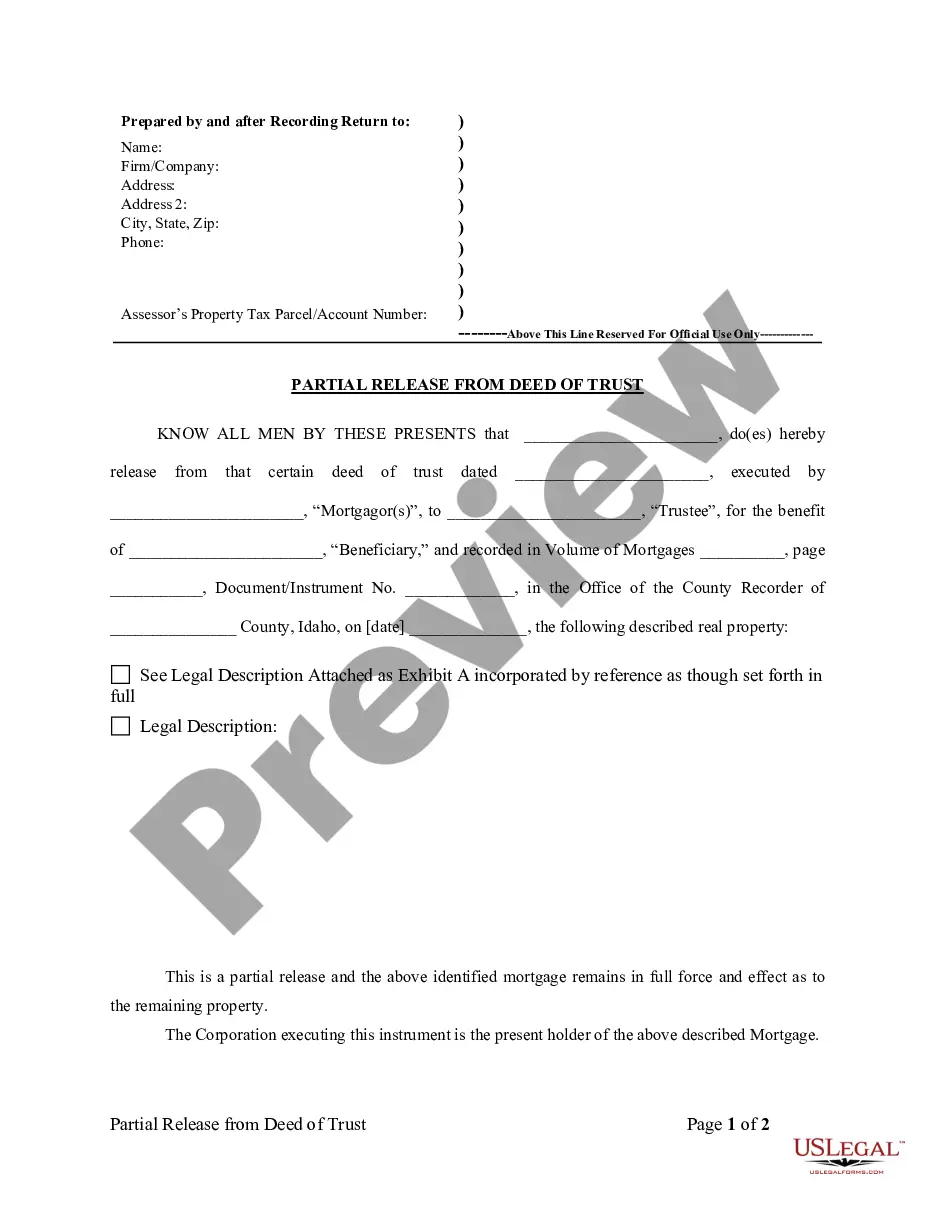

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Washington Agreement Dissolving Business Interest in Connection with Certain Real Property

Description

How to fill out Agreement Dissolving Business Interest In Connection With Certain Real Property?

Locating the appropriate legal document template can be quite a challenge. Of course, there are numerous templates accessible online, but how do you find the legal form you require.

