Washington Space, Net, Net, Net - Triple Net Lease

Description

How to fill out Space, Net, Net, Net - Triple Net Lease?

US Legal Forms - one of the most prominent repositories of legal documents in the United States - offers a vast selection of legal document templates that you can purchase or print.

By utilizing the website, you can find thousands of documents for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest editions of documents like the Washington Space, Net, Net, Net - Triple Net Lease within moments.

If the document does not meet your needs, utilize the Search field at the top of the page to find one that does.

If you are satisfied with the document, confirm your choice by clicking the Purchase now button. Then, select the payment plan you prefer and provide your credentials to create an account.

- If you already hold a subscription, Log In and retrieve Washington Space, Net, Net, Net - Triple Net Lease from the US Legal Forms collection.

- The Download option will appear on each document you view.

- You have access to all previously downloaded documents in the My documents section of your account.

- If you want to use US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you have selected the correct document for your city/county.

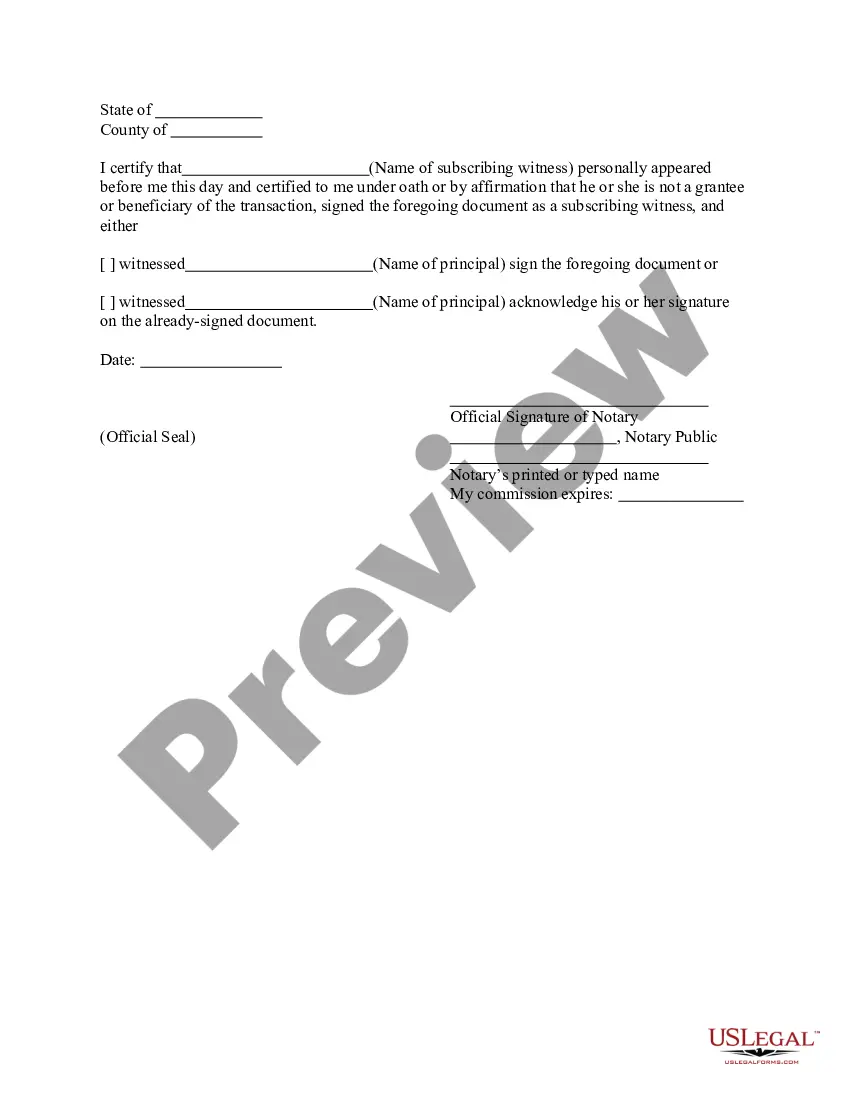

- Click the Review option to evaluate the document's content.

Form popularity

FAQ

In a Washington Space, Net, Net, Net - Triple Net Lease, operating expenses typically include property taxes, insurance, and maintenance costs. These expenses can fluctuate depending on various factors, such as market conditions and property requirements. By being aware of these costs, you can better prepare for your financial responsibilities. It's wise to review these terms carefully with your landlord before signing the lease.

When it comes to a Washington Space, Net, Net, Net - Triple Net Lease, one key disadvantage is that tenants bear most, if not all, operating costs. This means that unexpected expenses can significantly impact your budget. Additionally, if the property value decreases, tenants may find themselves paying high lease costs for a space worth much less. It's important to evaluate your financial situation and understand the risks involved before committing.

Accounting for a triple net lease involves recording both rent revenue and the associated expenses that the tenant takes on. Landlords note the rent as income and track any costs, while tenants account for lease payments, taxes, insurance, and maintenance as expenses. If you're interested in effectively managing property in line with Washington Space, Net, Net, Net - Triple Net Lease, ulegalforms offers valuable resources to simplify the accounting process.

In a triple net lease, the tenant is responsible for carrying insurance on the property. This requirement typically includes liability coverage, property damage, and sometimes additional coverage based on the lease agreement. For those navigating Washington Space, Net, Net, Net - Triple Net Lease, ensuring adequate insurance can protect both tenants and landlords from unexpected financial burdens.

Net net refers to a type of lease in which the tenant is responsible for two major expenses—property taxes and insurance—on top of the base rent. This arrangement decreases the landlord's financial responsibilities while providing the tenant with more control over the property. Understanding this in the realm of Washington Space, Net, Net, Net - Triple Net Lease can help you make informed decisions regarding property management.

The terms NN and NNN refer to different types of lease agreements. In a Net Lease (NN), the tenant pays property taxes and insurance, while the landlord covers maintenance costs. In a Triple Net Lease (NNN), the tenant assumes all responsibility, including taxes, insurance, and maintenance. Knowing this distinction is essential when evaluating commercial real estate in the context of Washington Space, Net, Net, Net - Triple Net Lease.

To gain approval for a triple net lease in the Washington Space, Net, Net, Net - Triple Net Lease market, demonstrate your financial stability and ability to handle the lease obligations. Prepare financial documents, including credit reports and business plans, to present to landlords. A strong application can significantly enhance your chances of approval.

Calculating triple nets involves summing the costs of property taxes, insurance, and maintenance fees. In the Washington Space, Net, Net, Net - Triple Net Lease scenario, these expenses are typically divided by the lease space you’re renting. Keep track of these costs throughout the year to ensure a clear understanding of your financial responsibilities.

You can identify if you have a triple net lease by reviewing your lease agreement carefully. Look for clauses that indicate you are responsible for property taxes, insurance, and maintenance within the Washington Space, Net, Net, Net - Triple Net Lease framework. If you are unsure, consider consulting a legal expert to clarify your obligations.

Tenants often choose a triple net lease for its predictable rental costs and the potential for lower base rent. In the Washington Space, Net, Net, Net - Triple Net Lease environment, this lease type offers tenants control over property expenses. Moreover, it can lead to longer lease terms, as landlords appreciate the security related to tenant responsibilities.