Washington FMLA Leave Periodic Status Report

Description

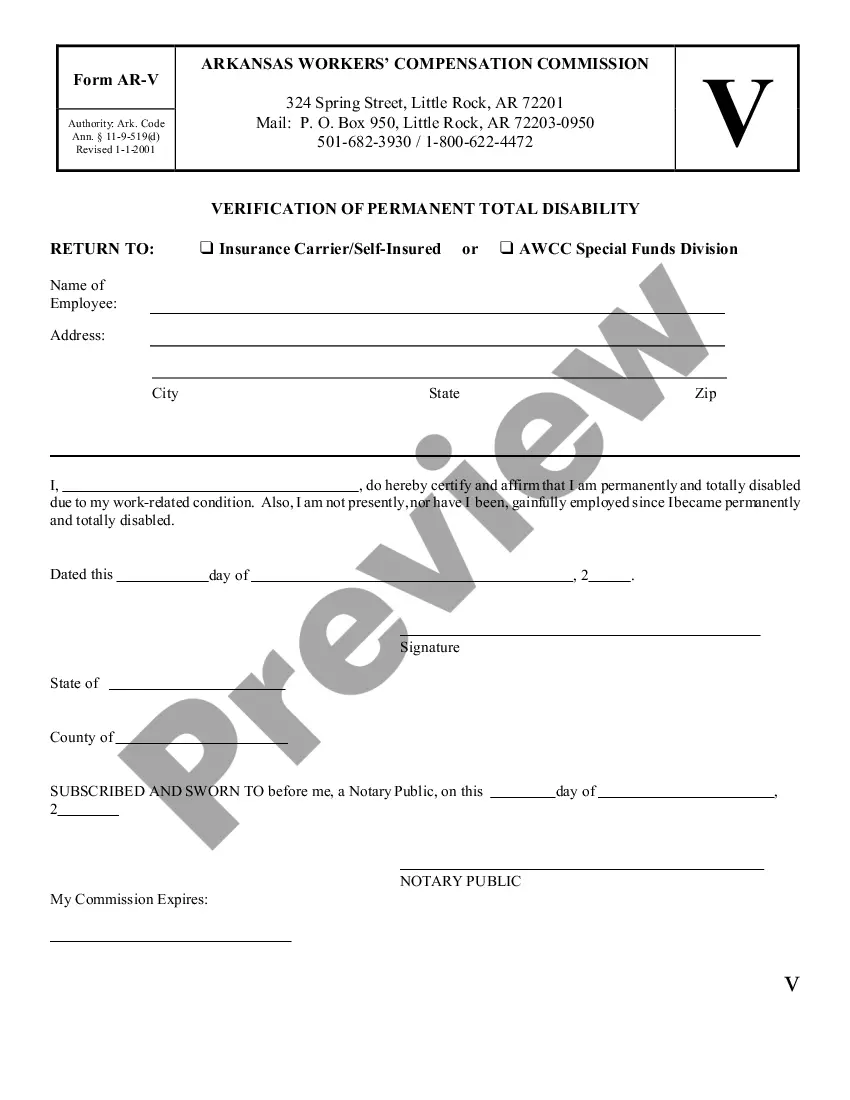

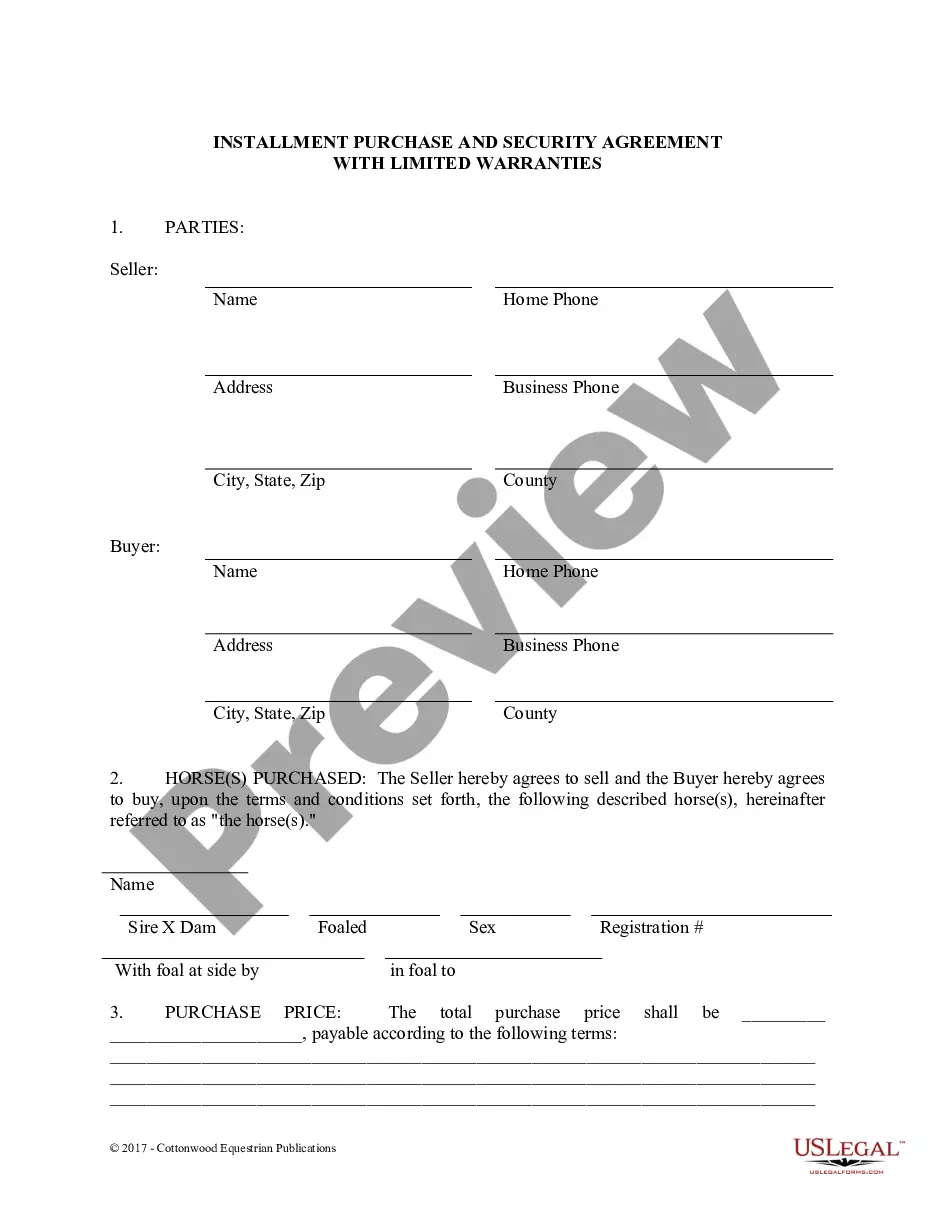

How to fill out FMLA Leave Periodic Status Report?

If you need to finalize, download, or print authorized document templates, utilize US Legal Forms, the premier selection of legal forms available online.

Take advantage of the site's straightforward and convenient search feature to find the documents you require.

Various templates for business and personal purposes are organized by categories and regions, or keywords.

Step 4. Once you have located the document you need, click the Get now button. Choose your preferred payment plan and provide your information to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to access the Washington FMLA Leave Periodic Status Report with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to retrieve the Washington FMLA Leave Periodic Status Report.

- You can also find forms you have saved previously in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the document for the correct city/state.

- Step 2. Use the Preview option to review the form's details. Remember to read the description.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find other variations of the legal document format.

Form popularity

FAQ

Intermittent leave can be tracked by recording the employee's work schedule and subtracting from it the number of hours they took for FMLA leave. If the employee was scheduled to work 7 hours and only worked 3 hours, then 4 hours of FMLA leave can be counted. Employers must track this information.

Washington Paid Family and Medical Leave (PFML) Washington PFML is a state-mandated insurance program designed to provide paid leave to employees to receive or give care. Premium collection and reporting requirements began on January 1, 2019. Benefits began to be paid out starting January 1, 2020.

