Washington Triple Net Lease for Industrial Property

Description

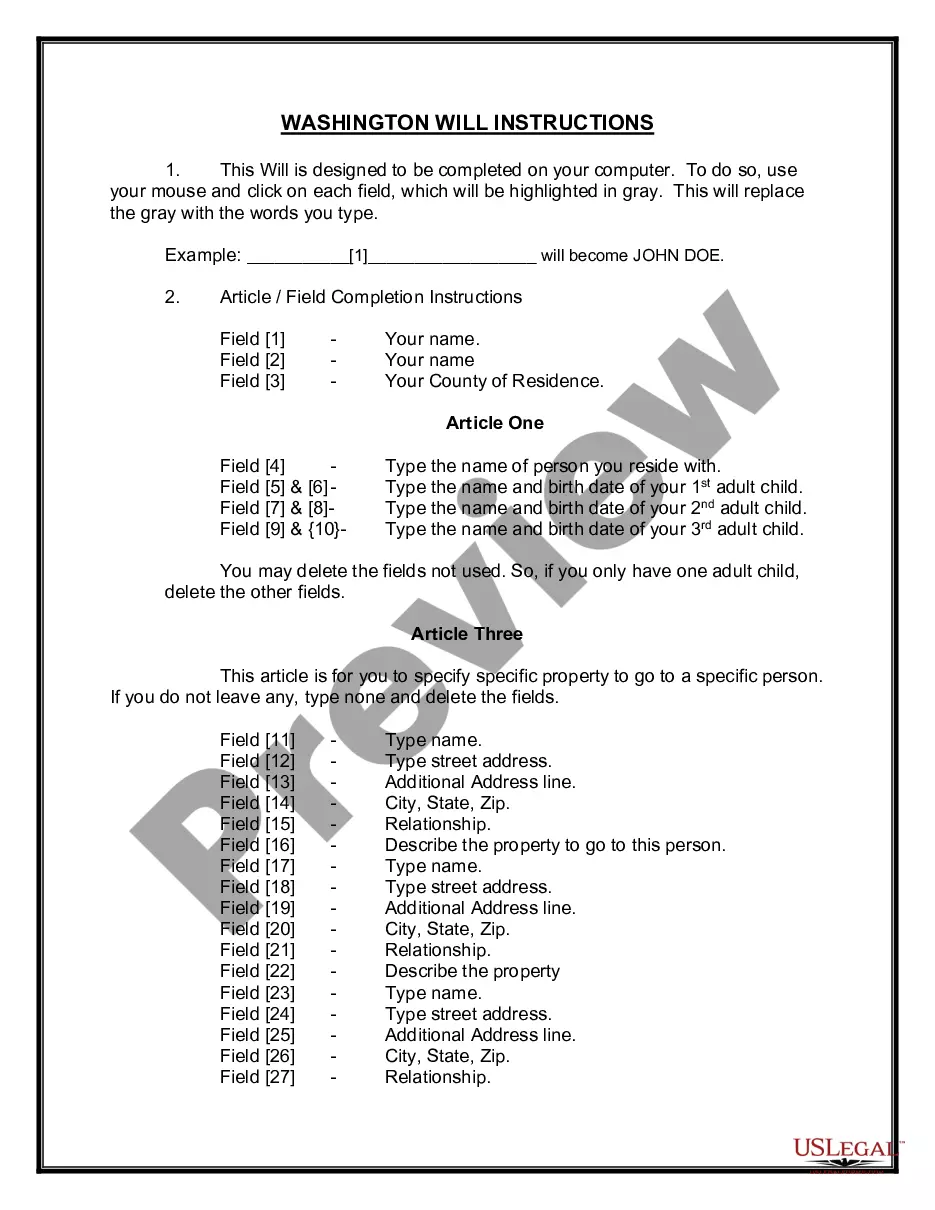

How to fill out Triple Net Lease For Industrial Property?

Selecting the appropriate legal document template can be a challenge. Of course, there are numerous templates available online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. This service provides thousands of templates, including the Washington Triple Net Lease for Industrial Property, which can be used for both business and personal purposes. All documents are reviewed by experts and meet state and federal requirements.

