Washington Agreement to Reimburse for Insurance Premium

Description

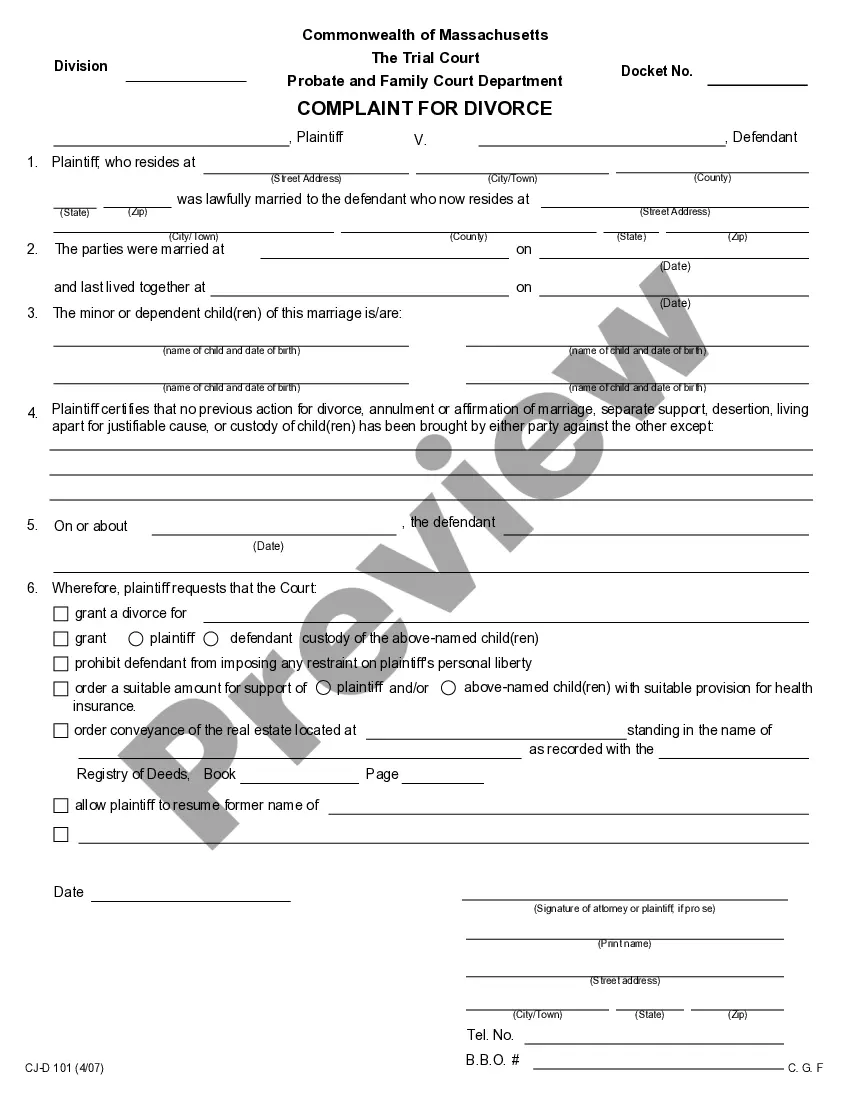

How to fill out Agreement To Reimburse For Insurance Premium?

US Legal Forms - one of the most extensive collections of legal documents in the United States - provides a variety of legal paperwork templates that you can download or print.

By using the website, you will obtain countless documents for business and personal needs, categorized by types, states, or keywords. You can find the latest editions of forms such as the Washington Agreement to Reimburse for Insurance Premium in moments.

If you hold a membership, Log In to access and download the Washington Agreement to Reimburse for Insurance Premium from the US Legal Forms database. The Download button will appear on every form you view. All previously downloaded forms can be found in the My documents section of your account.

Complete the payment process. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the document onto your device. Edit. Fill out, modify, and print, and sign the downloaded Washington Agreement to Reimburse for Insurance Premium. Each template you added to your account does not expire and is yours indefinitely. Thus, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Washington Agreement to Reimburse for Insurance Premium with US Legal Forms, the most extensive repository of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- Ensure you have selected the correct form for your city/state.

- Use the Preview button to review the form's details.

- Check the form description to confirm you have chosen the appropriate document.

- If the form does not suit your requirements, utilize the Search box at the top of the page to find the one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose the payment method you prefer and provide your details to create an account.

Form popularity

FAQ

An insurance premium is the amount of money an individual or business must pay for an insurance policy. Insurance premiums are paid for policies that cover healthcare, auto, home, and life insurance.

HCA has a Premium Payment program to help pay for Washington Apple Health (Medicaid) individuals' private health insurance premiums. For those that have access to private health insurance, the agency may pay premiums for the entire family as long as someone has Apple Health (either MAGI-based or Classic Medicaid).

Premiums can be paid through monthly, half-yearly or even annual installments. Customers can also pay the entire amount as a one-time payment for the whole policy term prior to the commencement of coverage in some cases.

In the insurance industry, pro rata means that claims are only paid out in proportion to the insurance interest in the asset; this is also known as the first condition of average.

Long-term care (LTC) insurance, according to Washington state law (leg.wa.gov), is an insurance policy, contract or rider that provides coverage for at least 12 consecutive months to an insured person if they experience a debilitating prolonged illness or disability.

Pro rate for insurance premiumsDetermine the total amount for the insurance premium for a year.Divide the total annual premium by the number of days in a year (365).Multiply this number by the number of days in the shorter pay term.

Generally, you cannot use your Health Savings Account to pay premiums for health insurance coverage. Exceptions include COBRA premiums, long-term care premiums or premium payments that allow you to retain coverage while receiving unemployment compensation.

No, premiums cannot be prorated for a shorter period. You must pay the full premium amount for each month. Partial payments will be accepted, but cannot be reported to the carrier until the full amount has been paid. You will not have coverage until all premiums have been paid in full.

Insurers provide a variety of ways to pay renewal premiums. Get to know the ones that your insurer offers to be able to renew your policy conveniently.By Sunil Dhawan.Payment by cheque.Payment by credit card.Payments at ATM.Payments through SMS.Bank account auto-debit facility.Bank collection centers.Online payments.More items...?

Premium is required to be paid in advance and can be paid via cash up to Rs 50,000, (the limit set by IRDA for cash payments) cheque or DD.