Washington Software as a Service Subscription Agreement

Description

How to fill out Software As A Service Subscription Agreement?

If you require to complete, retrieve, or create authorized document templates, utilize US Legal Forms, the leading collection of legal forms available online.

Employ the site’s straightforward and user-friendly search to find the documents you need.

Various templates for business and personal uses are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Choose the payment plan you prefer and enter your credentials to register for an account.

Step 5. Complete the transaction. You can utilize your Visa or Mastercard or PayPal account to finalize the payment. Step 6. Select the format of your legal document and download it to your device. Step 7. Complete, review, and print or sign the Washington Software as a Service Subscription Agreement.

- Utilize US Legal Forms to locate the Washington Software as a Service Subscription Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Washington Software as a Service Subscription Agreement.

- You can also find forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Make sure you have selected the form for the correct city/state.

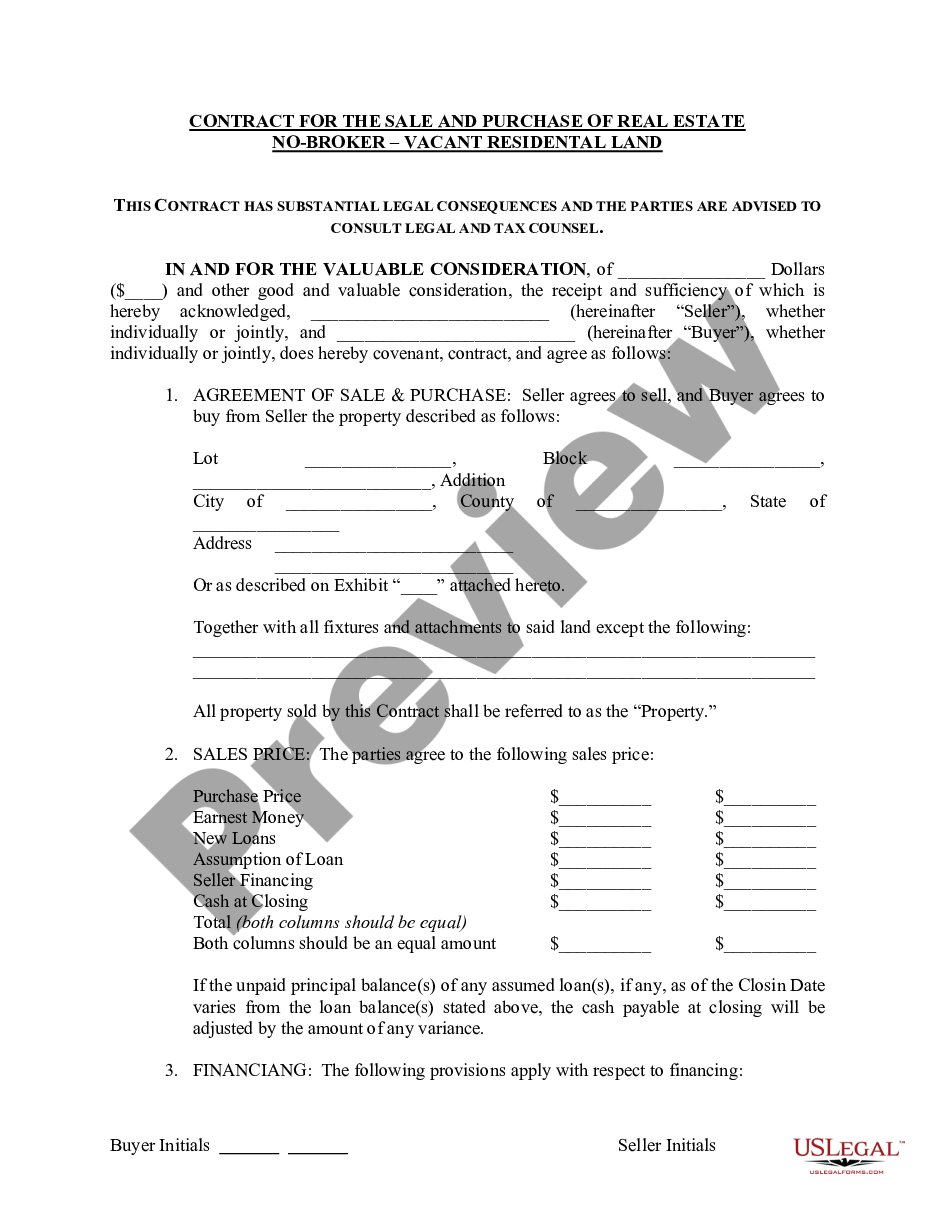

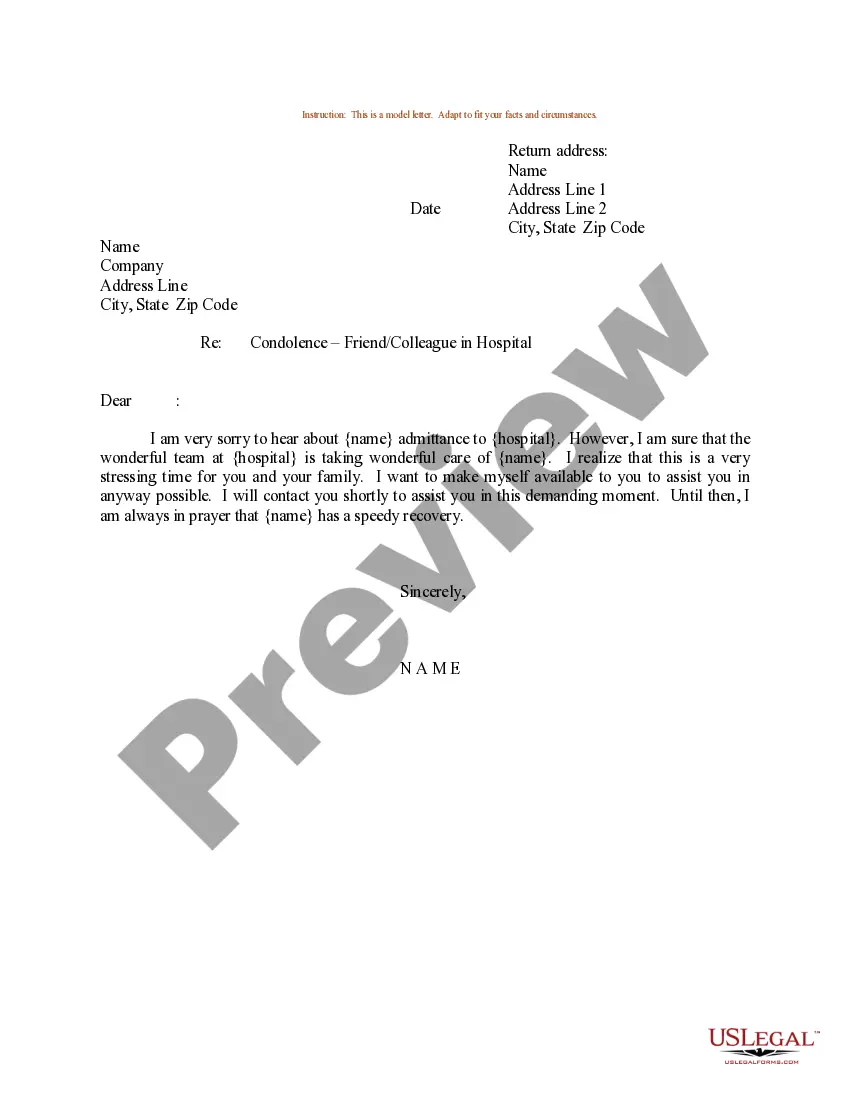

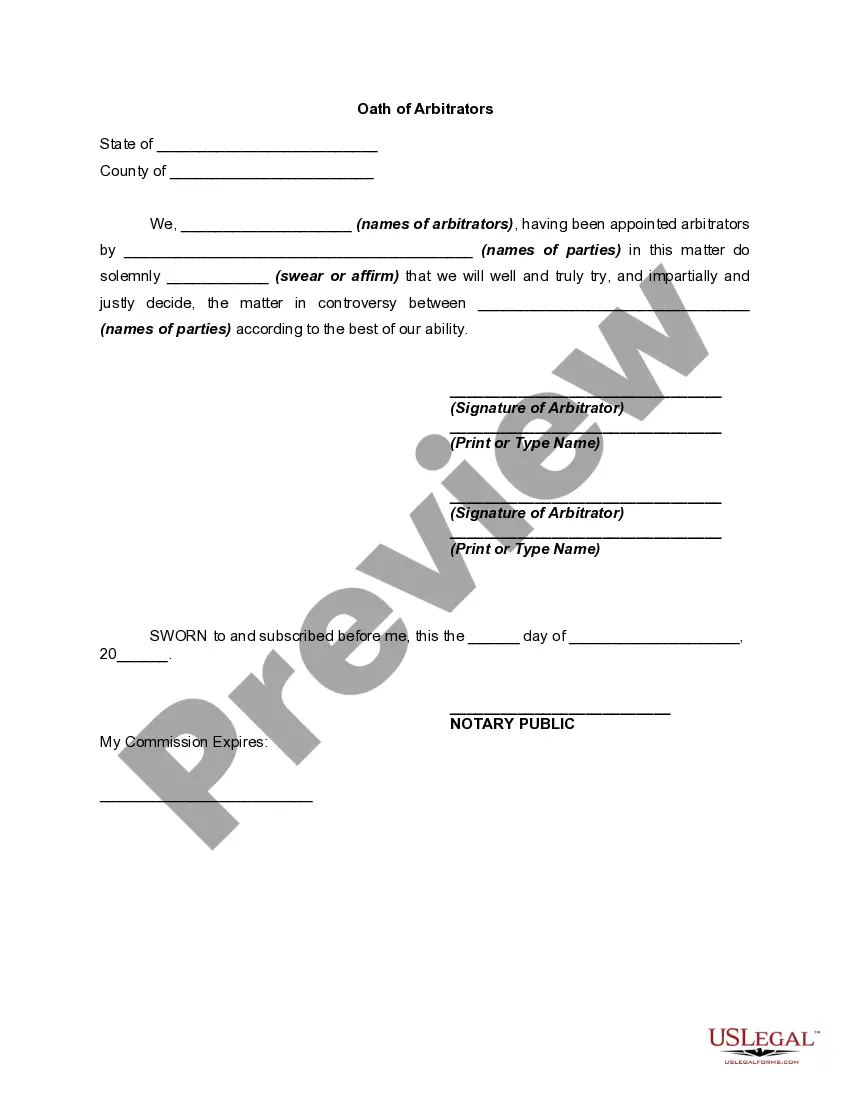

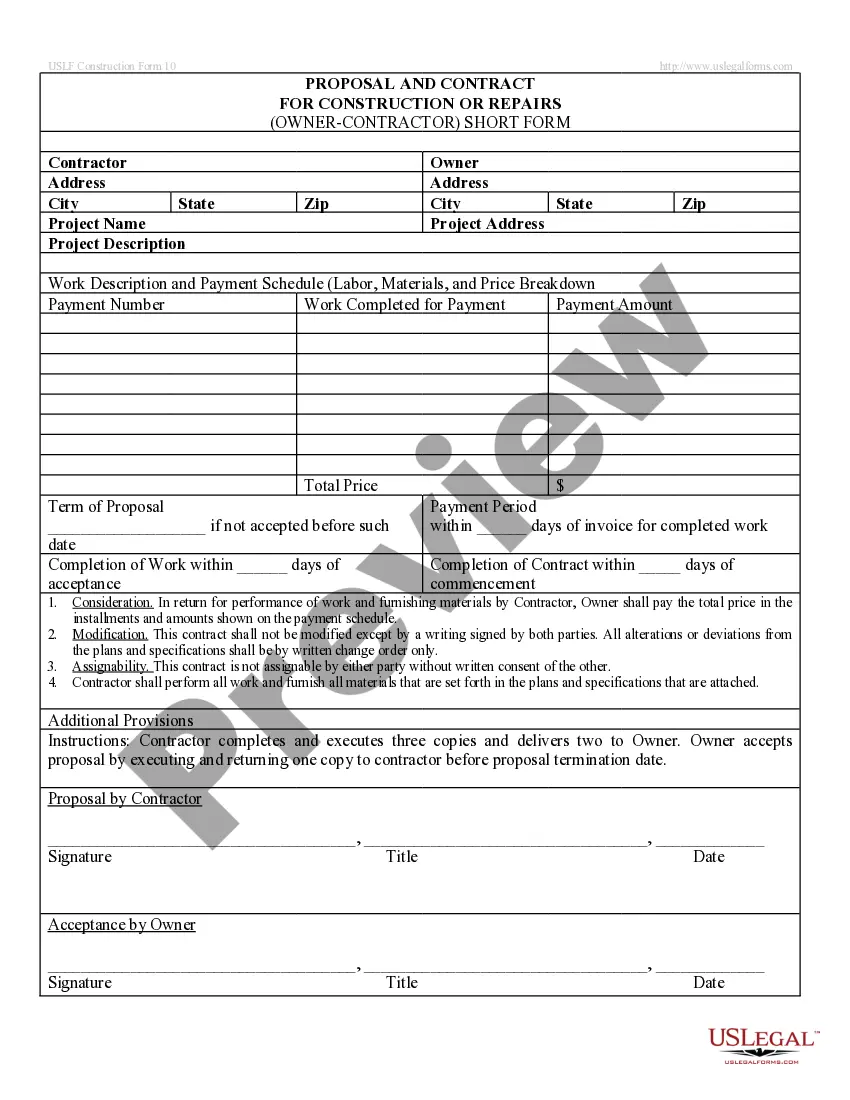

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the document, use the Search area at the top of the screen to find other versions of the legal document format.

Form popularity

FAQ

In most states, where services aren't taxable, SaaS also isn't taxable. Other states, like Washington, consider SaaS to be an example of tangible software and thus taxable. Just like with anything tax related, each state has made their own rules and laws.

