Washington Resolution of Meeting of LLC Members to Dissolve the Company

Description

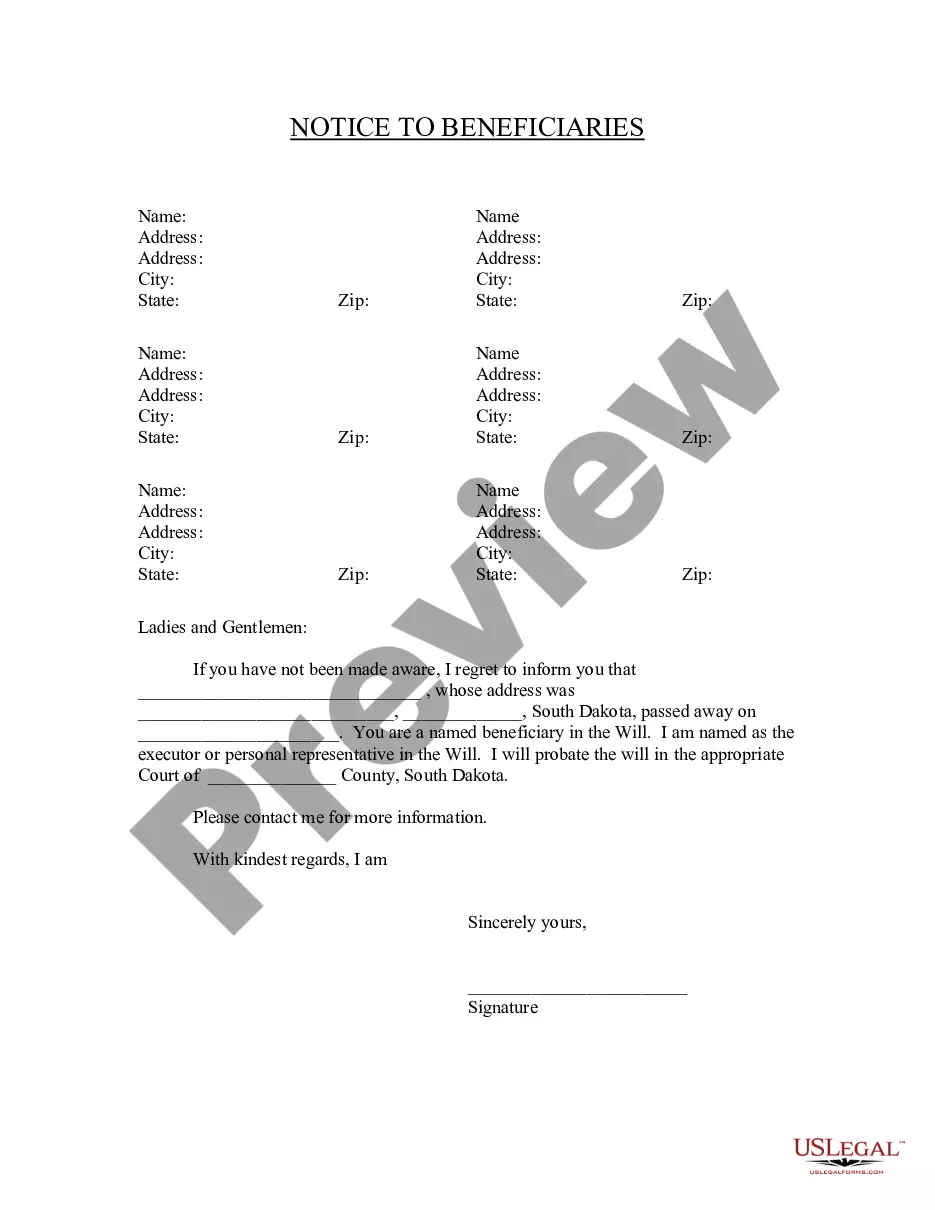

How to fill out Resolution Of Meeting Of LLC Members To Dissolve The Company?

Have you ever found yourself in a situation where you need documents for either business or personal reasons on a daily basis? There are numerous legal document templates accessible online, but finding ones that you can trust is quite challenging.

US Legal Forms offers a vast selection of form templates, such as the Washington Resolution of Meeting of LLC Members to Dissolve the Company, which are crafted to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Washington Resolution of Meeting of LLC Members to Dissolve the Company template.

View all the document templates you have purchased in the My documents section. You can acquire an additional copy of the Washington Resolution of Meeting of LLC Members to Dissolve the Company at any time if needed. Simply select the required form to download or print the document template.

Utilize US Legal Forms, the most extensive array of legal forms, to save time and minimize mistakes. The service provides well-crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and begin simplifying your life.

- Obtain the form you need and ensure it is for the correct city/region.

- Utilize the Review button to inspect the form.

- Check the details to confirm you have selected the appropriate form.

- If the form is not what you are looking for, use the Search field to find a form that meets your requirements.

- Once you locate the correct form, click Get now.

- Choose the pricing plan you desire, complete the required information to set up your account, and pay for your order using your PayPal or credit card.

- Select a convenient document format and download your copy.

Form popularity

FAQ

How to Dissolve a Washington Corporation or LLCSubmit a Revenue Clearance Certificate Application.Wait for processing.Fill out Articles of Dissolution.Attach the certificate.Submit Articles of Dissolution.Wait for processing.Inform your registered agent.

Dissolution is a process to bring about the end of an unwanted company. When a company has been dissolved, it will cease to exist as a legal entity. All trade will stop, the company's name will be removed from the Companies House register, and it will have no further filing requirements.

RoadmapDissolve your business entity with the Corporations Division, (202) 442-4400, Option #5, 1100 4th Street, SW, 2nd Floor, Washington, DC 20024;Cancel your Basic Business License with the Business Licensing Division, (202) 442-4400, Option #4, 1100 4th Street, SW, 2nd Floor, Washington, DC 20024.More items...

(ii) Dissolution by Notice: A partnership at will can be dissolved when a partner gives a notice,in writing, to all the other partners about his/her intentions about dissolution of the firm.

Once the decision has been made to dissolve, the nonprofit must stop transacting business, except to wind down its activities. The assets of a charitable nonprofit can only be used for exempt purposes. 6feff This means that assets may not go to staff or board members.

If the leadership of the organization decides that winding down is the best option, the organization will need a plan of dissolution. A plan of dissolution is essentially a written description of how the nonprofit intends to distribute its remaining assets and address its remaining liabilities.

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

With the resolution to dissolve in hand, Washington law provides for voluntary dissolution as follows:if your nonprofit has voting members, by action of the directors followed by a vote or other consent of the members; or.if your nonprofit doesn't have members, by a vote of the directors.

The certificate of intent to dissolve serves as public notice that the corporation is no longer carrying on its activities, except to the extent necessary for the liquidation.

Steps to Dissolving a NonprofitFile a final form. In this type of dissolution, the IRS mandates that the board of directors of the nonprofit organization complete certain requirements to "dissolve," or shut down, the 501(c)(3).Vote for dissolution.File Form 990.File the paperwork.