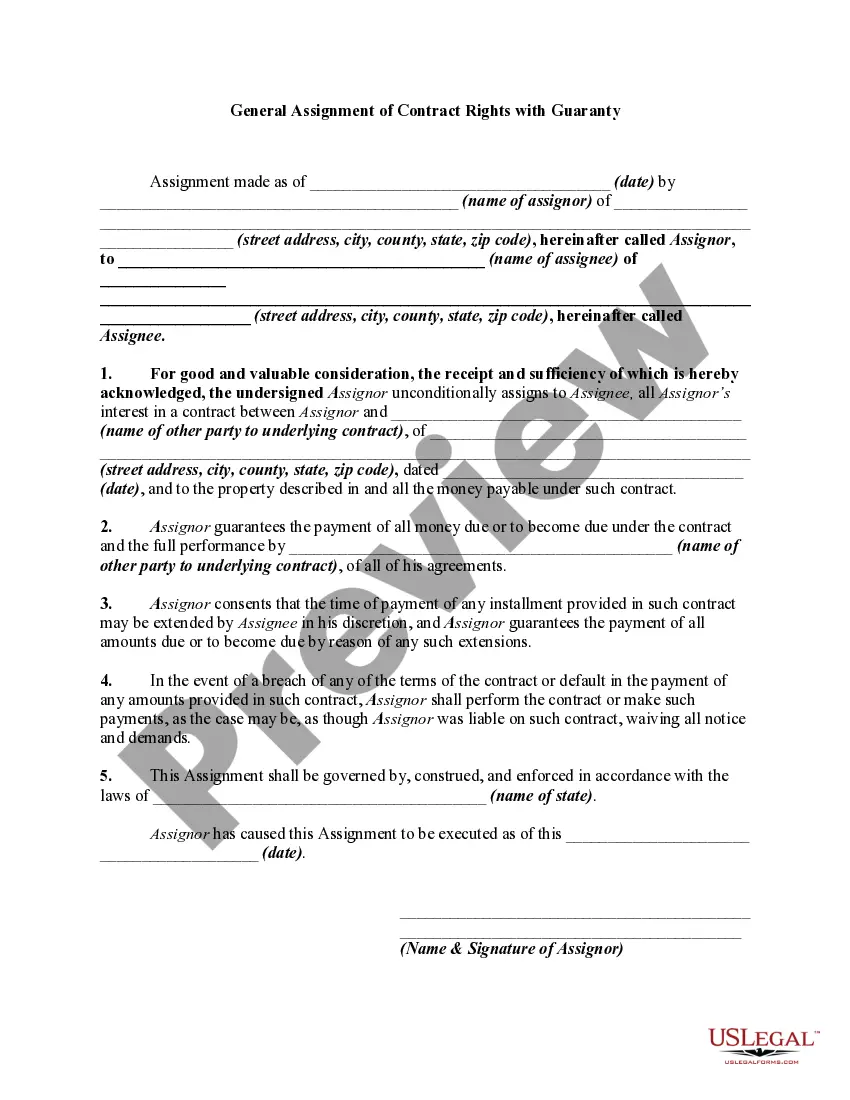

Washington Assignment of Principal Obligation and Guaranty

Description

How to fill out Assignment Of Principal Obligation And Guaranty?

Are you presently inside a place the place you will need files for either business or personal purposes nearly every day time? There are tons of authorized record web templates available on the net, but locating versions you can depend on is not simple. US Legal Forms offers a huge number of kind web templates, such as the Washington Assignment of Principal Obligation and Guaranty, which can be written to fulfill state and federal needs.

When you are currently familiar with US Legal Forms website and get a free account, just log in. Following that, you are able to down load the Washington Assignment of Principal Obligation and Guaranty format.

If you do not have an accounts and wish to begin to use US Legal Forms, abide by these steps:

- Get the kind you want and ensure it is for your correct town/county.

- Use the Review switch to check the form.

- Look at the outline to ensure that you have chosen the proper kind.

- When the kind is not what you are seeking, take advantage of the Research field to obtain the kind that meets your requirements and needs.

- Once you discover the correct kind, simply click Get now.

- Select the prices program you would like, complete the required details to generate your bank account, and purchase the transaction making use of your PayPal or credit card.

- Select a hassle-free paper file format and down load your backup.

Find each of the record web templates you might have bought in the My Forms menu. You may get a additional backup of Washington Assignment of Principal Obligation and Guaranty any time, if necessary. Just select the necessary kind to down load or produce the record format.

Use US Legal Forms, the most comprehensive assortment of authorized varieties, in order to save efforts and stay away from errors. The service offers skillfully produced authorized record web templates that you can use for a variety of purposes. Produce a free account on US Legal Forms and begin producing your lifestyle easier.

Form popularity

FAQ

Finding a Guarantor A guarantor on an agreement is usually a close family member. This person will need to have excellent credit and sufficient income. The guarantor will need to sign a guarantor agreement that states all the terms of the agreement.

An agreement by which a party (the guarantor) assumes the responsibility for the payment or performance of an obligation or action of another person (the primary obligor) if that other person defaults. A guarantee creates a secondary obligation to support the primary obligor's primary obligation to a third party.

A guarantor is a financial term describing an individual who promises to pay a borrower's debt if the borrower defaults on their loan obligation. Guarantors pledge their own assets as collateral against the loans.

A guarantor is a person who makes a promise to pay a debt if the original debtor on the loan cannot pay.

The person who gives the guarantee is called the "surety"; the person in respect of whose default the guarantee is given is called the "principal debtor", and the person to whom the guarantee is given is called the "creditor". A guarantee may be either oral or written.

Every contract can be different, and all should be read carefully, but a responsible party shouldn't be financially liable unless that term is referred to alongside ?guarantor.? A guarantor is a person who agrees to pay from their own assets if another party can't.

At law, the giver of a guarantee is called the surety or the "guarantor". The person to whom the guarantee is given is the creditor or the "obligee"; while the person whose payment or performance is secured thereby is termed "the obligor", "the principal debtor", or simply "the principal".

In order for a guaranty agreement to be enforceable, it has to be in writing, the writing has to be signed by the guarantor, and the writing has to contain each of the following essential elements: 1. the identity of the lender; 2. the identity of the primary obligor; 3.