Should your business charge sales tax on SaaS in Washington? SaaS is generally always taxable in Washington. Washington refers to SaaS as remotely accessed software (RAS) and says: RAS is prewritten software provided remotely.

Under these guidelines, even a small company can have nexus in multiple states. The untenable nature of SaaS taxability also poses a problem for software sellers. Only two states Tennessee and Vermont have specific statutes in place to address SaaS transactions and sales tax.

Should your business charge sales tax on SaaS in Washington? SaaS is generally always taxable in Washington.

The definition of SaaS sometimes falls in the gray area of digital service. Washington DC does tax SaaS products, but check the website to confirm that the definition firmly applies to your service.

Subscription products are an indirect transaction. The customer pays a subscription fee that covers the cost of goods. The thing to be mindful of is that the products are subject to sales tax. So you have to tax the goods through the monthly subscription fee.

Sales of custom software - downloaded are exempt from the sales tax in Washington. Sales of customization of canned software are exempt from the sales tax in Washington. In the state of Washington, any digital goods that are streamed or remotely accessed are considered to be taxable.

Sales of custom software - downloaded are exempt from the sales tax in Washington. Sales of customization of canned software are exempt from the sales tax in Washington. In the state of Washington, any digital goods that are streamed or remotely accessed are considered to be taxable.