It's yours. Paid Family and Medical Leave is a new benefit for Washington workers. It's here for you when a serious health condition prevents you from working or when you need time to care for a family member, bond with a new child or spend time with a family member preparing for military service overseas.

What information did Paid Leave send to the IRS? We are required to submit details to the IRS in their standard template for 1099-G information which includes your name, SSN, address, and the dollar amount of the family leave benefits we paid to you in 2021.

Family leave insurance benefits are subject to federal income tax and to federal rules on reporting income and paying taxes. CA PFL benefits are not subject to California state income tax. Benefits paid directly from the state of California are reported on Form 1099-G. Benefits paid by Lincoln are reported on Form W-2.

Washington's Family and Medical Leave ProgramMost workers are eligible for up to 12 weeks of paid leave a year, with some eligible for up to 16 weeks. Employees in Washington who take paid leave can receive as much as 90 percent of their weekly wages, with a cap of $1,000 a week.

Benefits provide a percentage of the employee's gross wages between $100-1,000 per week while the employee is on approved leave. To receive benefits under the Paid Family and Medical Leave program, you must have worked a total of at least 820 hours for any Washington employers during the previous 12 months.

Yes. PFML may be used intermittently as long as the employee is absent for 8 consecutive hours in a week.

Here's how to prepare and file your report.Log in to your Paid Leave account through SecureAccess Washington (SAW).If you are setting up your account for the first time, have your UBI number on hand.Choose a reporting format: either manual entry (you can do this for up to 50 employees) or completing and uploading a .

PFL isn't included in your employer's regular W-2. Instead, it's reported on a separate 1099-G from the insurer. Amounts labeled as PFL on the W-2 from your employer are taxable both on the federal level and state levels if you are in a state that is not tax-exempt.