes for organization and individual purposes are sorted by categories and states, or key phrases. Use US Legal Forms to find the Washington Approval of Company Stock Award Plan within a few mouse clicks.

Should you be presently a US Legal Forms buyer, log in to your accounts and click on the Acquire button to have the Washington Approval of Company Stock Award Plan. Also you can gain access to kinds you formerly delivered electronically in the My Forms tab of the accounts.

If you use US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have selected the shape to the correct city/region.

- Step 2. Take advantage of the Preview solution to look through the form`s content. Never neglect to read the explanation.

- Step 3. Should you be unhappy with the type, make use of the Search field near the top of the display screen to locate other models from the lawful type design.

- Step 4. Once you have found the shape you need, go through the Purchase now button. Opt for the rates prepare you choose and put your credentials to sign up to have an accounts.

- Step 5. Process the purchase. You may use your credit card or PayPal accounts to perform the purchase.

- Step 6. Find the format from the lawful type and download it on your gadget.

- Step 7. Full, modify and printing or indicator the Washington Approval of Company Stock Award Plan.

Every single lawful file design you get is the one you have permanently. You might have acces to each type you delivered electronically with your acccount. Select the My Forms segment and select a type to printing or download once again.

Compete and download, and printing the Washington Approval of Company Stock Award Plan with US Legal Forms. There are millions of professional and status-particular kinds you can utilize to your organization or individual requires.

Form popularity

FAQ

Once you have a plan in place, you can simply make amendments to increase the number of shares in the option pool on an as-needed basis. The initial plan and any expansions must be approved by your board of directors and then by shareholders.

A stock option plan must be adopted by the company's directors and, in some cases, approved by the company's shareholders.

There are many requirements on using ISOs. First, the employee must not sell the stock until after two years from the date of receiving the options, and they must hold the stock for at least a year after exercising the option like other capital gains. Secondly, the stock option must last ten years.

The option plan must be approved by the stockholders within 12 months before or after the plan is adopted (see also Explanation: §423, Shareholder Approval Requirement) (IRC § 422(b)(1); Reg. §1.422-3).

Once approved by the stockholders, an ESPP does not need to be approved by the stockholders again unless there is an amendment to the ESPP that would be considered the ?adoption of a new plan.? As a practical matter, this means a change in the number of shares reserved for issuance or a change in the related ...

Stock awards provide corporations a way to pay their executives based on company performance so their compensation aligns with the expectations of the shareholders. Companies may also grant stock awards to lower-level employees to incentivize them to take ownership of the company's performance and retain their loyalty.

The US federal tax laws do not generally address the level of approval required for equity awards, but the tax rules that govern the qualification of so-called incentive stock options require that the options be granted under a shareholder-approved plan.

You and the company will need to sign a contract that outlines the terms of the stock options; this might be included in the employment contract. The contract will specify the grant date, which is the day your options begin to vest.