Washington Miller Trust Forms for Medicaid

Description

How to fill out Miller Trust Forms For Medicaid?

If you wish to finalize, acquire, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms accessible online. Take advantage of the site's simple and efficient search to find the documents you need.

A variety of templates for business and personal purposes are organized by categories and keywords, or phrases. Use US Legal Forms to access the Washington Miller Trust Forms for Medicaid in just a few clicks.

If you are already a US Legal Forms user, sign in to your account and click the Download button to retrieve the Washington Miller Trust Forms for Medicaid. You can also access forms you have previously obtained within the My documents section of your account.

Each legal document template you purchase is yours indefinitely. You will have access to every form you acquired with your account. Click on the My documents section and select a form to print or download again.

Compete and download, and print the Washington Miller Trust Forms for Medicaid with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Step 1. Ensure you have selected the form relevant to your specific city/state.

- Step 2. Use the Preview option to review the content of the form. Remember to check the outline.

- Step 3. If you are not satisfied with the form, utilize the Search feature at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have located the form you need, click the Get now button. Select the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill out, revise, and print or sign the Washington Miller Trust Forms for Medicaid.

Form popularity

FAQ

To avoid the Medicaid lookback period, it's vital to plan financial transactions well ahead of your Medicaid application. Transferring assets or creating trusts too close to your application can lead to penalties. Using Washington Miller Trust Forms for Medicaid could provide you with the necessary tools to manage your assets effectively, thereby minimizing potential issues. Proactive planning is key to a smoother application process.

Certain assets do not count when determining Medicaid eligibility. These typically include your primary residence, personal belongings, and specific retirement accounts. Utilizing Washington Miller Trust Forms for Medicaid can help you strategically manage your assets to qualify for Medicaid benefits. It's essential to consult professionals to ensure you're navigating this process correctly.

A trust does not count as income for Medicaid in most cases. Instead, it may be considered an asset, depending on its structure. Washington Miller Trust Forms for Medicaid can help you manage your income effectively while applying for Medicaid. Understanding how your trust functions will ensure that you meet Medicaid's requirements without unnecessary complications.

The 5-year lookback rule for Medicaid in Washington state examines any assets or income transfers made within five years of applying for benefits. Any gifts or asset transfers could affect eligibility due to this rule. To navigate this complex regulation, employing tools like Washington Miller Trust Forms for Medicaid can be invaluable in ensuring that you maintain your eligibility while protecting your assets.

Avoiding the Medicaid 5-year lookback requires careful gifting and transferring strategies to preserve your assets. You might consider putting structures in place well ahead of applying for Medicaid, utilizing tools like Washington Miller Trust Forms for Medicaid to set aside income. Planning ahead with professional guidance ensures compliance and helps safeguard your wealth.

Protecting your assets from Medicaid in Washington state can be achieved through strategic planning. Utilizing Washington Miller Trust Forms for Medicaid is a viable option, as it helps to manage your income effectively and allows for certain assets to remain protected. Consulting with estate planning professionals can further enhance your asset protection strategy.

In Washington state, certain assets are exempt from Medicaid calculations, including your primary residence, personal belongings, and some retirement accounts. However, there are specific limits to be aware of. Understanding the exemptions is crucial, and resources like Washington Miller Trust Forms for Medicaid can help clarify these details and guide you through the process.

Putting your home in a trust may offer some protection against Medicaid claims, but it largely depends on the type of trust you use. A Miller trust specifically addresses income rather than the principal residence. It is wise to consult with an expert to understand how the home trust interacts with Medicaid eligibility and how Washington Miller Trust Forms for Medicaid can play a role.

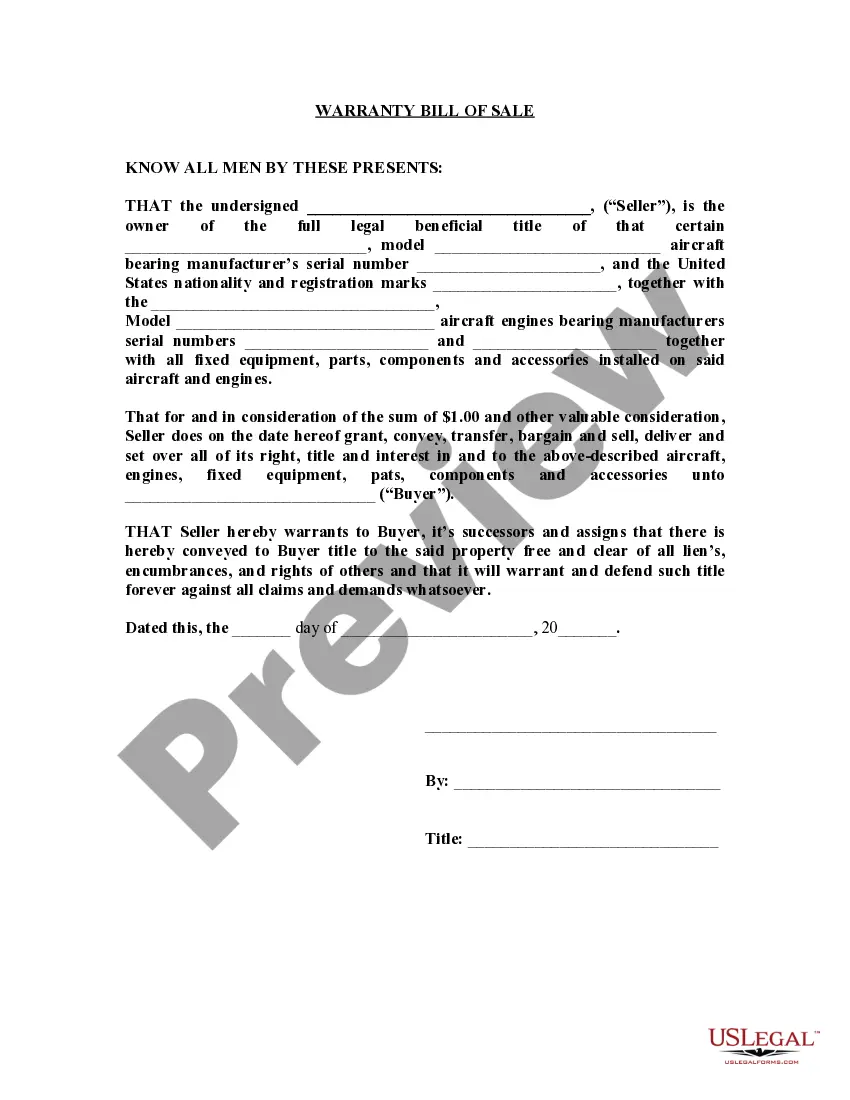

Filling out a Miller trust requires careful attention to detail to ensure compliance with Medicaid regulations. Start by gathering all necessary personal and financial information. Then, use Washington Miller Trust Forms for Medicaid to properly outline your income and assets required for the trust. If you need assistance, resources like uslegalforms offer templates and guidance to streamline the process.

To effectively protect your assets from Medicaid, consider utilizing Washington Miller Trust Forms for Medicaid. These forms help you create a legal structure that can allow you to set aside certain income and resources, making you eligible for Medicaid without losing everything. Additionally, consulting with a legal professional can provide personalized strategies to safeguard your wealth.