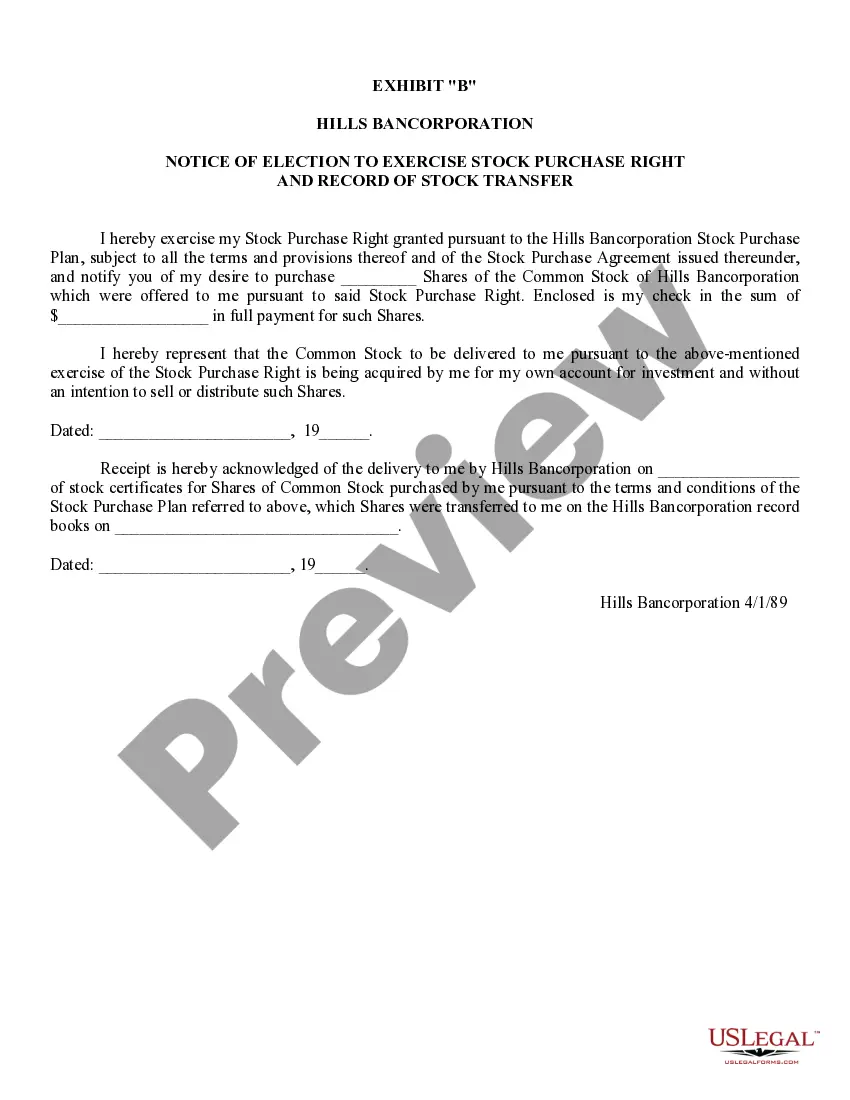

Washington Notice of Election to Exercise Stock Purchase Right and Record of Stock Transfer

Description

How to fill out Notice Of Election To Exercise Stock Purchase Right And Record Of Stock Transfer?

US Legal Forms - one of many most significant libraries of lawful varieties in the States - gives a wide range of lawful document themes it is possible to download or print out. Using the internet site, you may get a large number of varieties for company and individual purposes, sorted by classes, claims, or key phrases.You can get the most up-to-date types of varieties much like the Washington Notice of Election to Exercise Stock Purchase Right and Record of Stock Transfer within minutes.

If you currently have a membership, log in and download Washington Notice of Election to Exercise Stock Purchase Right and Record of Stock Transfer in the US Legal Forms library. The Download key will appear on every form you perspective. You get access to all formerly acquired varieties inside the My Forms tab of your respective bank account.

If you want to use US Legal Forms initially, listed here are straightforward directions to help you began:

- Ensure you have selected the best form for your city/area. Select the Review key to analyze the form`s content. Browse the form description to ensure that you have chosen the proper form.

- In the event the form does not satisfy your requirements, take advantage of the Look for discipline at the top of the display to discover the one that does.

- When you are content with the form, validate your decision by simply clicking the Get now key. Then, opt for the costs plan you like and offer your qualifications to register on an bank account.

- Approach the purchase. Utilize your bank card or PayPal bank account to perform the purchase.

- Choose the file format and download the form on your device.

- Make adjustments. Fill up, edit and print out and signal the acquired Washington Notice of Election to Exercise Stock Purchase Right and Record of Stock Transfer.

Each and every template you put into your money lacks an expiry day and is yours eternally. So, if you wish to download or print out yet another backup, just proceed to the My Forms portion and click around the form you need.

Gain access to the Washington Notice of Election to Exercise Stock Purchase Right and Record of Stock Transfer with US Legal Forms, one of the most comprehensive library of lawful document themes. Use a large number of professional and condition-specific themes that meet your business or individual requires and requirements.

Form popularity

FAQ

With an 83(b) election, you may choose to exercise your non-qualified stock options and pay income taxes prior to the option vesting. One reason to choose this is if you hope for the spread between the exercise price and the fair market value to be lower now than it will be later.

Some NQSOs may allow you to opt for an 83(b) election. You can likely check your company plan document to confirm whether this is available for you. With an 83(b) election, you may choose to exercise your non-qualified stock options and pay income taxes prior to the option vesting.

Non-qualified stock options require payment of income tax of the grant price minus the price of the exercised option. NSOs might be provided as an alternative form of compensation. Prices are often similar to the market value of the shares.

What is Form 3921? Form 3921 is an IRS form that must be filed by a company when an employee has exercised an incentive stock option (ISO) in the last tax year. Form 3921 informs the IRS which shareholders received ISO compensation. You must file one form per ISO exercise.

Exercise and Hold Difference between the fair market value (FMV) at exercise and the grant price is taxed as ordinary income and subject to federal, state and local income taxes in addition to payroll taxes. Difference between the FMV at exercise and the sale price is taxed as a short-term capital gain or loss.

To exercise an option, you simply advise your broker that you wish to exercise the option in your contract. Your broker will initiate an exercise notice, which informs the seller or writer of the contract that you are exercising the option.

Exercising stock options means you're purchasing shares of a company's stock at a set price. If you decide to exercise your stock options, you'll own a piece of the company. Owning stock options is not the same as owning shares outright.

83(b) and Incentive Stock Options Instead, for a qualifying disposition, the sale of stock must occur at least one year beyond the vesting date of the ISO, regardless of an early exercise and filing of an 83(b) election. This does not mean that an 83(b) for ISOs is not a good idea.