If you are already a registered user, Log In to your account and click the Download button to obtain the Washington Triple Net Lease for Industrial Property. Use your account to search for the legal documents you have purchased previously. Go to the My documents tab in your account to download another copy of the document you need.

Complete, modify, print, and sign the acquired Washington Triple Net Lease for Industrial Property. US Legal Forms is the largest repository of legal forms where you can find numerous document templates. Use the service to obtain professionally crafted documents that comply with state regulations.

- If you are a new user of US Legal Forms, here are basic instructions you should follow.

- Firstly, ensure you have selected the correct form for your city/region. You can browse the form using the Preview button and read the form description to confirm it is the right one for you.

- If the form does not meet your needs, use the Search section to find the appropriate form.

- Once you are certain the form is suitable, click the Acquire now button to obtain the form.

- Select the pricing plan you wish and enter the required information. Create your account and pay for the order using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

Typically, the most commonly used leases for industrial property include the Washington Triple Net Lease for Industrial Property and the gross lease. The triple net lease offers a clear financial framework that many industrial tenants find appealing. This structure allows for sustainability in property management by transferring responsibilities to tenants. In contrast, a gross lease simplifies billing but may not provide the same control over expenses as a triple net option.

The most common lease used by industrial tenants is the Washington Triple Net Lease for Industrial Property. This lease option provides a comprehensive solution for managing operational costs effectively. By having tenants cover expenses like property taxes, maintenance, and insurance, landlords benefit from reduced financial uncertainty. This dynamic often results in a win-win situation, where tenants feel empowered and landlords enjoy consistent revenue.

Industrial properties generally utilize the Washington Triple Net Lease for Industrial Property due to its effective structure. This lease form allows for the landlord to transfer operational costs to tenants, thereby creating an efficient business environment. With this arrangement, tenants take on responsibilities including maintenance, insurance, and property taxes. Consequently, landlords can focus on their core investments while ensuring tenants have a vested interest in maintaining the property.

Properties that typically feature a triple net lease include industrial spaces, retail stores, and some office buildings. In the context of the Washington Triple Net Lease for Industrial Property, industrial facilities often benefit from this arrangement, as it allows landlords to minimize their risk while providing tenants with autonomy. These properties frequently involve substantial investments, making the triple net lease an appealing option for both parties. Overall, this lease type facilitates a clear financial structure that can promote successful long-term arrangements.

In industrial settings, the most common lease is the Washington Triple Net Lease for Industrial Property. This type of lease allows landlords to pass on expenses related to the property so they can focus on their investment. Tenants, in turn, appreciate the responsibilities that come with this lease type, such as managing maintenance and utilities. This symbiotic relationship often leads to longer lease terms and stable occupancy rates.

The best lease type for commercial property often depends on the needs of both the landlord and the tenant. For many situations, a Washington Triple Net Lease for Industrial Property emerges as a strong option. This lease structure transfers most property expenses, such as taxes, insurance, and maintenance, directly to the tenant. This arrangement provides clarity and predictability for landlords while offering tenants control over property care.

Structuring a triple net lease involves specifying the terms related to rental payments, lease duration, and the tenant's responsibilities for taxes, insurance, and maintenance. Clear and detailed clauses ensure all parties understand their obligations. For those looking to create a Washington Triple Net Lease for Industrial Property, utilizing templates and legal resources from platforms like uslegalforms can streamline the process.

To calculate commercial rent with a NNN lease, first, determine the base rent as specified in the lease agreement. Then, add the proportionate share of property taxes, insurance costs, and maintenance fees. When working with a Washington Triple Net Lease for Industrial Property, it's wise to ensure you fully understand these calculations to avoid unexpected expenses.

In Washington state, commercial leases do not necessarily need to be notarized to be legally binding. However, having a notary public witness the signing of a lease can provide an extra layer of protection and affirmation for all parties involved. For those exploring a Washington Triple Net Lease for Industrial Property, it's advisable to consult legal guidance to ensure compliance with state laws.

The primary difference between a commercial lease and an industrial lease lies in the type of property being leased. A commercial lease typically applies to retail or office spaces, while an industrial lease focuses on properties used for manufacturing, storage, or distribution. Understanding these distinctions is crucial when considering a Washington Triple Net Lease for Industrial Property, as the terms and conditions can vary significantly based on the property type.