This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Washington Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness

Description

How to fill out Assignment Of Portion For Specific Amount Of Money Of Interest In Estate In Order To Pay Indebtedness?

You can devote hours on-line looking for the legal document design which fits the state and federal needs you will need. US Legal Forms supplies 1000s of legal varieties that are reviewed by experts. You can actually obtain or printing the Washington Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness from your service.

If you currently have a US Legal Forms bank account, you are able to log in and then click the Down load button. Afterward, you are able to complete, revise, printing, or sign the Washington Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness. Each legal document design you buy is your own property permanently. To obtain one more backup for any bought type, go to the My Forms tab and then click the corresponding button.

If you work with the US Legal Forms site initially, follow the basic directions below:

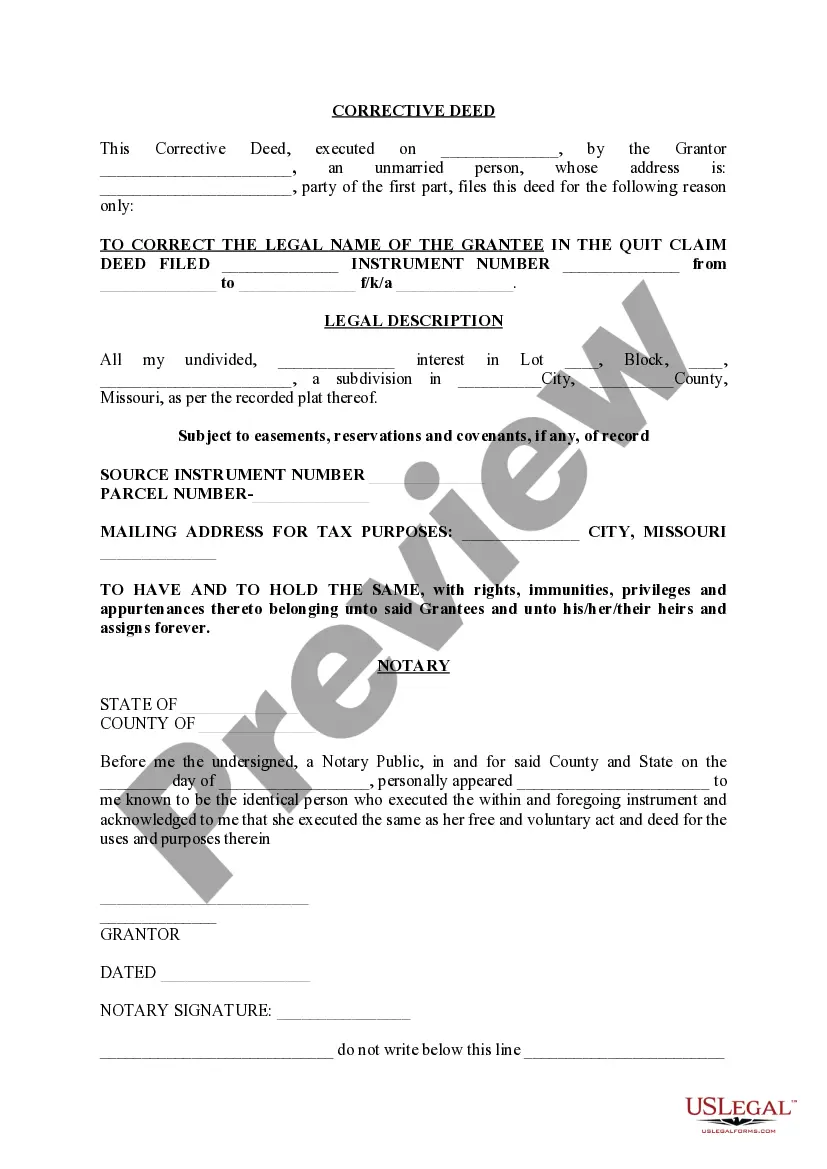

- First, make certain you have chosen the best document design for your region/town of your choice. Browse the type information to ensure you have selected the right type. If readily available, make use of the Preview button to appear through the document design as well.

- If you wish to get one more variation of the type, make use of the Lookup discipline to find the design that suits you and needs.

- After you have located the design you want, click Acquire now to carry on.

- Find the prices strategy you want, enter your credentials, and register for an account on US Legal Forms.

- Full the purchase. You may use your Visa or Mastercard or PayPal bank account to purchase the legal type.

- Find the file format of the document and obtain it to your device.

- Make adjustments to your document if required. You can complete, revise and sign and printing Washington Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness.

Down load and printing 1000s of document themes utilizing the US Legal Forms Internet site, which provides the most important selection of legal varieties. Use skilled and status-specific themes to handle your small business or specific needs.

Form popularity

FAQ

No. Generally, the deceased person's estate is responsible for paying any unpaid debts. The estate's finances are handled by the personal representative, executor, or administrator.

What is a controlling interest transfer? A controlling interest transfer occurs when there is a 50% or more change of ownership in an entity. If that entity owns real property in Washington, a controlling interest transfer return is required to be completed within 5 days of the completed transfer.

Affidavit or Declaration Find a Notary Public, Take your document to the Notary, Recite the oath, Swear that the statements are true, Have the Notary sign the document, and will likely. Pay the Notary a fee for the service ?

A Washington small estate affidavit, known as the State of Washington Affidavit of Successor, is used to expedite the probate process for an estate worth less than $100,000.

The Court Clerk's office will accept a Small Estate Affidavit for filing with the Court for a filing fee of $20.

The ?Affidavit of Successor? may be used to claim a debt or personal property from any person or organization indebted to or having possession of any personal property belonging to a decedent. Please note this affidavit is only to be used to claim a debt or personal property.

The ?Affidavit of Successor? may be used if the decedent left no will and the estate was not probated. Living heirs have certain rights ing to Washington State laws of Descent and Distribution. One heir may claim and distribute to other heirs with their written approval.

Otherwise, the estate remains liable (in most cases) until 24 months after date of death. This means that any heir or beneficiary who receives an estate asset remains liable for dilatory Creditor's Claims until the second anniversary of Decedent's death.