Washington Personal Property - Schedule B - Form 6B - Post 2005

Description

How to fill out Personal Property - Schedule B - Form 6B - Post 2005?

Have you been inside a placement the place you need paperwork for sometimes organization or personal purposes virtually every day time? There are tons of authorized file themes available on the net, but discovering types you can rely is not effortless. US Legal Forms offers 1000s of type themes, like the Washington Personal Property - Schedule B - Form 6B - Post 2005, which are written to fulfill federal and state requirements.

When you are already familiar with US Legal Forms website and also have a free account, merely log in. Afterward, you are able to down load the Washington Personal Property - Schedule B - Form 6B - Post 2005 template.

Should you not offer an accounts and wish to begin to use US Legal Forms, adopt these measures:

- Find the type you require and make sure it is for the proper area/region.

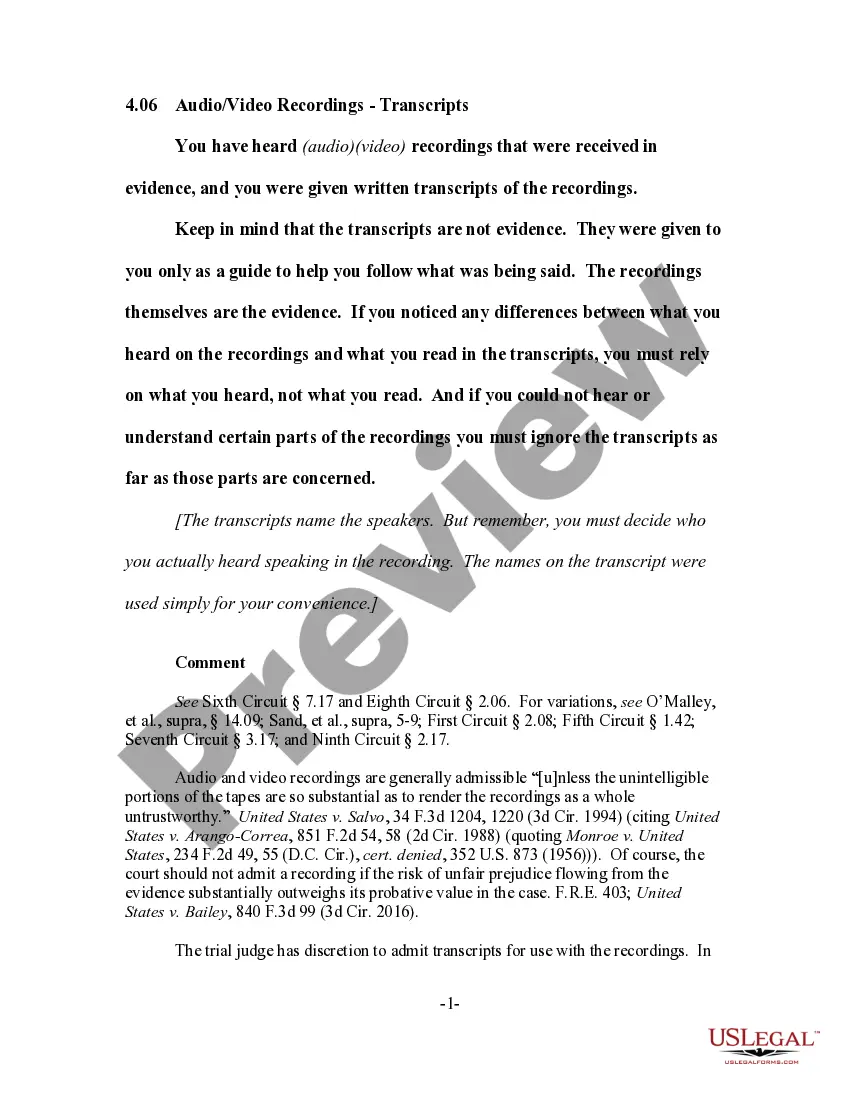

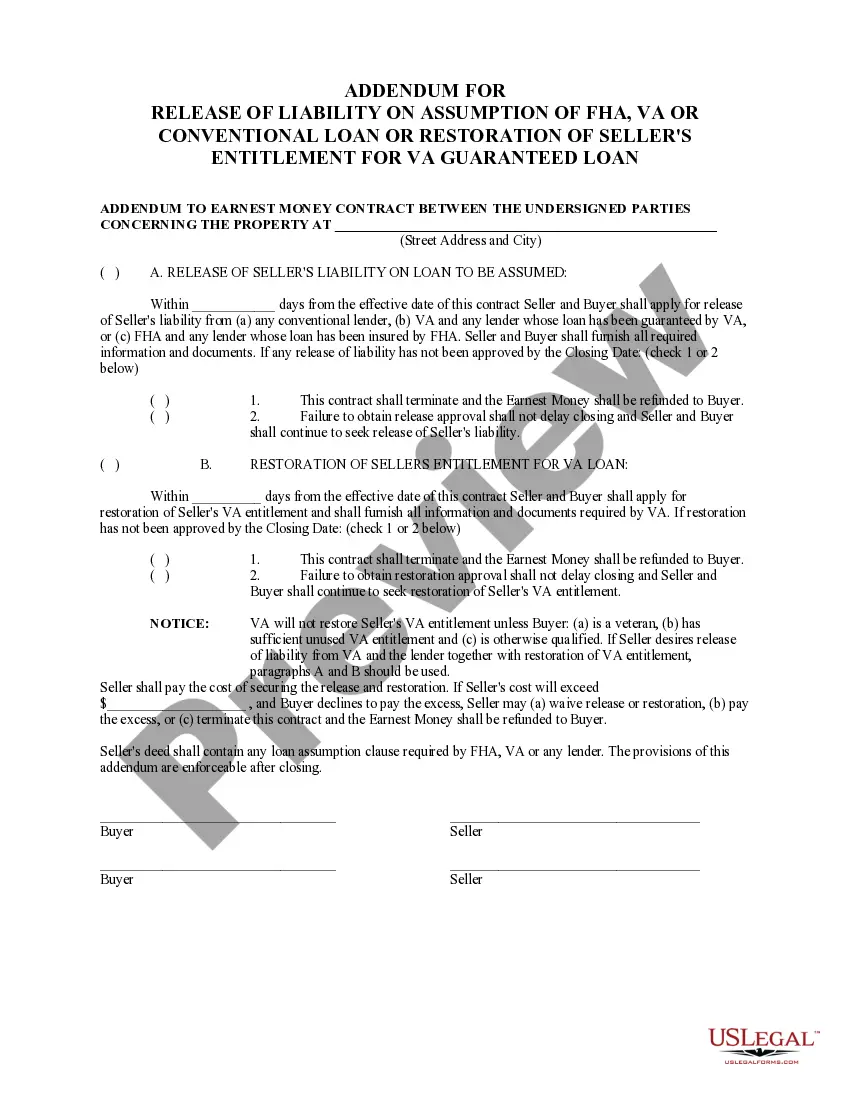

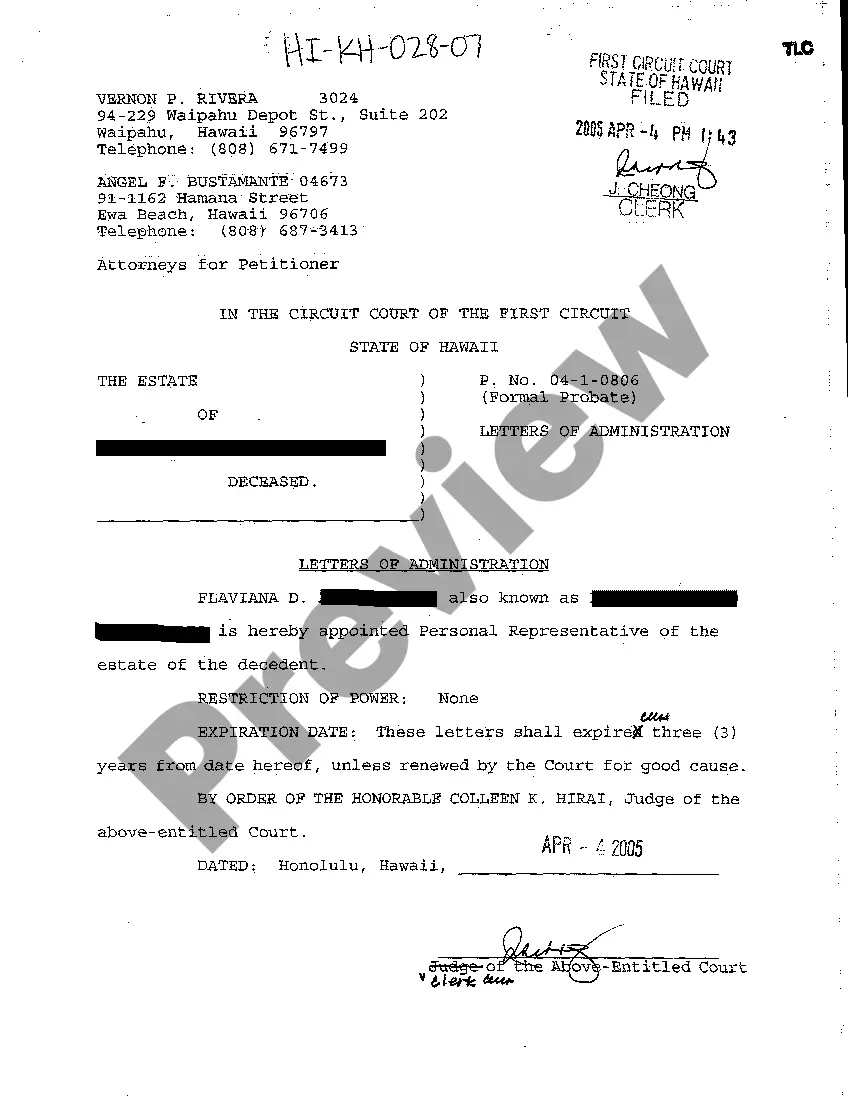

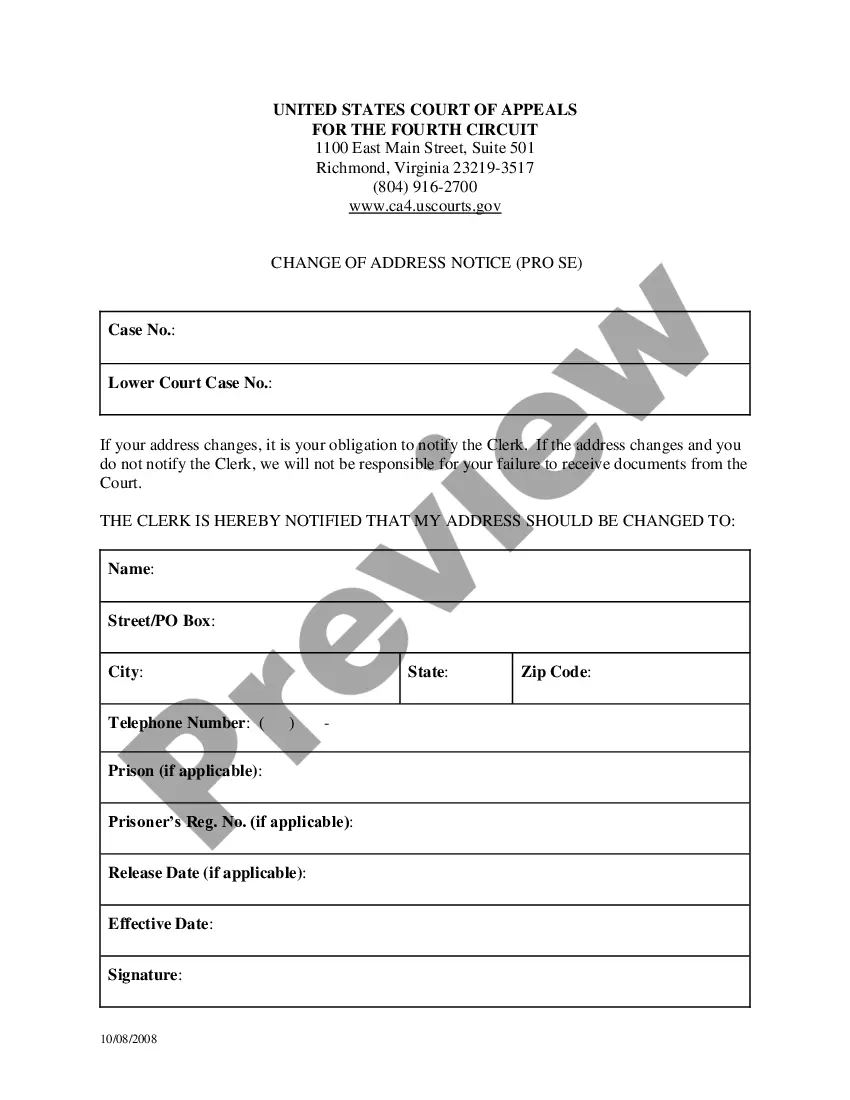

