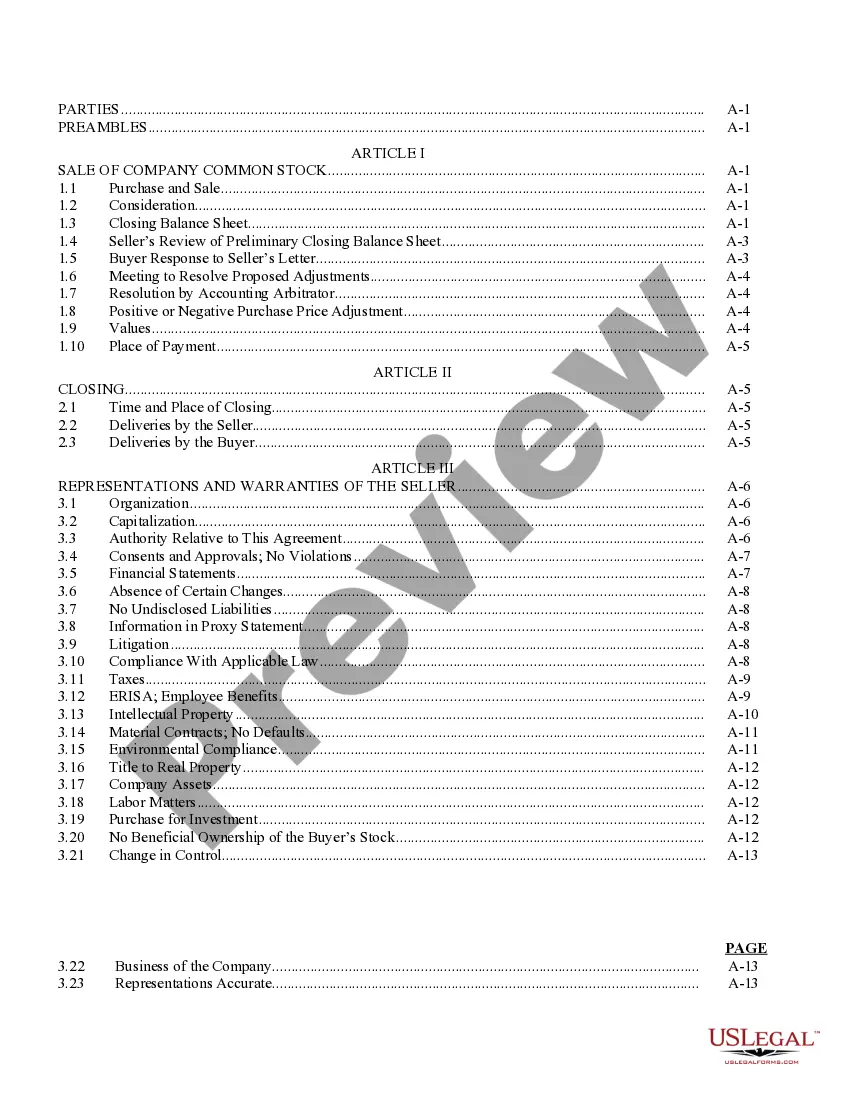

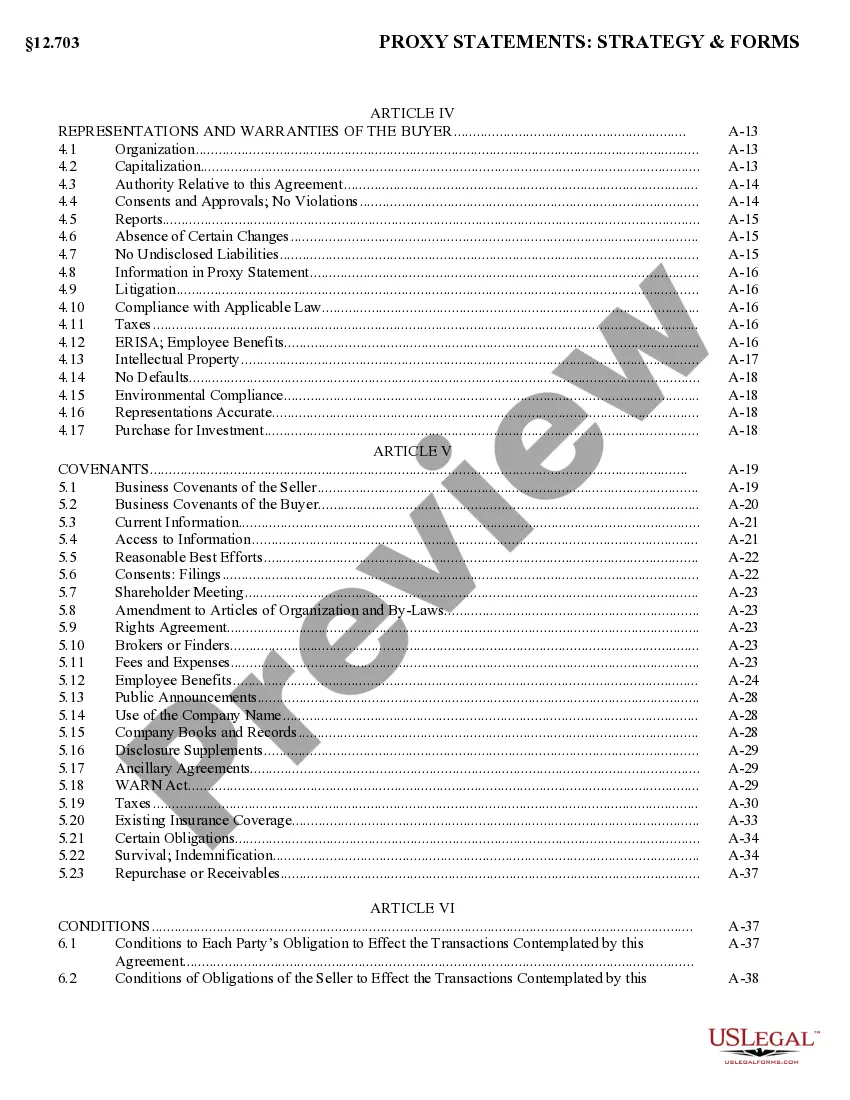

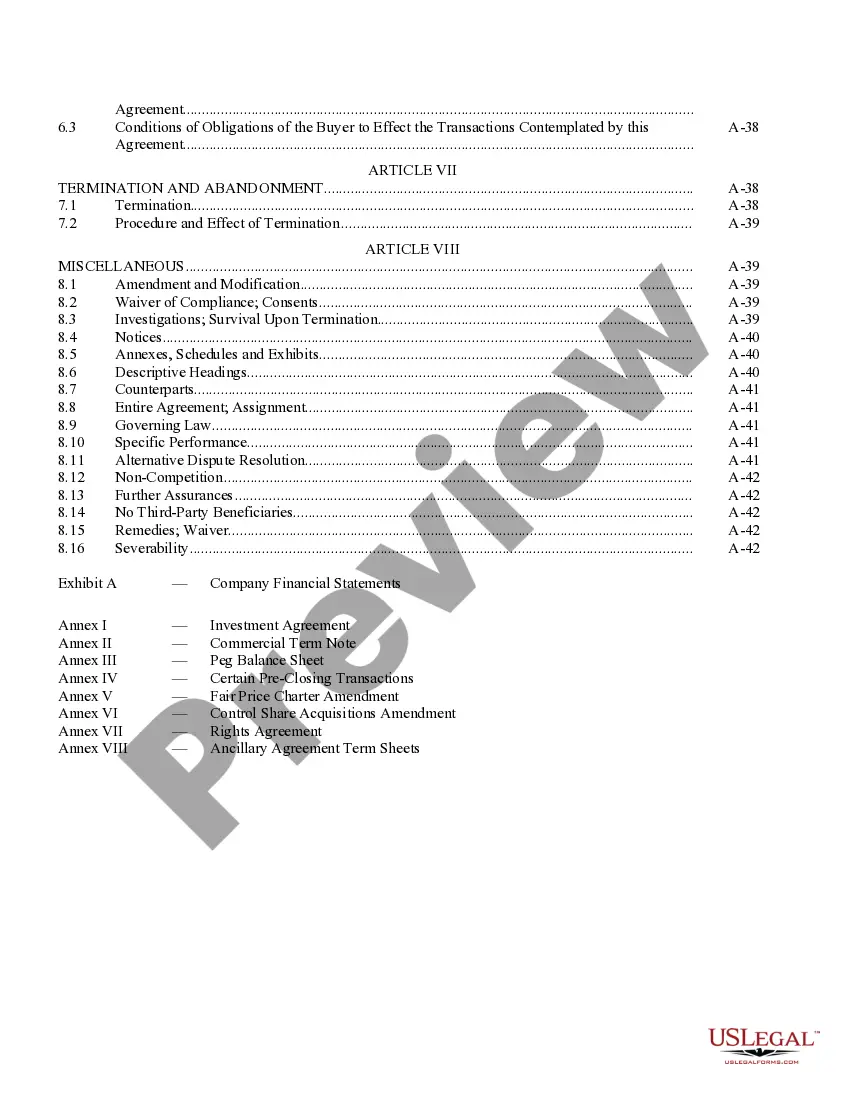

Washington Sample Stock Purchase Agreement general form to be used across the United States

Description

How to fill out Sample Stock Purchase Agreement General Form To Be Used Across The United States?

Are you presently in the situation the place you need to have paperwork for either company or personal functions virtually every day? There are plenty of lawful papers themes available on the Internet, but finding kinds you can trust is not easy. US Legal Forms gives a large number of type themes, just like the Washington Sample Stock Purchase Agreement general form to be used across the United States, that happen to be written in order to meet state and federal requirements.

