Washington Business Trust

Description

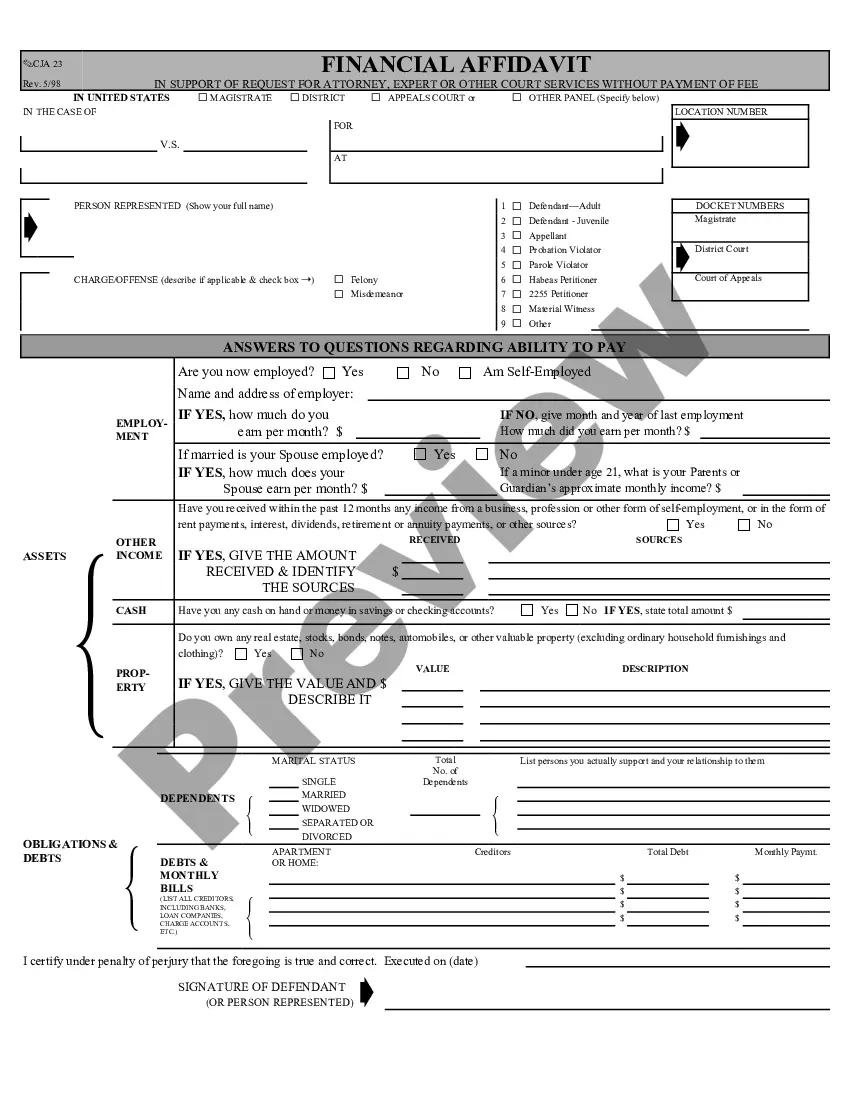

How to fill out Business Trust?

If you need to finalize, obtain, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the site's straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are organized by categories and regions, or keywords.

Every legal document template you download is yours permanently. You have access to each form you’ve downloaded within your account. Click on the My documents section and choose a form to print or download again.

Stay competitive and obtain and print the Washington Business Trust with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- Utilize US Legal Forms to obtain the Washington Business Trust in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to get the Washington Business Trust.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are a first-time user of US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview mode to review the content of the form. Be sure to read the description.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you require, click the Get now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Washington Business Trust.

Form popularity

FAQ

To register an out-of-state business in Washington State, start by ensuring compliance with Washington business laws. You must file for a Certificate of Authority with the Washington Secretary of State, providing details about your business and its operations. Remember to obtain any necessary local permits and licenses as well. This process allows your out-of-state business to operate as a Washington business trust.

A living trust never needs to be filed with a court, either before or after your death. The probate court isn't involved in supervising your trustee, the person you name in the trust document to handle the distribution of the trust assets.

A trust company is a legal entity that acts as a fiduciary, agent, or trustee on behalf of a person or business for a trust. A trust company is typically tasked with the administration, management, and the eventual transfer of assets to beneficiaries.

In Washington, there is a relatively high threshold for which estates must go through probate. Any estate worth less than $100,000 does not have to go to probate court, so you likely won't need a living trust if your estate is worth less than that.

The trustee must register the trust by filing with the clerk of the court in any county where venue lies for the trust under RCW 11.96A.

A Washington living trust holds your assets in trust while you continue to use and control them. After your death, the trust passes assets to your beneficiaries according to your instructions. A revocable living trust can provide flexibility and control.

All told, the decision to use a will or a trust is largely dependent on your life circumstances and where you live. As an example, Washington State has a nominal flat-rate probate fee and a relatively straightforward probate process, so using a trust solely to avoid the cost of probate may not be the best choice.

There is currently no legal consensus on whether a trust should be registered in states where it is not mandatory. Some argue that the registration of trusts, especially big ones, can be so costly and complicated that it becomes fiscally impractical.

To make a living trust in Washington, you:Choose whether to make an individual or shared trust.Decide what property to include in the trust.Choose a successor trustee.Decide who will be the trust's beneficiariesthat is, who will get the trust property.Create the trust document.More items...

Trusts that hold property will, like other trusts, only need to be registered if the trustees incur a liability to tax. Thus, if the property is occupied by a beneficiary and is not income-producing - no requirement for registration will exist unless a taxable event occurs for IHT, CGT or SDLT purposes.