If the method of changing beneficiaries in insurance policies is prescribed by statute or by the policy itself, the required formalities must be observed. If the beneficiary has a vested right in the policy or if the policy does not reserve the right of the insured to change the beneficiary, the consent of the beneficiary must be obtained to change the beneficiary. Relevant state statutes must be consulted to determine if they require the consent of the beneficiary to effectuate a change of the beneficiary.

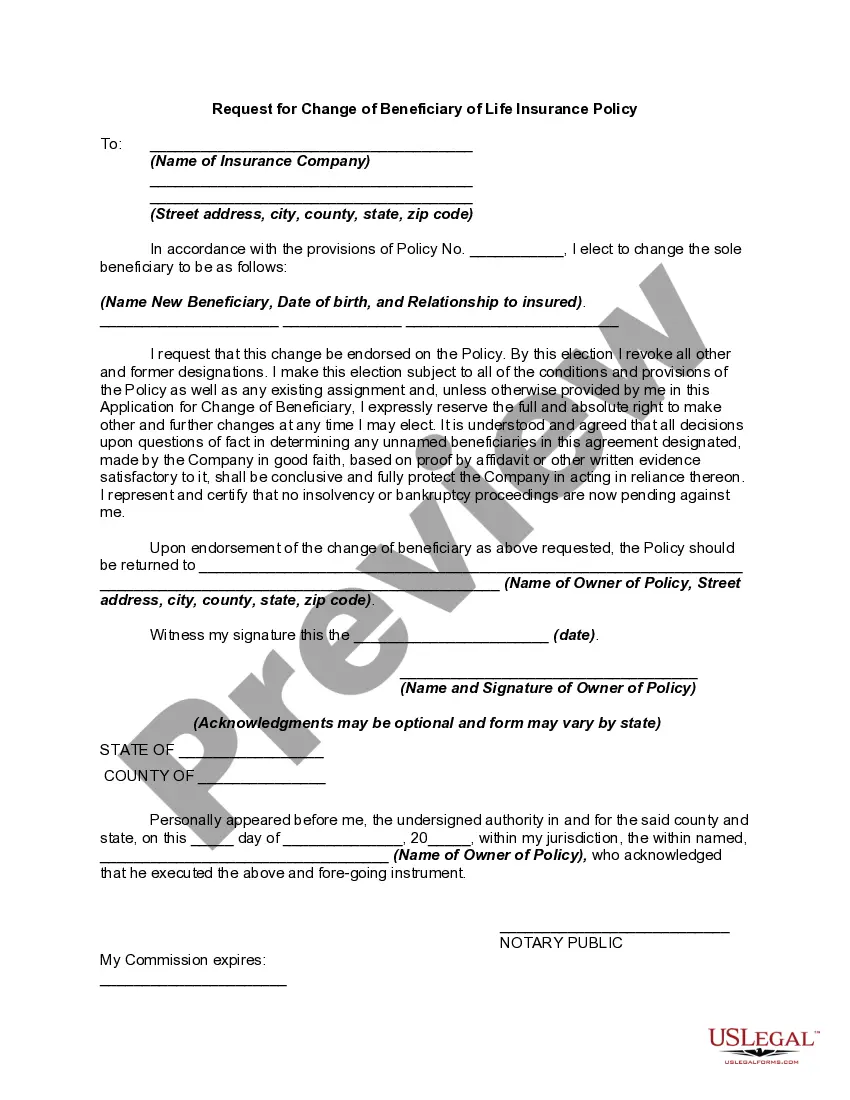

Washington Request for Change of Beneficiary of Life Insurance Policy

Description

How to fill out Request For Change Of Beneficiary Of Life Insurance Policy?

US Legal Forms - one of several largest libraries of legitimate forms in America - gives a wide array of legitimate file themes it is possible to obtain or print out. Making use of the site, you can get a huge number of forms for business and individual purposes, categorized by groups, claims, or key phrases.You can find the most recent models of forms like the Washington Request for Change of Beneficiary of Life Insurance Policy within minutes.

If you have a membership, log in and obtain Washington Request for Change of Beneficiary of Life Insurance Policy from the US Legal Forms local library. The Down load button will appear on each type you view. You gain access to all formerly saved forms within the My Forms tab of the accounts.

In order to use US Legal Forms the first time, allow me to share simple guidelines to obtain started out:

- Ensure you have chosen the right type to your town/region. Go through the Preview button to check the form`s content material. Browse the type outline to actually have selected the correct type.

- In case the type doesn`t satisfy your needs, use the Research discipline near the top of the display to find the the one that does.

- Should you be pleased with the form, validate your selection by clicking the Acquire now button. Then, pick the pricing prepare you like and offer your credentials to sign up on an accounts.

- Procedure the purchase. Utilize your bank card or PayPal accounts to finish the purchase.

- Pick the formatting and obtain the form on your gadget.

- Make modifications. Fill out, edit and print out and indication the saved Washington Request for Change of Beneficiary of Life Insurance Policy.

Each and every design you included in your bank account does not have an expiry date and is also the one you have eternally. So, if you would like obtain or print out yet another duplicate, just check out the My Forms section and then click about the type you require.

Gain access to the Washington Request for Change of Beneficiary of Life Insurance Policy with US Legal Forms, by far the most extensive local library of legitimate file themes. Use a huge number of professional and express-specific themes that meet up with your small business or individual demands and needs.

Form popularity

FAQ

There are two options when it comes to transferring a life insurance policy: Transfer ownership of your policy to any other adult, including the policy beneficiary (in this case, your child or children). Create an irrevocable life insurance trust and transfer the ownership of the policy to the trust.

Your ability to change your beneficiary or have multiple beneficiaries depends on the pension option you chose when you retired. You may only change your beneficiary if: You chose a single life pension option with a guarantee period. Your spouse gave up their beneficiary rights to your pension by signing a waiver.

Generally, you can review and update your beneficiary designations by contacting the company or organization that provides your insurance or retirement plan. You can sometimes do this online. Otherwise, you'll have to complete, sign, and mail a paper form.

Disputing who was named as the beneficiary can be a complicated, expensive ordeal. Only the court may overturn the person named as beneficiary. Insurance companies cannot change or alter the beneficiary without a court order to do so.

Most life insurance policies list one beneficiary, but some allow for more than one beneficiary. You can change the beneficiary at any time, depending on the terms of the policy, without any penalty or fee.

What action will the insurance company take if T requests a change of beneficiary. Answer: Request of the change will be refused. An irrevocable designation may not be changed without the written consent of the beneficiary.

In most cases, life insurance policies contain a clause that allows you to contest the designated beneficiary. If you can prove that a mistake has been made or a fraud was committed for example, your policy may be able to pay out its death benefit to someone else.

An irrevocable beneficiary is a person or entity who is designated to receive the assets in your life insurance policy and cannot easily be changed or removed unless they consent.