Washington Retirement Cash Flow

Description

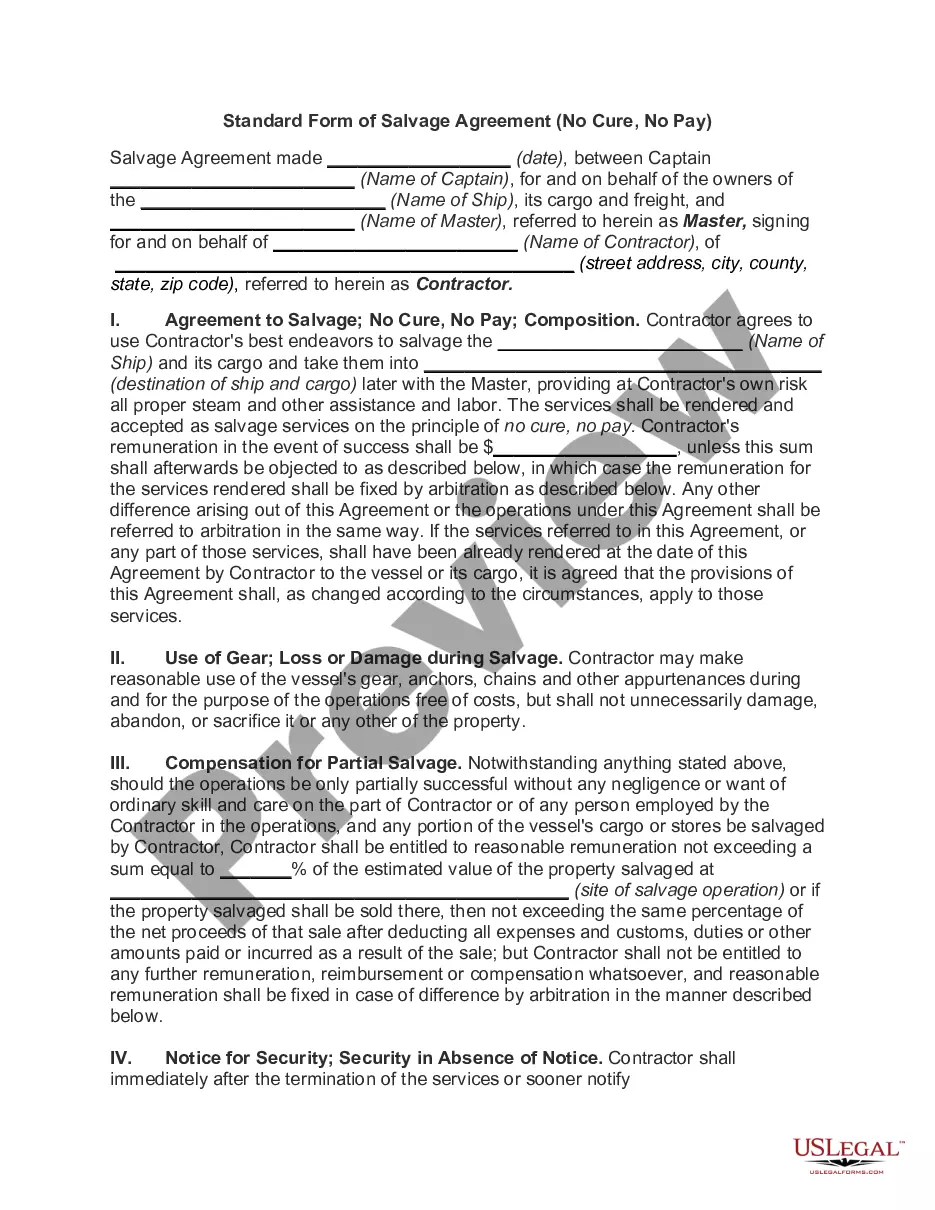

How to fill out Retirement Cash Flow?

If you are required to finalize, acquire, or generate legal document templates, utilize US Legal Forms, the top assortment of legal documents, accessible online.

Take advantage of the site’s straightforward and convenient search to find the documents you require. A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Employ US Legal Forms to get the Washington Retirement Cash Flow with just a few clicks.

Every legal document template you purchase is yours indefinitely. You will have access to every document you downloaded in your account.

Click on the My documents section and choose a document to print or download again. Stay competitive and acquire, and print the Washington Retirement Cash Flow with US Legal Forms. There are numerous professional and state-specific documents available for your business or personal requirements.

- If you are already a US Legal Forms customer, Log In to your account and click on the Get button to receive the Washington Retirement Cash Flow.

- You may also access documents you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Do not forget to read the details.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Washington Retirement Cash Flow.

Form popularity

FAQ

Service retirement is a lifetime benefit. You can retire as early as age 50 with five years of service credit unless all service was earned on or after January 1, 2013. Then you must be at least age 52 to retire. There are some exceptions to the 5-year requirement.

Washington has become a favorite state to retire because of the absence of a state income tax, low property tax rates, nice climate, outdoor activities, and great coffee. In fact, MarketWatch recently listed Spokane, WA as a great place to retire because of those reasons and more!

Washington is tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are not taxed. Wages are taxed at normal rates, and your marginal state tax rate is 5.90%.

PERS 2 is a defined-benefit plan employees who retire get a guaranteed percentage of their salary (2 percent times the years of service, times the average final compensation) annually. PERS 3 has features of both a defined- benefit and defined-contribution plan.

LEOFF Plan 2 is a defined benefit plan.When you meet plan requirements and retire, you are guaranteed a monthly benefit for the rest of your life. Your monthly benefit will be based on your earned service credit and compensation while a member of LEOFF Plan 2.

Social Security retirement benefits start as early as age 62, but the benefits are permanently reduced unless you wait until your full retirement age. Payments are for life.

Service retirement is a lifetime benefit. In most cases, the employee can retire as early as age 50 with five years of service credit. If the employee became a member on or after January 1, 2013, they must be at least 52 years old to retire.

Once CalPERS membership is terminated, you no longer are entitled to any CalPERS benefits, including retirement. You are eligible for a refund only if you are not entering employment with another CalPERS-covered employer. Applicable state and federal taxes will be withheld from your refund.

Service retirement is a lifetime benefit. In most cases, the employee can retire as early as age 50 with five years of service credit. If the employee became a member on or after January 1, 2013, they must be at least 52 years old to retire.

Contribution and Funding Rates The methods adopted by the Board are intentionally set to provide stability to rates and assure the plan is fully funded. LEOFF Plan 2 contributions are divided 50/30/20 percent between members, employers and the state.