- Make use of the Preview option to analyze the form.

- See the description to ensure that you have chosen the correct type.

- In case the type is not what you`re looking for, make use of the Lookup area to find the type that meets your needs and requirements.

- If you find the proper type, click Purchase now.

- Choose the pricing program you desire, fill in the required info to make your account, and buy the transaction making use of your PayPal or charge card.

- Decide on a handy document file format and down load your backup.

Find all of the file themes you may have bought in the My Forms food list. You may get a additional backup of Washington Personal Property - Schedule B - Form 6B - Post 2005 anytime, if required. Just select the needed type to down load or print out the file template.

Use US Legal Forms, by far the most extensive variety of authorized kinds, to save lots of time and prevent errors. The services offers skillfully made authorized file themes that you can use for a selection of purposes. Produce a free account on US Legal Forms and initiate making your life easier.

Form popularity

FAQ

Personal property refers to the items that people own such as furniture, appliances, or electronics. In short, these items differ from real property because they are movable. Personal property can be intangible, as in the case of stocks and bonds, or tangible, such as clothes or artwork.

Unless specifically exempt, all tangible personal property is taxable, including items such as: office equipment, communication equipment, supplies and materials not held for sale or not components of a product. tools, furniture, rugs and fixtures used in a business.

Moving to Washington new residents Registration of the vehicle in another state is commonly used as documentation for this exemption. If you purchased a personal vehicle in another state within 90 days of moving here, you owe use tax when you register and license it.

This is called personal property tax and it applies to businesses in every county in Washington State and most states across the nation. State law requires every business to report their personal property each year to the county assessor for assessment purposes (Revised Code of Washington {RCW} 84.40. 185).

Washington State Vehicle Sales Tax on Car Purchases ing to the Sales Tax Handbook, a 6.5 percent sales tax rate is collected by Washington State. On top of that is a 0.3 percent lease/vehicle sales tax. This means that in total, the state tax on the lease or purchase of a vehicle adds up to 6.8 percent.

065. Personal property tax applies to vehicles that are used off-road and not primarily designed for use on public streets or highways, licensed or not. Taxable vehicles include: ? Vehicles used entirely upon private property. Special highway construction equipment, such as earth moving and paving equipment.

At least 61 years of age or older. Retired from regular gainful employment due to a disability. Veteran of the armed forces of the United States receiving compensation from the United States Department of Veterans Affairs at one of the following: Combined service-connected evaluation rating of 80% or higher.

Unless specifically exempt, all tangible personal property is taxable, including items such as: office equipment, communication equipment, supplies and materials not held for sale or not components of a product. tools, furniture, rugs and fixtures used in a business.