Utilize the US Legal Forms website. The service provides thousands of templates, such as the Washington Agreement Terminating Business Interest Related to Specific Real Estate, that can be utilized for both business and personal needs. All of the forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Washington Agreement Terminating Business Interest Related to Specific Real Estate. Use your account to browse through the legal forms you have previously purchased. Visit the My documents section of your account to download another copy of the documents you require.

Select the file format and download the legal document template to your device. Complete, edit, print, and sign the received Washington Agreement Terminating Business Interest Related to Specific Real Estate. US Legal Forms is the largest library of legal forms where you can find various document templates. Use the service to obtain professionally crafted documents that conform to state requirements.

- First, ensure you have selected the correct form for your city/state.

- You can review the form using the Preview button and read the form description to make sure it is suitable for you.

- If the form does not meet your needs, utilize the Search field to find the right form.

- Once you are confident that the form is correct, click the Buy now button to purchase the form.

- Choose the pricing plan you want and enter the necessary information.

- Create your account and pay for your order using your PayPal account or credit card.

Form popularity

FAQ

Sales tax in Washington is primarily based on the location of the buyer, where the item is delivered or the service is performed. This means you must consider various factors involving buyer agreements, especially if your situation involves a Washington Agreement Dissolving Business Interest in Connection with Certain Real Property. Understanding these details can aid in making informed decisions during business transactions.

To dissolve a business in Washington state, you must file a Certificate of Dissolution with the Secretary of State and settle any outstanding obligations. This also includes addressing the distribution of assets, such as any real property tied to your business interests. A well-crafted Washington Agreement Dissolving Business Interest in Connection with Certain Real Property can streamline this process, ensuring compliance and clarity in asset distribution.

Certain organizations and individuals qualify for exemptions from Washington state sales tax. These include non-profit organizations, government entities, and specific exemptions for items such as food and prescription drugs. If you're involved in drafting a Washington Agreement Dissolving Business Interest in Connection with Certain Real Property, understanding potential sales tax exemptions can help optimize your financial planning.

In general, Washington state does not allow for the deduction of real estate excise tax on your federal tax return. However, when you engage in transactions involving a Washington Agreement Dissolving Business Interest in Connection with Certain Real Property, it is crucial to know how these taxation elements affect your overall financial strategy. Always consult with a tax professional for tailored advice based on your specific situation.

In Washington state, property tax exemptions are available for individuals who are 61 years or older, or who are retired due to disability. Once you meet these criteria, you can apply for relief programs that may reduce or eliminate your property tax burden. It is important to understand how these exemptions relate to your Washington Agreement Dissolving Business Interest in Connection with Certain Real Property, especially if your property is part of a business dissolution strategy.

Dissolving a business in Washington involves several key steps. First, you need to file a Washington Agreement Dissolving Business Interest in Connection with Certain Real Property to properly document the dissolution. Additionally, ensure to settle any outstanding debts and liabilities of your business. Finally, notify relevant agencies and close your business accounts to complete the process smoothly.

A controlling interest transfer in Washington state refers to the sale or transfer of ownership rights that allows one party to gain significant power over a business entity. This often involves a Washington Agreement Dissolving Business Interest in Connection with Certain Real Property, facilitating the separation of interests among parties. Understanding this process is vital for business owners as it can impact property rights and responsibilities. If you need assistance, you can use the uslegalforms platform, which provides resources and templates to effectively manage these transfers.

Legally gifting a house involves preparing a gift deed and executing it in accordance with state laws, including Washington state requirements. If the property is linked to a business interest, a Washington Agreement Dissolving Business Interest in Connection with Certain Real Property may be necessary to clarify the transfer. It’s advisable to seek legal counsel to navigate any challenges and ensure the process is straightforward and compliant.

To gift a house to a family member in Washington state, start by drafting a gift deed that clearly indicates the transfer of ownership. Make sure to include any relevant documentation, such as a Washington Agreement Dissolving Business Interest in Connection with Certain Real Property if applicable. Consulting an attorney can help ensure you comply with all legal requirements and avoid potential pitfalls.

A controlling interest transfer refers to the change in ownership of a majority stake in a company, often affecting the management and operations of the business. When transferring such interests, especially concerning real estate transactions, a Washington Agreement Dissolving Business Interest in Connection with Certain Real Property may be necessary to formalize the transfer. It’s critical to assess any implications this transfer may have on the business operations.