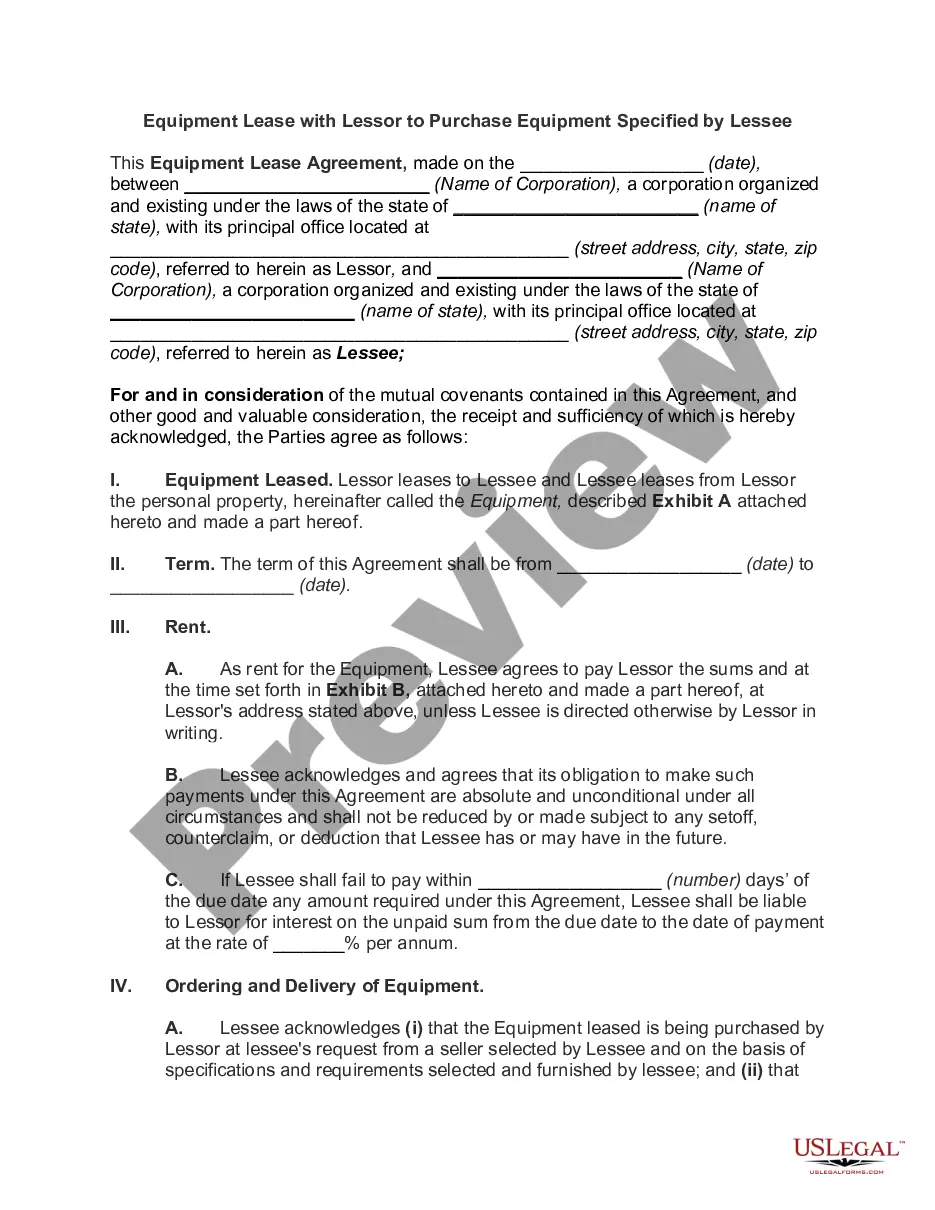

Washington Equipment Lease with Lessor to Purchase Equipment Specified by Lessee

Description

How to fill out Equipment Lease With Lessor To Purchase Equipment Specified By Lessee?

If you have to comprehensive, obtain, or print out lawful file layouts, use US Legal Forms, the largest selection of lawful types, that can be found on the Internet. Utilize the site`s easy and practical search to obtain the paperwork you require. Different layouts for organization and personal functions are categorized by types and suggests, or keywords and phrases. Use US Legal Forms to obtain the Washington Equipment Lease with Lessor to Purchase Equipment Specified by Lessee in a few click throughs.

If you are already a US Legal Forms consumer, log in to the bank account and then click the Down load key to have the Washington Equipment Lease with Lessor to Purchase Equipment Specified by Lessee. Also you can accessibility types you in the past acquired inside the My Forms tab of your bank account.

If you work with US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the form for your proper area/region.

- Step 2. Utilize the Review method to check out the form`s articles. Don`t overlook to learn the information.

- Step 3. If you are unhappy with all the develop, utilize the Research field near the top of the screen to find other types of your lawful develop web template.

- Step 4. When you have found the form you require, click on the Get now key. Select the prices plan you like and add your credentials to register for an bank account.

- Step 5. Method the purchase. You can utilize your Мisa or Ьastercard or PayPal bank account to accomplish the purchase.

- Step 6. Select the formatting of your lawful develop and obtain it on your own product.

- Step 7. Full, modify and print out or indicator the Washington Equipment Lease with Lessor to Purchase Equipment Specified by Lessee.

Every lawful file web template you purchase is your own eternally. You have acces to each develop you acquired inside your acccount. Select the My Forms segment and select a develop to print out or obtain once again.

Be competitive and obtain, and print out the Washington Equipment Lease with Lessor to Purchase Equipment Specified by Lessee with US Legal Forms. There are many skilled and condition-distinct types you may use for the organization or personal needs.

Form popularity

FAQ

Like hotel and B&B stays, short-term rentals in Washington state are subject to tax. Tax authorities require short-term vacation rental hosts to collect applicable short-term rental taxes from their guests and remit them to the proper authorities.

The three most common types of leases are gross leases, net leases, and modified gross leases.The Gross Lease. The gross lease tends to favor the tenant.The Net Lease. The net lease, however, tends to favor the landlord.The Modified Gross Lease.

Because the rental of equipment with an operator is not a sale of tangible personal property, it is not eligible for the M&E exemption.

What is the rental tax rate? The rate is 1.25% of the rental price on each heavy equipment rental property rented by a consumer within the state of Washington. The heavy equipment rental tax is in addition to the retail sales tax.

Learn more about Equipment Leasing!Sale/Leaseback: (allows you to use your equipment to get working capital)True Lease or Operating Equipment Leases: (Also known as fair market value leases)The P.U.T. Option Lease (Purchase upon Termination)TRAC Equipment Leases.More items...

The three main types of leasing are finance leasing, operating leasing and contract hire.

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

A lease will always have at least two parties: the lessor and the lessee. The lessor is the person or business that owns the equipment. The lessee is the person or business renting the equipment. The lessee will make payments to the lessor throughout the contract.

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

Various Types of Lease: Finance, Operating, Direct, LeveragedVarious Types of Lease.(1) Finance lease :(2) Operating lease :(3) Sale and lease back :(4) Direct lease :(5) Single investor lease :(6) Leveraged lease :(7) Domestic Lease :More items...