Washington Amended Uniform commercial code security agreement

Description

How to fill out Amended Uniform Commercial Code Security Agreement?

If you need to full, obtain, or printing legitimate document themes, use US Legal Forms, the most important collection of legitimate kinds, which can be found online. Make use of the site`s basic and handy look for to find the documents you want. A variety of themes for organization and personal reasons are sorted by classes and states, or keywords. Use US Legal Forms to find the Washington Amended Uniform commercial code security agreement with a few click throughs.

In case you are already a US Legal Forms consumer, log in to the bank account and click on the Download option to find the Washington Amended Uniform commercial code security agreement. Also you can accessibility kinds you formerly acquired inside the My Forms tab of your own bank account.

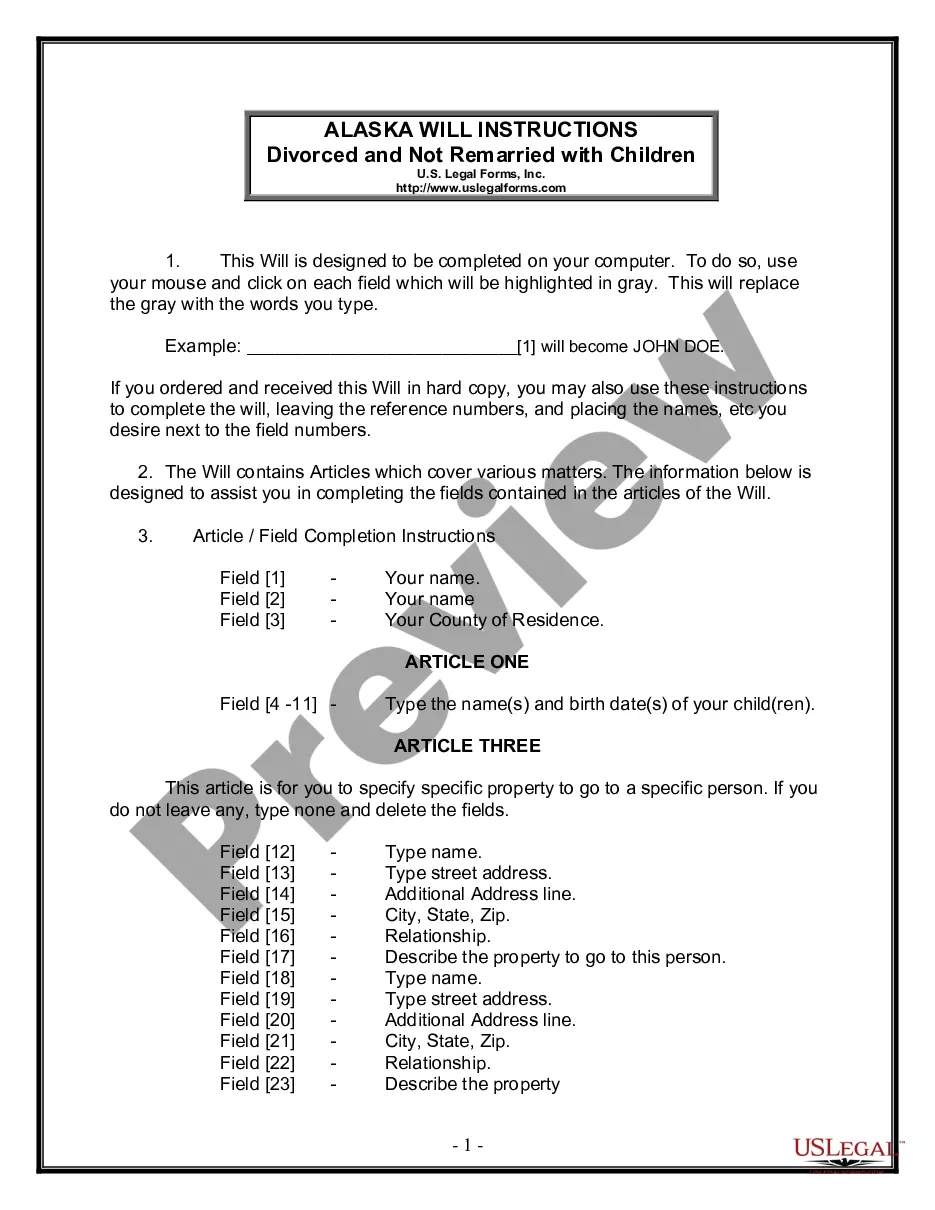

If you work with US Legal Forms the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the form for your correct area/land.

- Step 2. Make use of the Review choice to examine the form`s content material. Do not overlook to see the outline.

- Step 3. In case you are not happy with all the form, take advantage of the Search industry at the top of the screen to find other types of your legitimate form design.

- Step 4. After you have identified the form you want, click the Get now option. Opt for the prices program you prefer and put your credentials to register on an bank account.

- Step 5. Approach the transaction. You may use your bank card or PayPal bank account to accomplish the transaction.

- Step 6. Select the file format of your legitimate form and obtain it on your system.

- Step 7. Total, edit and printing or indication the Washington Amended Uniform commercial code security agreement.

Every legitimate document design you get is your own property eternally. You have acces to every form you acquired within your acccount. Select the My Forms section and pick a form to printing or obtain yet again.

Contend and obtain, and printing the Washington Amended Uniform commercial code security agreement with US Legal Forms. There are millions of specialist and condition-particular kinds you can use for your organization or personal needs.

Form popularity

FAQ

Article 9 details exactly how to create a secured transaction between a creditor and debtor and requires three (3) essential components: (A) Value must be given, this is typically a line of credit; (B) the Debtor must have rights in the collateral, the individual using their property as collateral (car, house, a ...

Article 9 governs security interests in personal property, though other parts of the Uniform Commercial Code sometimes play a role in the creation, enforcement, perfection, and priority of security interests. In Washington, Article 9 is at Chapter 62A. 9A RCW.

As of July 24, 2023, 8 states have adopted the 2022 Amendments to the Uniform Commercial Code, including Article 12 regarding "Controllable Electronic Records" ? Alabama, Colorado, Hawaii, Indiana, Nevada, New Mexico, North Dakota, and Washington.

UCC § 9-203 sets forth the requirements for attachment and enforceability of security interests. In general: (1) the creditor must give value, (2) the debtor must have rights in the collateral, and (3) there must be a security agreement or other action indicating an intent to convey a security interest.

Article 9 of the Uniform Commercial Code requires a financing statement to include the name of the debtor. It is important to set forth the exact legal name of the debtor in any filings that are made.

Uniform Commercial Code (UCC) filings allow creditors to notify other creditors about a debtor's assets used as collateral for a secured transaction. UCC liens filed with Secretary of State offices act as a public notice by the "creditor" of the creditor's interest in the property.

§§ 9-306B, 12-107. The 2022 Amendments amend the Article 9 definition of chattel paper to make it clear that it is the underlying right of payment of a monetary obligation that is chattel paper and not record or records that evidence that right.

Section 9-102(a)(64) of the UCC provides that proceeds are whatever is received upon the sale, lease, license, exchange, or other disposition or collection of, or distribution on account of, collateral.