If you are presently knowledgeable about US Legal Forms site and get a merchant account, simply log in. Afterward, you may obtain the Washington Sample Stock Purchase Agreement general form to be used across the United States format.

Should you not offer an bank account and need to start using US Legal Forms, abide by these steps:

- Find the type you want and make sure it is for that right metropolis/region.

- Take advantage of the Review key to analyze the shape.

- Browse the outline to ensure that you have selected the appropriate type.

- In the event the type is not what you are searching for, utilize the Lookup industry to obtain the type that meets your needs and requirements.

- Once you obtain the right type, click on Get now.

- Opt for the rates plan you need, submit the desired information to make your account, and pay for the order utilizing your PayPal or Visa or Mastercard.

- Select a hassle-free paper file format and obtain your copy.

Get all the papers themes you might have bought in the My Forms menus. You can get a further copy of Washington Sample Stock Purchase Agreement general form to be used across the United States anytime, if needed. Just click the required type to obtain or print out the papers format.

Use US Legal Forms, the most comprehensive variety of lawful types, to conserve some time and steer clear of errors. The service gives appropriately produced lawful papers themes that you can use for a selection of functions. Create a merchant account on US Legal Forms and start generating your life easier.

Form popularity

FAQ

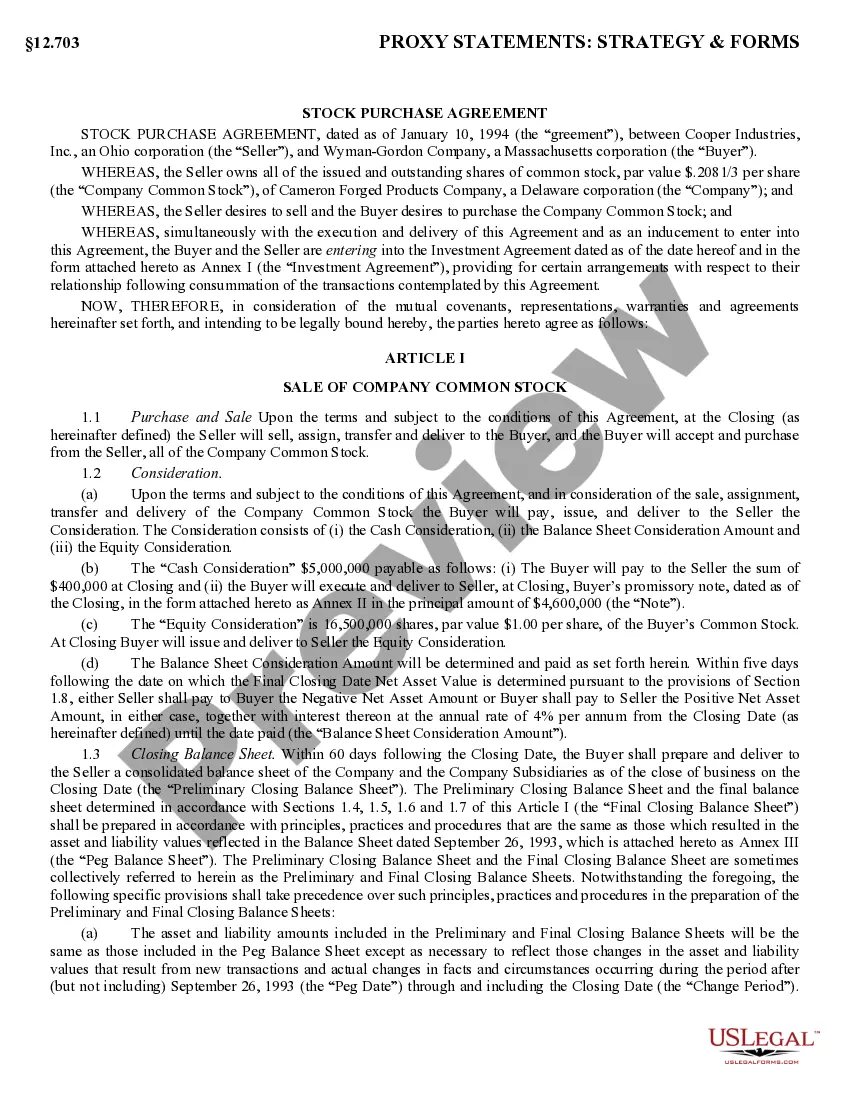

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

A purchase and sale agreement is used to document the parties' intentions and the terms they have agreed will govern the transaction. You can include specific terms like the product or property, the price of the product or property, conditions for the delivery of the product, and the date of product delivery.

A simplified, short form agreement (SPA) for the sale and purchase of the entire issued share capital of a private limited company, involving a single target company and a simultaneous exchange and completion.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

A share purchase agreement is a formal contract or an agreement that sets out the terms and conditions relating to the sale and purchase of shares in a company. The share purchase agreement should very clearly set out what is being sold, to whom and for how much, as well as any other obligations and liabilities.

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.